Costco 2009 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2009 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

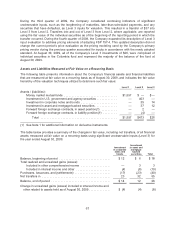

Derivatives

Effective November 24, 2008, the beginning of the Company’s second quarter of 2009, the Company

adopted the disclosure requirements of Statement of Financial Accounting Standards (SFAS) No. 161,

“Disclosures about Derivative Instruments and Hedging Activities—an Amendment of FASB Statement

No. 133” (SFAS 161). The Company follows SFAS No 133, “Accounting for Derivative Instruments and

Hedging Activities (as amended)” (SFAS 133), in accounting for derivative and hedging activities.

The Company is exposed to foreign currency exchange-rate fluctuations in the normal course of its

business, which the Company manages, in part, through the use of forward foreign exchange

contracts, seeking to hedge the impact of fluctuations of foreign exchange on known future

expenditures denominated in a foreign currency. The forward foreign exchange contracts are entered

into by the Company primarily to hedge U.S. dollar merchandise inventory expenditures. Currently,

these instruments do not qualify for derivative hedge accounting. The Company uses these

instruments to mitigate risk and does not intend to engage in speculative transactions. The aggregate

notional amount of forward foreign exchange contracts was $183 and $90 at the end of 2009 and

2008, respectively. These contracts do not contain any credit-risk-related contingent features.

The Company seeks to manage the counterparty risk associated with these forward foreign exchange

contracts by limiting transactions to counterparties with which the Company has an established

banking relationship. There can be no assurance, however, that this effectively mitigates counterparty

risk. In addition, the contracts are limited to a time period of less than one year. See Note 3 for

information on the fair value of these contracts.

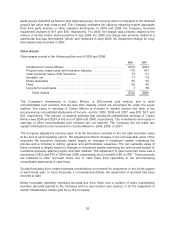

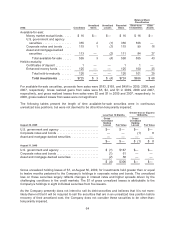

At the end of 2009, the fair value of the Company’s derivatives, which do not qualify for hedge

accounting under SFAS 133, was as follows:

Asset Liability

Forward foreign exchange contracts(1) ............................... $2 $4

Total derivatives ................................................. $2 $4

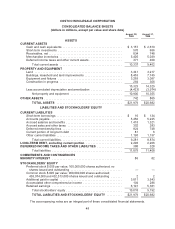

(1) The asset and the liability values are included in deferred income taxes and other current assets

and other current liabilities, respectively, in the accompanying consolidated balance sheets.

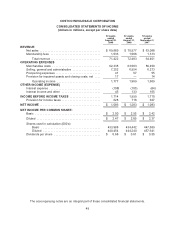

The following table summarizes the amount of gain or (loss) recognized in interest income and other in

the accompanying consolidated statements of income:

2009 2008 2007

Forward foreign exchange contracts ...................... $(5) $6 $—

Total ............................................ $(5) $6 $—

The Company is exposed to risks due to fluctuations in energy prices, particularly electricity and

natural gas, which it seeks to partially mitigate through the use of fixed-price contracts with

counterparties for approximately 24% of its warehouses and other facilities in the U.S. and Canada.

The Company also enters into variable-priced contracts for some purchases of natural gas and fuel for

its gas stations on an index basis. These contracts qualify for treatment as “normal purchase or normal

sales” under SFAS 133 and require no mark-to-market adjustment.

57