Costco 2009 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2009 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.COSTCO WHOLESALE CORPORATION

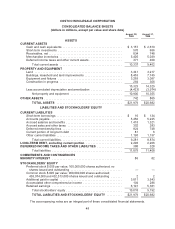

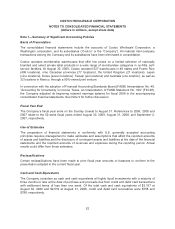

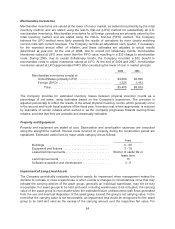

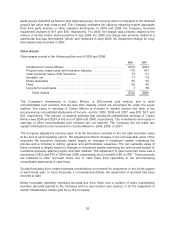

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(dollars in millions, except share data)

Note 1—Summary of Significant Accounting Policies

Basis of Presentation

The consolidated financial statements include the accounts of Costco Wholesale Corporation, a

Washington corporation, and its subsidiaries (“Costco” or the “Company”). All material inter-company

transactions among the Company and its subsidiaries have been eliminated in consolidation.

Costco operates membership warehouses that offer low prices on a limited selection of nationally

branded and select private label products in a wide range of merchandise categories in no-frills, self-

service facilities. At August 30, 2009, Costco operated 527 warehouses in 40 states and Puerto Rico

(406 locations), nine Canadian provinces (77 locations), the United Kingdom (21 locations), Japan

(nine locations), Korea (seven locations), Taiwan (six locations) and Australia (one location), as well as

32 locations in Mexico, through a 50%-owned joint venture.

In connection with the adoption of Financial Accounting Standards Board (FASB) Interpretation No. 48,

“Accounting for Uncertainty in Income Taxes, an Interpretation of FASB Statement No. 109” (FIN 48),

the Company adjusted its beginning retained earnings balance for fiscal 2008 in the accompanying

consolidated financial statements. See Note 9 for further discussion.

Fiscal Year End

The Company’s fiscal year ends on the Sunday closest to August 31. References to 2009, 2008 and

2007 relate to the 52-week fiscal years ended August 30, 2009, August 31, 2008, and September 2,

2007, respectively.

Use of Estimates

The preparation of financial statements in conformity with U.S. generally accepted accounting

principles requires management to make estimates and assumptions that affect the reported amounts

of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial

statements and the reported amounts of revenues and expenses during the reporting period. Actual

results could differ from those estimates.

Reclassifications

Certain reclassifications have been made to prior fiscal year amounts or balances to conform to the

presentation adopted in the current fiscal year.

Cash and Cash Equivalents

The Company considers as cash and cash equivalents all highly liquid investments with a maturity of

three months or less at the date of purchase and proceeds due from credit and debit card transactions

with settlement terms of less than one week. Of the total cash and cash equivalents of $3,157 at

August 30, 2009 and $2,619 at August 31, 2008, credit and debit card receivables were $758 and

$788, respectively.

52