Capital One 1998 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 1998 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

53 Capital One Financial Corporation

Cash and Cash Equivalents

The carrying amounts of cash and due from banks, federal funds

sold and resale agreements and interest-bearing deposits at other

banks approximated fair value.

Securities Available for Sale

The fair value of securities available for sale was determined using

current market prices. See Note B.

Consumer Loans

The net carrying amount of consumer loans, including the Com-

pany’s seller’s interest in securitized consumer loan receivables,

approximated fair value due to the relatively short average life and

variable interest rates on a substantial number of these loans. This

amount excluded any value related to account relationships.

Interest Receivable

The carrying amount approximated fair value.

Interest Only Strips

The fair value of the I/O strips was determined using discounted

cash flow calculations. Cash flows are estimated based on the latest

forecast for the activity related to securitized loans.

Borrowings

The carrying amounts of interest-bearing deposits, other borrowings

and deposit notes approximated fair value. The fair value of senior

notes was $3,769,000 and $3,351,000 as of December 31,

1998 and 1997, respectively, and determined based on quoted

market prices.

Interest Payable

The carrying amount approximated fair value.

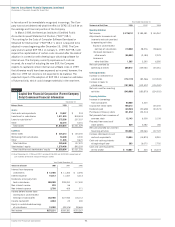

Off-Balance Sheet Financial Instruments

The fair value was the estimated net amount that the Company

would have (paid)/received to terminate the interest rate swaps, cur-

rency swaps and f/x contracts at the respective dates, taking into

account the forward yield curve on the swaps and the forward rates

on the currency swaps and f/x contracts. As of December 31, 1998

and 1997, the estimated fair value was $(64,713) and $5,800,

respectively.

Note R

Recent Accounting Pronouncements

In June 1998, the FASB issued SFAS No. 133, “Accounting for

Derivative Instruments and Hedging Activities” (“SFAS 133”),

which is required to be adopted in years beginning after June 15,

1999. SFAS 133 permits early adoption as of the beginning of any

fiscal quarter after its issuance. SFAS 133 will require the Com-

pany to recognize all derivatives on the balance sheet at fair value.

Derivatives that are not hedges must be adjusted to fair value

through earnings. If the derivative is a hedge, depending on the

nature of the hedge, changes in the fair value of derivatives will

either be offset against the change in fair value of the hedged

assets, liabilities or firm commitments through earnings or recog-

nized in other comprehensive income until the hedged item is rec-

ognized in earnings. The ineffective portion of a derivative’s change

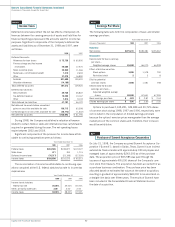

variable rates to match the original swaps. As of December 31,

1998 and 1997, the original swaps had notional amounts totaling

$291,000 and $1,041,000, respectively. The offsetting swaps also

had notional amounts totaling $291,000 and $1,041,000 as of

December 31, 1998 and 1997, respectively. As of December 31,

1998, the variable rate payments on the original and offsetting

swaps were matched and will continue to offset each other through

the swaps’ maturities in 1999 and 2000.

Note P

Significant Concentration of Credit Risk

The Company is active in originating consumer loans, primarily in

the United States. The Company reviews each potential customer’s

credit application and evaluates the applicant’s financial history

and ability and willingness to repay. Loans are made primarily on an

unsecured basis; however, certain loans require collateral in the

form of cash deposits. International consumer loans are originated

primarily in Canada and the United Kingdom. The geographic dis-

tribution of the Company’s consumer loans was as follows:

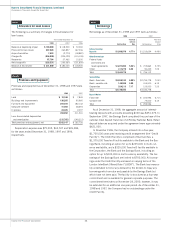

Year Ended December 31

1998 1997

Percentage Percentage

Geographic Region Loans of Total Loans of Total

South $ 5,868,386 33.74% $ 5,061,414 35.57%

West 3,609,952 20.75 3,361,556 23.62

Northeast 3,032,061 17.43 2,835,256 19.92

Midwest 2,992,334 17.20 2,533,469 17.80

International 1,892,393 10.88 439,320 3.09

17,395,126 100.00% 14,231,015 100.00%

Less securitized

balances (11,238,015) (9,369,328)

Total $ 6,157,111 $ 4,861,687

Note Q

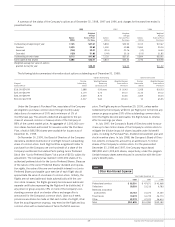

Disclosures About Fair Value of Financial Instruments

The following discloses the fair value of financial instruments as of

December 31, 1998 and 1997, whether or not recognized in the

balance sheets. In cases where quoted market prices are not avail-

able, fair values are based on estimates using present value or other

valuation techniques. Those techniques are significantly affected

by the assumptions used, including the discount rate and estimates

of future cash flows. In that regard, the derived fair value estimates

cannot be substantiated by comparison to independent markets

and, in many cases, could not be realized in immediate settlement

of the instrument. As required under GAAP, these disclosures

exclude certain financial instruments and all non-financial instru-

ments. Accordingly, the aggregate fair value amounts presented do

not represent the underlying value of the Company.

The following methods and assumptions were used by the Com-

pany in estimating the fair value of its financial instruments as of

December 31, 1998 and 1997: