Costco 2009 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2009 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

During the third quarter of 2009, the Company considered continuing indicators of significant

unobservable inputs, such as the lengthening of maturities, later-than-scheduled payments, and any

securities that have defaulted, as Level 3 inputs for valuation. This resulted in a transfer of $37 into

Level 3 from Level 2. Transfers into and out of Level 3 from Level 2, where applicable, are reported

using the fair value of the individual securities as of the beginning of the reporting period in which the

transfer occurred. During the fourth quarter of 2009, the Company expanded its description of Level 3

input evaluation to address pricing elements of adopting FSP 157-4. This updated description did not

change the current period’s price evaluation as the pricing modeling used by the Company’s primary

pricing vendor during the previous quarter accounted for inputs in accordance with the newly adopted

standard. At August 30, 2009, all of the Company’s Level 3 investments of $26, were comprised of

individual securities in the Columbia fund and represent the majority of the balance of the fund at

August 30, 2009.

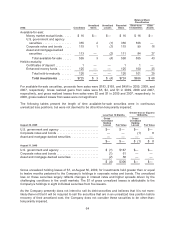

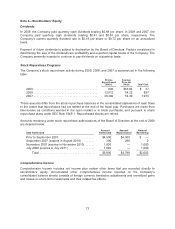

Assets and Liabilities Measured at Fair Value on a Recurring Basis

The following table presents information about the Company’s financial assets and financial liabilities

that are measured at fair value on a recurring basis as of August 30, 2009, and indicates the fair value

hierarchy of the valuation techniques utilized to determine such fair value:

Level 1 Level 2 Level 3

Assets / (liabilities):

Money market mutual funds .................................. $1,597 $ — $ —

Investment in U.S. government and agency securities ............. — 403 —

Investment in corporate notes and bonds ....................... — 35 14

Investment in asset and mortgage-backed securities .............. — 37 12

Forward foreign exchange contracts, in asset position(1) .......... — 2 —

Forward foreign exchange contracts, in liability position(1) ......... — (4) —

Total ................................................. $1,597 $473 $26

(1) See Note 1 for additional information on derivative instruments.

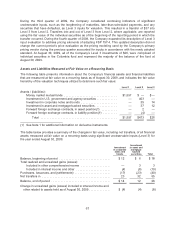

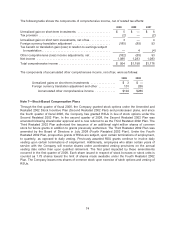

The table below provides a summary of the changes in fair value, including net transfers, of all financial

assets measured at fair value on a recurring basis using significant unobservable inputs (Level 3) for

the year ended August 30, 2009:

Investment

in corporate

notes and

bonds

Investment

in asset and

mortgage-

backed

securities Total

Balance, beginning of period ................................. $12 $ 6 $18

Total realized and unrealized gains (losses):

Included in other comprehensive income ................... — 3 3

Included in interest income and other ...................... (4) (6) (10)

Purchases, issuances, and (settlements) ....................... (17) (23) (40)

Net transfers in ............................................ 23 32 55

Balance, end of period ...................................... $14 12 26

Change in unrealized gains (losses) included in interest income and

other related to assets held as of August 30, 2009 .............. $ (4) (4) (8)

67