Costco 2009 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2009 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Expansion Plans

Our primary requirement for capital is the financing of land, building, and equipment costs for new and

remodeled warehouses. Capital is also required for initial warehouse operations and working capital. While

there can be no assurance that current expectations will be realized and plans are subject to change upon

further review, it is our current intention to spend approximately $1,300 during fiscal 2010 for real estate,

construction, remodeling, and equipment for warehouses and related operations. These expenditures are

expected to be financed with a combination of cash provided from operations and existing cash and cash

equivalents and short-term investments.

We plan to open approximately 16 to 18 new warehouses in 2010, including one to two relocations of

existing warehouses to larger and better located facilities.

Additional Equity Investments in Subsidiaries and Joint Ventures

Our investments in the Costco Mexico joint venture and in other unconsolidated joint ventures that are less

than majority owned are accounted for under the equity method. We did not make any capital contributions

to our investment in Costco Mexico (a 50%-owned joint venture) in 2009, 2008, or 2007.

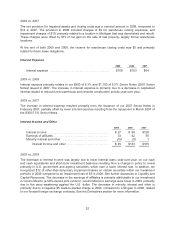

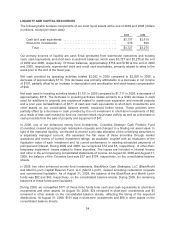

Bank Credit Facilities and Commercial Paper Programs (all amounts stated in millions, in U.S. dollars)

Entity

Credit Facility

Description

Expiration

Date

Total of

all Credit

Facilities

Credit Line Usage at

August 30, 2009

Available

Credit

Applicable

Interest

Rate

Stand-by

LC &

Letter of

Guaranty

Commercial

Letter of

Credit

Short-

Term

Borrowing

U.S. ................. Uncommitted

Stand By

Letter of Credit

N/A $ 22 $22 $— $ — $ — N/A

U.S. ................. Uncommitted

Commercial Letter

of Credit

N/A 50 — 20 — 30 N/A

Australia(1) ........... Guarantee Line N/A 8 — — — 8 N/A

Canada(1) ............ Multi-Purpose Line March-10 28 18 — — 10 1.76%

Japan(1) ............. Revolving Credit February-10 37 — — 8 29 0.64%

Japan(1) ............. Bank Guaranty March-10 11 11 — — — N/A

Japan(1) ............. Revolving Credit February-10 37 — — 8 29 0.70%

Japan(2) ............. Commercial Letter

of Credit

N/A 1 — — — 1 N/A

Korea(1) ............. Multi-Purpose Line March-10 10 1 — — 9 3.75%

Taiwan .............. Multi-Purpose Line January-10 15 4 — — 11 2.50%

Taiwan .............. Multi-Purpose Line July-10 15 3 — — 12 2.59%

United Kingdom ....... Revolving Credit February-10 66 — — — 66 0.82%

United Kingdom ....... Uncommitted

Money Market

Line

N/A 33 — — — 33 3.05%

United Kingdom ....... Uncommitted

Overdraft Line

N/A 49 — — — 49 1.50%

United Kingdom(2) ..... Letter of

Guarantee

N/A 3 3 — — — N/A

United Kingdom ....... Commercial Letter

of Credit

N/A 3 — 1 — 2 N/A

TOTAL ..................... $388 $62 $21 $16 $289

(1) The U.S. parent company, Costco Wholesale Corporation, guarantees this entity’s credit facility.

(2) The letter of guarantee is fully cash-collateralized by the subsidiary.

36