Costco 2009 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2009 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

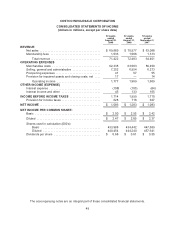

Accounts Payable

The Company’s banking system provides for the daily replenishment of major bank accounts as

checks are presented. Accordingly, included in accounts payable at the end of 2009 and 2008 are

$611 and $640, respectively, representing the excess of outstanding checks over cash on deposit at

the banks on which the checks were drawn.

Insurance/Self Insurance Liabilities

The Company uses a combination of insurance and self-insurance mechanisms, including a wholly-

owned captive insurance entity and participation in a reinsurance program, to provide for potential

liabilities for workers’ compensation, general liability, property damage, director and officers’ liability,

vehicle liability and employee health care benefits. Liabilities associated with the risks that are retained

by the Company are not discounted and are estimated, in part, by considering historical claims

experience, demographic factors, severity factors, and other actuarial assumptions. The estimated

accruals for these liabilities could be significantly affected if future occurrences and claims differ from

these assumptions and historical trends. As of the end of 2009 and 2008, these insurance liabilities of

$500 and $485, respectively, were included in accounts payable, accrued salaries and benefits, and

other current liabilities on the consolidated balance sheets, classified based on their nature.

The Company’s wholly-owned captive insurance subsidiary (the captive) received $120, $131, and

$140 in direct premiums during 2009, 2008, and 2007, respectively. These revenues are netted against

the Company’s premium costs in selling, general and administrative expenses, in the consolidated

statements of income. The captive participates in a reinsurance program. The member agreements

and practices of the reinsurance program limit any participating members’ individual risk. Reinsurance

premiums assumed and ceded were $76, $68, and $68 during 2009, 2008, and 2007, respectively.

Both revenues and costs are presented on a net basis in selling, general and administrative expenses

in the consolidated statements of income. Income statement adjustments related to the reinsurance

program are recognized as information is received. In the event the Company leaves the reinsurance

program, the Company is not relieved of its primary obligation to the policyholders for activity prior to

the termination of the agreement.

Other Current Liabilities

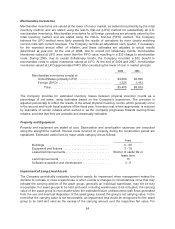

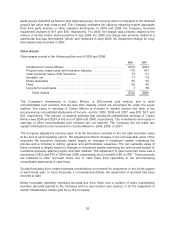

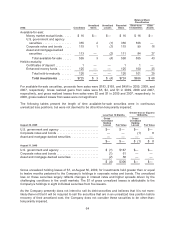

Other current liabilities consist of the following at the end of 2009 and 2008:

2009 2008

2% Reward liability ......................................... $ 456 $ 422

Insurance related liabilities ................................... 241 238

Cash card liability .......................................... 93 91

Other current liabilities ...................................... 83 82

Sales return reserve ........................................ 79 84

Sales and vendor consideration liabilities ....................... 68 79

Deferred sales adjustment ................................... 65 66

Tax-related liabilities ........................................ 54 44

Interest payable ............................................ 51 51

Other Current Liabilities ................................. $1,190 $1,157

56