Costco 2009 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2009 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

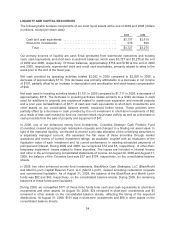

2008 vs. 2007

SG&A expenses, as a percent of net sales, decreased 14 basis points compared to 2007. Excluding

the unusual items affecting net sales and SG&A expenses in 2007, adjusted SG&A as a percentage of

adjusted net sales was comparable to 2007. Warehouse operating and central administrative costs

positively impacted adjusted SG&A comparisons, on a net basis, by approximately seven basis points,

primarily due to decreased payroll and benefits costs as a percent of adjusted net sales. Stock-based

compensation expense negatively impacted adjusted SG&A comparisons by three basis points,

primarily due to a higher closing stock price on the date that our October 2007 RSU grant was valued

as compared to previous grants. Additionally, in 2008, we recorded a $16 reserve in connection with a

litigation settlement and accrued approximately $9 for compensation adjustments we made to

employees enrolled in our medical and dental plans related to a decision to share a portion of the

health plan’s savings that we achieved. These two items negatively impacted adjusted SG&A

comparisons by four basis points.

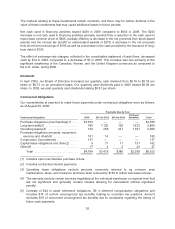

Preopening Expenses

2009 2008 2007

Preopening expenses .................................... $41 $57 $55

Warehouse openings ..................................... 19 34 30

Preopening expenses include costs incurred for startup operations related to new warehouses and the

expansion of ancillary operations at existing warehouses. Preopening expenses can vary due to the

timing of the opening relative to our year-end, whether the warehouse is owned or leased, whether the

opening is in an existing, new, or international market. The decline in 2009 is primarily attributable to

fewer warehouse openings.

Provision for Impaired Assets and Closing Costs, Net

2009 2008 2007

Warehouse closing expenses ............................. $ 9 $ 9 $16

Impairment of long-lived assets ............................ 8 10 —

Net gains on the sale of real property ....................... — (19) (2)

Provision for impaired assets & closing costs, net ............. $17 $ — $14

This provision primarily includes costs related to impairment of long-lived assets; future lease

obligations of warehouses that have been closed or relocated to new facilities; accelerated

depreciation, based on the shortened useful life through the expected closing date, on buildings to be

demolished or sold and that are not otherwise impaired; and losses or gains resulting from the sale of

real property, largely comprised of former warehouse locations.

2009 vs. 2008

The net provision for impaired assets and closing costs was a $17 in 2009, compared to a nominal

amount in 2008. The provision in 2009 included charges of $9 for warehouse closing expenses, and

impairment charges of $8, primarily related to the closing of our two Costco Home locations in July

2009.

31