Costco 2009 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2009 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

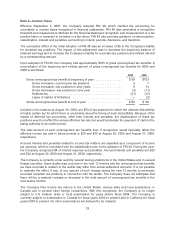

At August 30, 2009, the fair value of the Zero Coupon Notes, based on market quotes, was

approximately $44, the fair value of the 2012 Notes and 2017 Notes was $973 and $1,213,

respectively, and the fair value of other long-term debt approximated its carrying value. The fair value

of the Zero Coupon Notes and the 2007 Senior Notes are based on quoted market prices of similar

types of borrowing arrangements or the Company’s current incremental borrowing rate, if applicable.

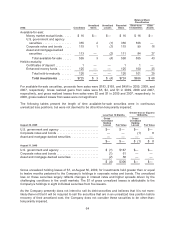

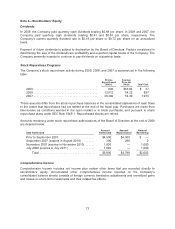

Maturities of long-term debt during the next five fiscal years and thereafter are as follows:

2010 ........................................................ $ 81

2011 ........................................................ 2

2012 ........................................................ 900

2013 ........................................................ 1

2014 ........................................................ 2

Thereafter ................................................... 1,301

Total .................................................... $2,287

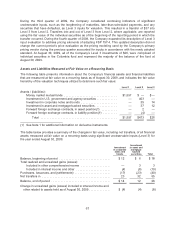

Note 5—Leases

The Company leases land and/or buildings at 112 of the 527 warehouses open at August 30, 2009,

and certain other office and distribution facilities primarily under operating leases. These leases expire

at various dates through 2049, with the exception of one lease in the Company’s United Kingdom

subsidiary, which expires in 2151. These leases generally contain one or more of the following options

which the Company can exercise at the end of the initial lease term: (a) renewal of the lease for a

defined number of years at the then-fair market rental rate or rate stipulated in the lease agreement;

(b) purchase of the property at the then-fair market value; or (c) right of first refusal in the event of a

third party purchase offer.

The Company accounts for its lease expense with free rent periods and step-rent provisions on a

straight-line basis over the original term of the lease, from the date the Company has control of the

property. Certain leases provide for periodic rental increases based on the price indices, and some of

the leases provide for rents based on the greater of minimum guaranteed amounts or sales volume.

Contingent rents have not been material. Certain leases may require the Company to incur costs to

return leased property to its original condition, such as the removal of gas tanks. The Company has

recorded the estimated asset retirement obligation associated with these leases, which amounted to

$24 at the end of 2009.

Aggregate rental expense for 2009, 2008, and 2007 was $177, $167, and $143, respectively.

The Company has sub-leases related to certain of its operating lease agreements. During 2009, 2008

and 2007, the Company recognized sub-lease income of $10, $10, and $9, respectively, which is

included in interest income and other in the consolidated statements of income.

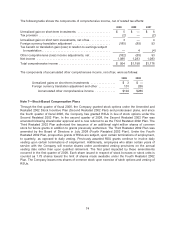

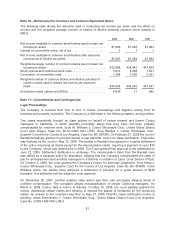

Future minimum payments, net of sub-lease income of $163 for all years combined, during the next

five fiscal years and thereafter under non-cancelable operating leases with terms of at least one year,

at August 30, 2009, were as follows:

2010 ........................................................ $ 145

2011 ........................................................ 139

2012 ........................................................ 127

2013 ........................................................ 126

2014 ........................................................ 121

Thereafter ................................................... 1,351

Total minimum payments ................................... $2,009

72