Costco 2009 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2009 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

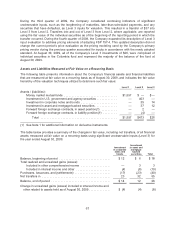

In 2008, one of the Company’s enhanced money fund investments, Columbia Strategic Cash Portfolio

Fund (Columbia), ceased accepting cash redemption requests and changed to a floating net asset

value. In light of the restricted liquidity, the Company elected to receive a pro-rata allocation of the

underlying securities in a separately managed account. The Company assessed the fair value of these

securities through market quotations and review of current investment ratings, as available, coupled

with an evaluation of the liquidation value of each investment and its current performance in meeting

scheduled payments of principal and interest. During 2009 and 2008, the Company recognized $12

and $5, respectively, of other-than-temporary impairment losses related to these securities. The losses

are included in interest income and other in the accompanying consolidated statements of income. At

August 30, 2009 and August 31, 2008, the balance of the Columbia fund was $27 and $104,

respectively, on the consolidated balance sheets.

In 2008, two other enhanced money fund investments, BlackRock Cash Strategies, LLC (BlackRock)

and Merrill Lynch Capital Reserve Fund, LLC (Merrill Lynch), ceased accepting redemption requests

and commenced liquidation. As of August 31, 2008, the balance of the BlackRock and Merrill Lynch

funds was $82 and $43, respectively, on the consolidated balance sheets. During 2009, these funds

were liquidated and the Company received the remaining balances of its investment.

During 2008, the Company reclassified $371 of these three funds from cash and cash equivalents to

short-term investments and other assets. At August 30, 2009, $24 remained in short-term investments

and $3 remained in other assets on the consolidated balance sheets, reflecting the timing of the

expected distributions. At August 31, 2008, $161 was in short-term investments and $68 in other

assets on the consolidated balance sheets.

The markets relating to these investments remain uncertain, and there may be further declines in the

value of these investments that may cause additional losses in future periods.

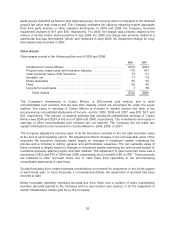

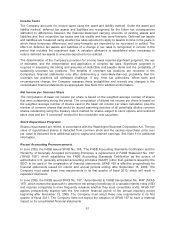

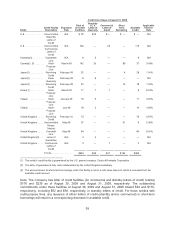

The maturities of available-for-sale and held-to-maturity securities at August 30, 2009 are as follows:

Available-For-Sale Held-To-Maturity

Cost Basis Fair Value Cost Basis Fair Value

Due in one year or less .............................. $324 $325 $59 $59

Due after one year through five years ................... 178 181 — —

Due after five years ................................. 8 8 — —

$510 $514 $59 $59

Note 3—Fair Value Measurement

On September 1, 2008, the Company adopted SFAS 157, as amended by FSP 157-1, FSP 157-2, and

FSP 157-3 and effective May 11, 2009, the Company adopted FSP 157-4 (collectively referred to as

SFAS 157), for all financial assets and liabilities that are recognized or disclosed at fair value in the

consolidated financial statements on a recurring basis or on a nonrecurring basis during the reporting

period. While the Company adopted the provisions of SFAS 157 for nonfinancial assets and liabilities

that are recognized or disclosed at fair value in the financial statements on a recurring basis, no such

assets or liabilities existed at the balance sheet date. The Company, in accordance with FSP 157-2,

delayed implementation of SFAS 157 for all nonfinancial assets and liabilities recognized or disclosed

at fair value in the financial statements on a nonrecurring basis. Nonfinancial nonrecurring assets and

liabilities included on the Company’s consolidated balance sheets include items, such as goodwill and

long lived assets, that are measured at fair value to test for and measure an impairment charge, when

necessary.

65