Costco 2009 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2009 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

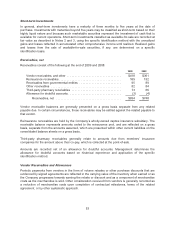

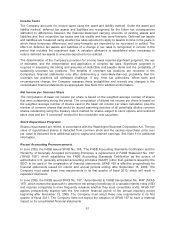

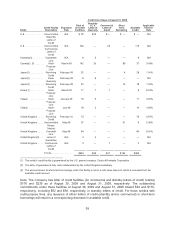

Preopening Expenses

Preopening expenses related to new warehouses, major remodels and expansions, new regional

offices and other startup operations are expensed as incurred.

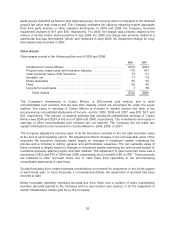

Closing Costs

Warehouse closing costs incurred relate principally to the Company’s relocation of certain warehouses

(that were not otherwise impaired) to larger and better-located facilities. The provisions for 2009, 2008,

and 2007 included charges in the amounts indicated below:

2009 2008 2007

Warehouse closing expenses ........................... $ 9 $ 9 $16

Impairment of long-lived operating assets ................. 8 10 —

Net gains on sale of real property ........................ — (19) (2)

Total ............................................ $17 $ — $14

Warehouse closing expenses primarily relate to accelerated building depreciation based on the

shortened useful life through the expected closing date and remaining lease obligations, net of

estimated sublease income, for leased locations. At the end of both 2009 and 2008, the Company’s

reserve for warehouse closing costs was $5 and primarily related to future lease obligations.

Fair Value of Financial Instruments

The carrying value of the Company’s financial instruments, including cash and cash equivalents,

receivables, and accounts payable approximate fair value due to their short-term nature or variable

interest rates. See Notes 2, 3, and 4 for details on the carrying value and fair value of the Company’s

investments, derivative instruments, and fixed rate debt.

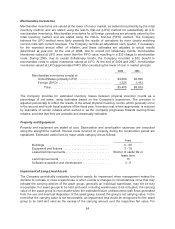

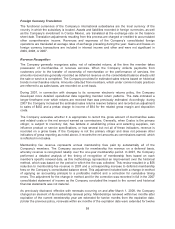

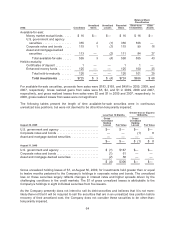

Interest Income and Other

Interest income and other includes:

2009 2008 2007

Interest income ...................................... $27 $ 96 $128

Earnings of affiliates .................................. 33 42 36

Minority interest and other .............................. (15) (5) 1

Interest income and other .......................... $45 $133 $165

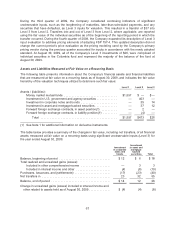

Other-Than-Temporary Impairment

The Company periodically evaluates unrealized losses in its investment securities for other-than-

temporary impairment using both qualitative and quantitative criteria. In the event a security is deemed

to be other-than-temporarily impaired, the Company recognizes the credit loss component in interest

income and other in the consolidated financial statements. The Company generally only invests in debt

securities.

60