Costco 2009 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2009 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Note 6—Stockholders’ Equity

Dividends

In 2009, the Company paid quarterly cash dividends totaling $0.68 per share. In 2008 and 2007, the

Company paid quarterly cash dividends totaling $0.61 and $0.55 per share, respectively. The

Company’s current quarterly dividend rate is $0.18 per share or $0.72 per share on an annualized

basis.

Payment of future dividends is subject to declaration by the Board of Directors. Factors considered in

determining the size of the dividends are profitability and expected capital needs of the Company. The

Company presently expects to continue to pay dividends on a quarterly basis.

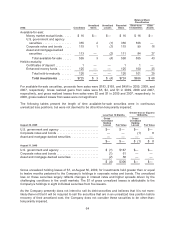

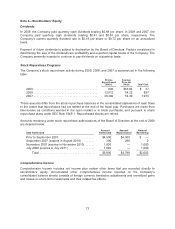

Stock Repurchase Programs

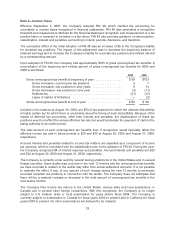

The Company’s stock repurchase activity during 2009, 2008, and 2007 is summarized in the following

table:

Shares

Repurchased

(000’s)

Average

Price per

Share Total Cost

2009 ......................................... 895 $63.84 $ 57

2008 ......................................... 13,812 64.22 887

2007 ......................................... 36,390 54.39 1,979

These amounts differ from the stock repurchase balances in the consolidated statements of cash flows

to the extent that repurchases had not settled at the end of the fiscal year. Purchases are made from

time-to-time as conditions warrant in the open market or in block purchases, and pursuant to share

repurchase plans under SEC Rule 10b5-1. Repurchased shares are retired.

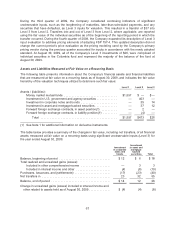

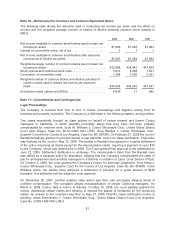

Amounts remaining under stock repurchase authorizations of the Board of Directors at the end of 2009

are detailed below:

Date Authorized

Amount

Authorized

Amount

Repurchased

Amount

Remaining

Prior to September 2007 ....................... $4,500 $4,500 $ —

September 2007 (expires in August 2010) ........ 300 298 2

November 2007 (expires in November 2010) ...... 1,000 — 1,000

July 2008 (expires in July 2011) ................. 1,000 — 1,000

Total ................................... $6,800 $4,798 $2,002

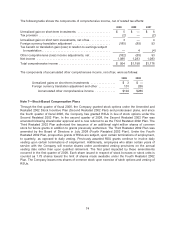

Comprehensive Income

Comprehensive income includes net income plus certain other items that are recorded directly to

stockholders’ equity. Accumulated other comprehensive income reported on the Company’s

consolidated balance sheets consists of foreign currency translation adjustments and unrealized gains

and losses on short-term investments and their related tax effects.

73