Costco 2009 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2009 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The markets relating to these investments remain uncertain, and there may be further declines in the

value of these investments that may cause additional losses in future periods.

Net cash used in financing activities totaled $439 in 2009 compared to $643 in 2008. The $204

decrease in net cash used in financing activities primarily resulted from a reduction in the cash used to

repurchase common stock of $826, partially offset by a decrease in the net proceeds from stock-based

awards and the excess tax benefit on share-based awards of $276, a decrease in the net proceeds

from short-term borrowings of $195 as well as a decrease in the cash provided by the issuance of long-

term debt of $103.

The effect of exchange rate changes, reflected in the consolidated statement of cash flows, decreased

cash by $14 in 2009, compared to a decrease of $7 in 2008. This increase was due primarily to the

significant weakening of the Canadian, Korean, and the United Kingdom currencies as compared to

the U.S. dollar, during 2009.

Dividends

In April 2009, our Board of Directors increased our quarterly cash dividend from $0.16 to $0.18 per

share or $0.72 on an annualized basis. Our quarterly cash dividends paid in 2009 totaled $0.68 per

share. In 2008, we paid quarterly cash dividends totaling $0.61 per share.

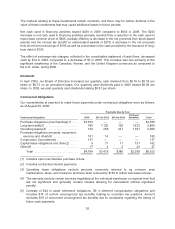

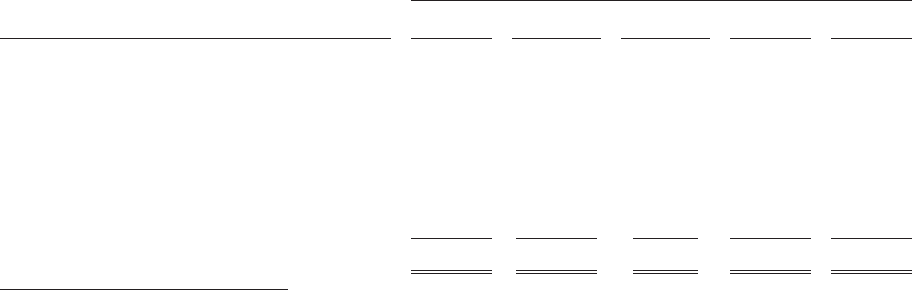

Contractual Obligations

Our commitments at year-end to make future payments under contractual obligations were as follows,

as of August 30, 2009:

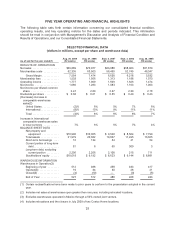

Payments Due by Year

Contractual obligations 2010 2011 to 2012 2013 to 2014

2015 and

thereafter Total

Purchase obligations (merchandise)(1) .... $3,539 — — — $3,539

Long-term debt(2) ..................... 186 1,120 126 1,432 2,864

Operating leases(3) .................... 145 266 247 1,351 2,009

Purchase obligations (property, equipment,

services and other)(4) ................ 151 14 — — 165

Construction Commitments .............. 137 — — — 137

Capital lease obligations and other(2) ..... 9 11 11 131 162

Other(5) ............................. 17 4 2 24 47

Total ............................ $4,184 $1,415 $386 $2,938 $8,923

(1) Includes open merchandise purchase orders.

(2) Includes contractual interest payments.

(3) Operating lease obligations exclude amounts commonly referred to as common area

maintenance, taxes, and insurance and have been reduced by $163 to reflect sub-lease income.

(4) The amounts exclude certain services negotiated at the individual warehouse or regional level that

are not significant and generally contain clauses allowing for cancellation without significant

penalty.

(5) Consists of $24 in asset retirement obligations, $9 in deferred compensation obligations and

includes $14 of current unrecognized tax benefits relating to uncertain tax positions. Amount

excludes $16 of noncurrent unrecognized tax benefits due to uncertainty regarding the timing of

future cash payments.

35