Costco 2009 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2009 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

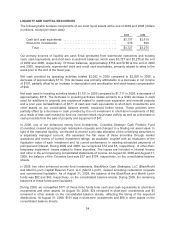

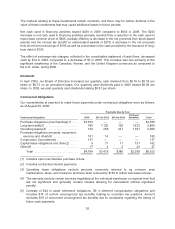

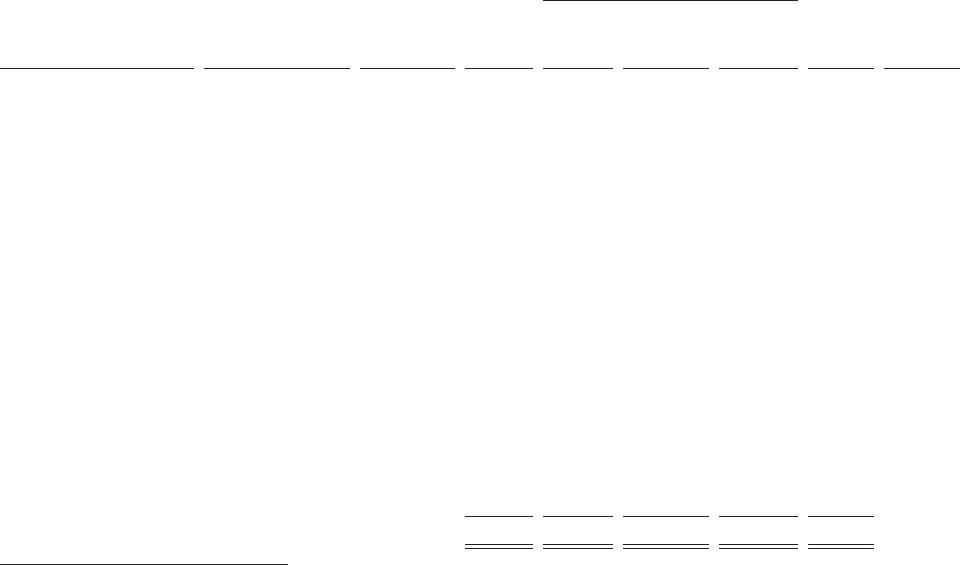

Entity

Credit Facility

Description

Expiration

Date

Total of

all Credit

Facilities

Credit Line Usage at

August 31, 2008

Available

Credit

Applicable

Interest

Rate

Stand-by

LC &

Letter of

Guaranty

Commercial

Letter of

Credit

Short

Term

Borrowing

U.S. ................. Uncommitted

Stand By

Letter of Credit

N/A $ 25 $25 $— $ — $ — N/A

U.S. ................. Uncommitted

Commercial Letter

of Credit

N/A 160 — 45 — 115 N/A

Australia(1) ........... Guarantee Line N/A 9 3 — — 6 N/A

Canada(1, 3) .......... Multi-Purpose Line March-09 142 20 — 85 37 3.43%

Japan(1) ............. Revolving Credit February-09 32 — — 4 28 1.00%

Japan(1) ............. Bank Guaranty February-09 9 9 — — — N/A

Japan(1) ............. Revolving Credit February-09 32 — — 14 18 1.04%

Korea(1) ............. Multi-Purpose Line March-09 11 1 1 — 9 6.53%

Taiwan .............. Multi-Purpose Line January-09 16 5 — — 11 4.50%

Taiwan .............. Multi-Purpose Line July-09 16 2 — — 14 4.59%

United Kingdom ....... Revolving Credit February-10 73 — — — 73 5.67%

United Kingdom ....... Uncommitted

Money Market

May-09 37 — — 31 6 5.36%

United Kingdom ....... Overdraft Line May-09 64 — — — 64 6.00%

United Kingdom(2) ..... Letter of

Guarantee

N/A 4 4 — — — N/A

United Kingdom ....... Commercial Letter

of Credit

N/A 3 — 1 — 2 N/A

TOTAL ..................... $633 $69 $47 $134 $383

(1) This entity’s credit facility is guaranteed by the U.S. parent company, Costco Wholesale Corporation.

(2) The letter of guarantee is fully cash-collateralized by the United Kingdom subsidiary.

(3) The amount shown for short-term borrowings under this facility is net of a note issue discount, which is excluded from

the available credit amount.

Note: We have credit facilities (for commercial and standby letters of credit) totaling $116 and $239 as of

August 30, 2009 and August 31, 2008, respectively. The outstanding commitments under these facilities at

August 30, 2009 and August 31, 2008, totaled $83 and $116, respectively, including $62 and $69,

respectively, in standby letters of credit. For those entities with multi-purpose lines, any issuance of either

letters of credit (standby and/or commercial) or short-term borrowings will result in a corresponding decrease

in available credit.

Financing Activities

In July 2009, we entered into a capital lease for a new warehouse building location and recorded a liability in

the amount of $72, representing the net present value of $150 in aggregate future minimum lease payments

at an imputed interest rate of 5.4%. This lease expires and becomes subject to a renewal clause in 2040. As

of August 30, 2009, $71 is included in long-term debt and $1 in the current portion of long-term debt in our

consolidated balance sheets. We have other minor capital lease obligations that amounted to $5 at the end

of 2009 and 2008.

In June 2008, our wholly-owned Japanese subsidiary entered into a ten-year term loan in the amount of $32,

with a variable rate of interest of Yen TIBOR (6-month) plus a 0.35% margin (0.95% and 1.24% at

August 30, 2009 and August 31, 2008, respectively) on the outstanding balance. The net proceeds were

used to repay the 1.187% Promissory Notes due in July 2008 and for general corporate purposes. Interest is

payable semi-annually in December and June and principal is due in June 2018.

37