Capital One 1998 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 1998 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

29 Capital One Financial Corporation

Kingdom, the Company will maintain a minimum Tier 1 Leverage

ratio of 3.0%. As of December 31, 1998 and 1997, the Company’s

Tier 1 Leverage ratio was 13.49% and 13.83%, respectively.

Additional information regarding capital adequacy can be found

in Note K to the Consolidated Financial Statements.

In July 1997, the Company’s Board of Directors voted to repur-

chase up to two million shares of the Company’s common stock

over the next two years to mitigate the dilutive impact of shares

issuable under its benefit plans, including its Associate Stock Pur-

chase Plan, dividend reinvestment plan and stock incentive plans.

In July 1998, the Company’s Board of Directors voted to increase

this amount by an additional 1.5 million shares of the Company’s

common stock. The Company uses various strategies to reduce the

cost of its share repurchase program, including the writing of put

options on anticipated repurchases. For the years ended December

31, 1998 and 1997, the Company repurchased 895,800 and

1,318,641 shares, respectively, under this program. Certain

treasury shares were reissued in connection with the Company’s

benefit plans.

Capital Adequacy

The Bank and the Savings Bank are subject to capital adequacy

guidelines adopted by the Federal Reserve Board (the “Federal

Reserve”) and the Office of Thrift Supervision (the “OTS”) (collec-

tively, the “regulators”), respectively. The capital adequacy guide-

lines and the regulatory framework for prompt corrective action

require the Bank and the Savings Bank to maintain specific capital

levels based upon quantitative measures of their assets, liabilities

and off-balance sheet items.

The most recent notifications received from the regulators cate-

gorized the Bank and the Savings Bank as “well-capitalized.” As of

December 31, 1998, there are no conditions or events since the

notifications discussed above that management believes have

changed either the Bank or the Savings Bank’s capital category.

During 1996, the Bank received regulatory approval and estab-

lished a branch office in the United Kingdom. In connection with

such approval, the Company committed to the Federal Reserve

that, for so long as the Bank maintains a branch in the United

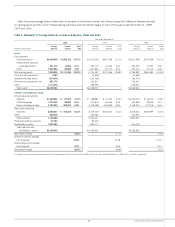

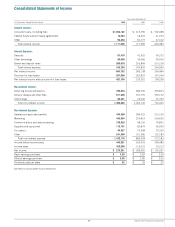

Table 11: Securitizations

—

Amortization Table

(Dollars in Thousands) 1999 2000 2001 2002 2003-2008

Balance at beginning of year $11,742,081 $(9,766,447 $(7,260,833 $(3,758,706 $(2,126,356

Less repayment amounts (1,975,634) (2,505,614) (3,502,127) (1,632,350) (2,126,356)

Balance at end of year $ 9,766,447 $(7,260,833 $(3,758,706 $(2,126,356 $

—

Table 10 shows the maturities of certificates of deposit in

denominations of $100,000 or greater (large denomination CDs) as

of December 31, 1998.

Table 10: Maturities of Domestic Large Denomination

Certificates

—

$100,000 or More

December 31, 1998

(Dollars in Thousands) Balance Percent

3 months or less $ 66,174 14.67%

Over 3 through 6 months 36,730 8.14%

Over 6 through 12 months 88,889 19.71%

Over 12 months 259,283 57.48%

Total $451,076 100.00%

Additional information regarding funding can be found in Note E

to the Consolidated Financial Statements.

Liquidity

Liquidity refers to the Company’s ability to meet its cash needs.

The Company meets its cash requirements by securitizing assets

and through issuing debt. As discussed in “Managed Consumer

Loan Portfolio,” a significant source of liquidity for the Company

has been the securitization of consumer loans. Maturity terms of

the existing securitizations vary from 1999 to 2008 and typically

have accumulation periods during which principal payments are

aggregated to make payments to investors. As payments on the

loans are accumulated and are no longer reinvested in new loans,

the Company’s funding requirements for such new loans increase

accordingly. The occurrence of certain events may cause the securi-

tization transactions to amortize earlier than scheduled, which

would accelerate the need for funding.

Table 11 shows the amounts of investor principal from securi-

tized consumer loans that are expected to amortize, or be otherwise

paid over the periods indicated, based on outstanding securitized

consumer loans as of January 1, 1999. As of December 31, 1998

and 1997, 65% and 66%, respectively, of the Company’s total

managed loans were securitized.

As such amounts amortize or are otherwise paid, the Company

believes it can securitize consumer loans, purchase federal funds

and establish other funding sources to fund the amortization or

other payment of the securitizations in the future, although no

assurance can be given to that effect. Additionally, the Company

maintains a portfolio of high-quality securities such as U.S. Trea-

suries and other U.S. government obligations, commercial paper,

interest-bearing deposits with other banks, federal funds and other

cash equivalents in order to provide adequate liquidity and to meet

its ongoing cash needs. As of December 31, 1998, the Company

had $2.1 billion of such securities.

Liability liquidity is measured by the Company’s ability to obtain

borrowed funds in the financial markets in adequate amounts

and at favorable rates. As of December 31, 1998, the Company,

the Bank and the Savings Bank collectively had over $1.9 billion

in unused commitments, under its credit facilities, available for

liquidity needs.