Costco 2009 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2009 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

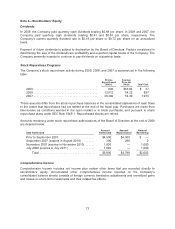

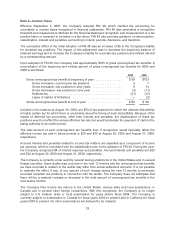

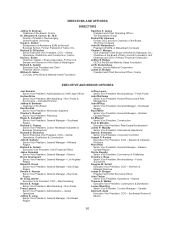

Note 10—Net Income Per Common and Common Equivalent Share

The following table shows the amounts used in computing net income per share and the effect on

income and the weighted average number of shares of dilutive potential common stock (shares in

000’s).

2009 2008 2007

Net income available to common stockholders used in basic net

income per share ..................................... $1,086 $1,283 $1,083

Interest on convertible notes, net of tax ..................... 1 1 1

Net income available to common stockholders after assumed

conversions of dilutive securities ......................... $1,087 $1,284 $1,084

Weighted average number of common shares used in basic net

income per share ..................................... 433,988 434,442 447,659

Stock options and restricted stock units ..................... 5,072 8,268 7,621

Conversion of convertible notes ........................... 1,394 1,530 2,361

Weighted number of common shares and dilutive potential of

common stock used in diluted net income per share per

share ............................................... 440,454 444,240 457,641

Anti-dilutive stock options and RSUs ....................... 8,045 11 692

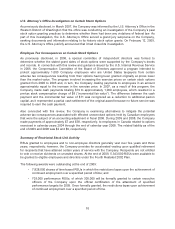

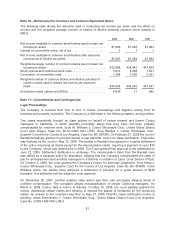

Note 11—Commitments and Contingencies

Legal Proceedings

The Company is involved from time to time in claims, proceedings and litigation arising from its

business and property ownership. The Company is a defendant in the following matters, among others:

Two cases purportedly brought as class actions on behalf of certain present and former Costco

managers in California, in which plaintiffs principally allege that they have not been properly

compensated for overtime work. Scott M. Williams v. Costco Wholesale Corp., United States District

Court (San Diego), Case No. 02-CV-2003 NAJ (JFS); Greg Randall v. Costco Wholesale Corp.,

Superior Court for the County of Los Angeles, Case No. BC-296369. On February 21, 2008 the court in

Randall tentatively granted in part and denied in part plaintiffs’ motion for class certification. That order

was finalized by the court on May 13, 2008. The parties in Randall have agreed on a partial settlement

of the action (resolving all claims except for the miscalculation claim), requiring a payment of up to $16

by the Company, which was reserved for in 2008. The Court granted final approval of the settlement on

June 22, 2009. Settlement distribution is underway. The miscalculation claim from the Randall case

was refiled as a separate action by stipulation, alleging that the Company miscalculated the rates of

pay for all department and ancillary managers in California in violation of Labor Code Section 515(d).

On October 2, 2009, the court granted the Company’s motion for summary judgement. Terry Head v.

Costco Wholesale Corp., Superior Court for the County of Los Angeles, Case No. BC-409805. In the

Williams action, the parties have achieved a settlement in principle for a gross amount of $440

thousand. Any settlement will be subject to court approval.

On December 26, 2007, another putative class action was filed, also principally alleging denial of

overtime compensation. The complaint alleges misclassification of certain California managers. On

March 6, 2008, Costco filed a motion to dismiss. On May 15, 2008, the court partially granted the

motion, dismissing certain claims and refusing to expand the statute of limitations for the remaining

claims. An answer to the complaint was filed on May 27, 2008. Plainiff’s class certification motion is

pending. Jesse Drenckhahn v. Costco Wholesale Corp., United States District Court (Los Angeles),

Case No. CV08-1408 FMC (JMJ).

81