Capital One 1998 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 1998 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

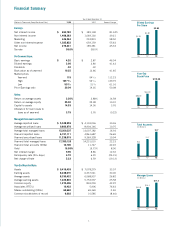

In 1998, for the fourth straight year, Capital One

broke records across the board and broke them by

wide margins. We see this long winning streak as

testimony to the power of our Information-Based Strategy,

our success in executing it and the commitment we have

made to innovation in every part of the company.

At the time of our initial public offering in November

1994, we announced two highly ambitious goals for

Capital One: annual per share earnings growth and

annual return on equity of at least 20%. We have

surpassed both goals for four consecutive years and have

already announced that we expect to surpass them again

in 1999. Our consumer franchise now includes one of

every seven U.S. households, and our loan portfolio has

grown to $17.4 billion. We were delighted that a share of

Capital One stock, worth $16 on the day we went public,

traded for $115 on December 31, 1998.

The company’s 1998 net income of $275.2 million,

or $3.96 per share, was up more than 40% from

$189.4 million, or $2.80 per share, in 1997. In addi-

tion, we doubled our marketing investment to $446

million, particularly note-

worthy in a year of such

strong earnings growth.

This investment, which

funds current marketing

efforts and the vast testing we do to find and pursue new

opportunities, generates a steady stream of innovation

and growth for Capital One.

Total revenue (managed net interest income plus non-

interest income) also reached record levels, rising 33% to

$2.8 billion in 1998 from $2.1 billion in 1997. Managed

net interest income was up 31% to $1.7 billion, the result

Fellow Stockholders:

of an increase of 109 basis points in the net interest mar-

gin and a 22% increase in managed loans. Managed non-

interest income was up 38% to $1.1 billion.

For the third consecutive year, Capital One’s rate of

account growth (42%) set a record. We added an impres-

sive 14,000 net new accounts a day. In the last quarter,

the pace accelerated to 20,000 a day. We ended the year

with 16.7 million customers—almost 5 million more

than we had at the end of 1997.

Credit performance was outstanding. Delinquencies

declined throughout the year to 4.70% as of December 31,

1998, compared with 6.20% a year earlier. Charge-offs

improved 186 basis points to 4.51% for the fourth quarter

of 1998, compared with 6.37% in the fourth quarter 1997.

Capital One’s fourth quarter net charge-offs as a percent-

age of managed loans were among the industry’s lowest.

While 1998’s credit performance benefited from an

improved consumer credit environment, it also reflects

the success of Capital One’s approach to credit and mar-

keting. We couple highly sophisticated credit modeling

with credit policies and pricing closely matched to the

risk profile of each cus-

tomer. And our marketing

success with customers

that we have dubbed

“superprime” has signifi-

cantly changed the mix of our loan portfolio: 30% of our

loans now represent borrowings by these customers.

These are high-income, very low-risk customers who are

even more attractive than the “prime” customers that are

the target of most of our industry’s marketing efforts.

Over the last two years, with innovative products designed

for the highly diverse needs of superprime customers, we

3

In 1998, for the fourth straight year, Capital

One broke records across the board and

broke them by wide margins.