Costco 2009 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2009 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Foreign currencies, particularly in Canada, the United Kingdom, and Korea, weakened against the U.S.

dollar, which negatively impacted net sales during 2009 by approximately $2,421 (341 basis points).

Net sales were also negatively impacted by gasoline price deflation during 2009 by approximately

$2,164 (305 basis points), which resulted from a 30% decline in the average sales price per gallon.

Comparable Sales

Comparable sales decreased 4% in 2009. Weakening foreign currencies negatively impacted

comparable sales by approximately $2,339 (333 basis points) in 2009. Gasoline price deflation

negatively impacted comparable sales results by approximately $2,113 (298 basis points) during 2009.

Comparable sales were negatively impacted by a decline in the average amount spent (after

adjustment for gasoline price deflation and measured in local currencies), partially offset by an

increase in shopping frequency. Reported comparable sales growth includes the negative impact of

cannibalization (established warehouses losing sales to our newly opened locations). We believe the

decline is a function of adverse economic conditions generally rather that a fundamental change in our

members’ relationship to the company.

2008 vs. 2007

Net sales increased 12.5% to $70,977 in 2008, from $63,088 in 2007. Excluding the impact of the

change in the estimated sales returns reserve in 2007, net sales, as adjusted, increased $7,437, or

11.7% in 2008 as compared to the previous year. The $7,437 increase in adjusted net sales is

comprised of $5,153 from the increase in comparable warehouse sales and $2,284 primarily from

sales at new warehouses opened during 2008 and 2007. In the third quarter of 2007, we introduced a

90-day return policy in the United States on certain electronic items.

Significantly stronger foreign currencies, particularly in Canada, positively impacted adjusted net sales

by approximately $1,134, or 180 basis points. Gasoline sales also contributed to the $7,437 adjusted

net sales growth by approximately $2,236, with approximately $1,489 related to the increase in

gasoline sales prices. Additionally, we experienced price increases in certain foods and fresh foods

items that positively impacted net sales, which were partially offset by price decreases in certain items

within our hardlines category.

Most of the comparable sales growth was derived from increased amounts spent by members, with a

smaller contribution from increases in shopping frequency. Gasoline sales positively impacted

comparable warehouse sales growth by approximately $1,938. Comparable warehouse sales growth

excluding gasoline would have been lower by approximately 267 basis points. Significantly stronger

foreign currencies, particularly in Canada, positively impacted comparable sales by approximately

$1,070, or 170 basis points. Reported comparable sales growth includes the negative impact of

cannibalization (established warehouses losing sales to our newly opened locations).

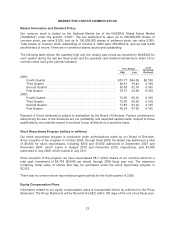

Membership Fees

2009 2008 2007

Membership fees ............................. $ 1,533 $ 1,506 $ 1,313

Adjustment to deferred membership balance ...... — — 56

Membership fees, as adjusted .................. $ 1,533 $ 1,506 $ 1,369

Membership fees increase ..................... 1.8% 14.7% 10.5%

Membership fees increase, as adjusted ........... 1.8% 10.0% 15.2%

Membership fees as a percent of net sales ........ 2.19% 2.12% 2.08%

Adjusted membership fees, as a percent of adjusted

net sales .................................. 2.19% 2.12% 2.16%

Total cardholders ............................. 56,000 53,500 50,400

28