Capital One 1998 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 1998 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

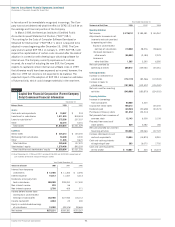

54Capital One Financial Corporation

Notes to Consolidated Financial Statements (continued)

(Currencies in Thousands, Except Per Share Data)

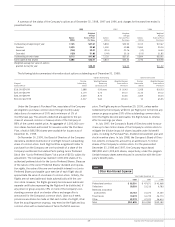

Year Ended December 31

Statements of Cash Flows 1998 1997 1996

Operating Activities:

Net income $ 275,231 $ 189,381 $(155,267

Adjustments to reconcile net

income to net cash provided

by operating activities:

Equity in undistributed

earnings of subsidiaries (19,902) 38,576 (38,665)

(Increase) decrease in

other assets (56,682) (2,183) 2,079

Increase in

other liabilities 1,365 3,290 6,380

Net cash provided by

operating activities 200,012 229,064 125,061

Investing Activities:

Increase in investment in

subsidiaries (172,119) (83,366) (119,502)

Increase in loans to

subsidiaries (167,889) (102,507) (105,000)

Net cash used for investing

activities (340,008) (185,873) (224,502)

Financing Activities:

Increase in borrowings

from subsidiaries 50,900 3,300

Issuance of senior notes 199,213 125,000

Dividends paid (20,533) (20,638) (20,573)

Purchases of treasury stock (91,672) (52,314)

Net proceeds from issuances of

common stock 12,143 6,509 3,109

Proceeds from exercise of

stock options 629 4,082 186

Net cash provided by (used for)

financing activities 150,680 (59,061) 107,722

Increase (decrease) in cash

and cash equivalents 10,684 (15,870) 8,281

Cash and cash equivalents

at beginning of year 203 16,073 7,792

Cash and cash equivalents

at end of year $ 10,887 $ 203 $(16,073

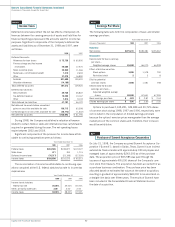

in fair value will be immediately recognized in earnings. The Com-

pany has not yet determined what the effect of SFAS 133 will be on

the earnings and financial position of the Company.

In March 1998, the American Institute of Certified Public

Accountants issued Statement of Position (“SOP”) 98-1,

“Accounting for the Costs of Computer Software Developed or

Obtained for Internal Use” (“SOP 98-1”), which is required to be

adopted in years beginning after December 15, 1998. The Com-

pany plans to adopt SOP 98-1 on January 1, 1999. SOP 98-1 will

require the capitalization of certain costs incurred after the date of

adoption in connection with developing or obtaining software for

internal use. The Company currently expenses such costs as

incurred. As a result of adopting the new SOP, the Company

expects to capitalize certain internal use software costs in 1999

that otherwise would have been expensed as incurred; however, the

effect on 1999 net income is not expected to be material. The

expected impact of the adoption of SOP 98-1 is based on estimates

of future activity, which could change materially in the near term.

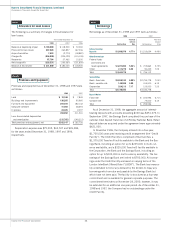

Note S

Capital One Financial Corporation (Parent Company

Only) Condensed Financial Information

December 31

Balance Sheets 1998 1997

Assets:

Cash and cash equivalents $ 10,887 $ 203

Investment in subsidiaries 1,211,255 818,518

Loans to subsidiaries(1) 375,396 207,507

Other 62,316 5,001

Total assets $1,659,854 $1,031,229

Liabilities:

Senior notes $ 324,213 $ 125,000

Borrowings from subsidiaries 54,200 3,300

Other 11,035 9,670

Total liabilities 389,448 137,970

Stockholders’ equity 1,270,406 893,259

Total liabilities and stockholders’ equity $1,659,854 $1,031,229

(1) As of December 31, 1998 and 1997, includes $108,400 and $143,500, respectively, of

cash invested at the Bank instead of the open market.

Year Ended December 31

Statements of Income 1998 1997 1996

Interest from temporary

investments $ 12,485 $ 11,352 $ 2,296

Interest expense 18,212 11,067 3,013

Dividends, principally from

bank subsidiaries 260,000 228,000 117,400

Non-interest income 893 56

Non-interest expense 2,700 409 571

Income before income taxes

and equity in undistributed

earnings of subsidiaries 252,466 227,932 116,112

Income tax benefit 2,863 25 490

Equity in undistributed earnings

of subsidiaries 19,902 (38,576) 38,665

Net income $275,231 $189,381 $155,267