Costco 2009 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2009 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Income Taxes

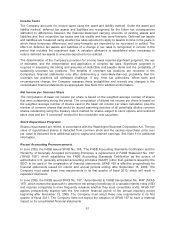

The Company accounts for income taxes using the asset and liability method. Under the asset and

liability method, deferred tax assets and liabilities are recognized for the future tax consequences

attributed to differences between the financial statement carrying amounts of existing assets and

liabilities and their respective tax bases and tax credits and loss carry-forwards. Deferred tax assets

and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in

which those temporary differences and carry-forwards are expected to be recovered or settled. The

effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the

period that includes the enactment date. A valuation allowance is established when necessary to

reduce deferred tax assets to amounts expected to be realized.

The determination of the Company’s provision for income taxes requires significant judgment, the use

of estimates, and the interpretation and application of complex tax laws. Significant judgment is

required in assessing the timing and amounts of deductible and taxable items and the probability of

sustaining uncertain tax positions. The benefits of uncertain tax positions are recorded in the

Company’s financial statements only after determining a more-likely-than-not probability that the

uncertain tax positions will withstand challenge, if any, from tax authorities. When facts and

circumstances change, the Company reassess these probabilities and records any changes in the

consolidated financial statements as appropriate. See Note 9 for additional information.

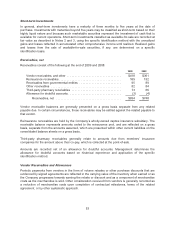

Net Income per Common Share

The computation of basic net income per share is based on the weighted average number of shares

that were outstanding during the period. The computation of diluted net income per share is based on

the weighted average number of shares used in the basic net income per share calculation plus the

number of common shares that would be issued assuming exercise of all potentially dilutive common

shares outstanding using the treasury stock method for shares subject to stock options and restricted

stock units and the “if converted” method for the convertible note securities.

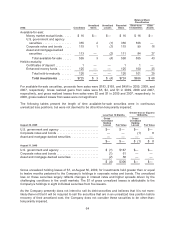

Stock Repurchase Programs

Shares repurchased are retired, in accordance with the Washington Business Corporation Act. The par

value of repurchased shares is deducted from common stock and the excess repurchase price over

par value is deducted from additional paid-in capital and retained earnings. See Note 6 for additional

information.

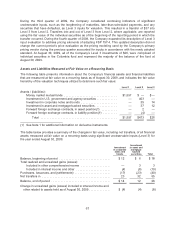

Recent Accounting Pronouncements

In June 2009, the FASB issued SFAS No. 168, “The FASB Accounting Standards Codification and the

Hierarchy of Generally Accepted Accounting Principles, a replacement of FASB Statement No. 162”

(“SFAS 168”), which establishes the FASB Accounting Standards Codification as the source of

authoritative U.S. generally accepted accounting principles (GAAP) (other than guidance issued by the

SEC) to be used in the preparation of financial statements. SFAS 168 is effective prospectively for

financial statements issued for interim and annual periods ending after September 15, 2009. The

Company must adopt these new requirements in its first quarter of fiscal 2010, which will result in

expanded disclosure.

In June 2009, the FASB issued SFAS No. 167, “Amendments to FASB Interpretation No. 46R” (SFAS

167), which revises the approach to determine the primary beneficiary of a variable interest entity (VIE)

and requires companies to more frequently reassess whether they must consolidate a VIE. SFAS 167

applies prospectively starting with the first interim financial period of the annual reporting period

beginning after November 15, 2009. The Company must adopt these new requirements in its first

quarter of fiscal 2011. The Company does not expect the adoption of SFAS 167 to have a material

impact on its consolidated financial statements.

61