Capital One 1998 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 1998 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52Capital One Financial Corporation

Notes to Consolidated Financial Statements (continued)

(Currencies in Thousands, Except Per Share Data)

Note N

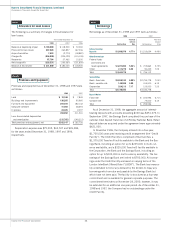

Securitizations

The Company securitized $4,616,972 ($245,752 international),

$2,114,695 and $2,695,000 of consumer loan receivables for the

years ended December 31, 1998, 1997 and 1996, respectively. As

of December 31, 1998, receivables under securitizations outstand-

ing consisted of $1,309,518 of retained (“seller’s”) interests and

$11,742,081 of investors’ undivided interests, maturing from

1999 to 2008.

The terms of securitizations require the Company to maintain a

certain level of assets, retained by the trust, to absorb potential

credit losses. The amount available to absorb potential credit losses

was included in accounts receivable from securitizations and was

$263,426 and $231,809 as of December 31, 1998 and 1997,

respectively.

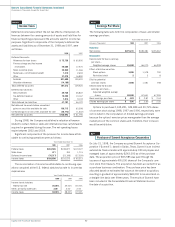

Note O

Off-Balance Sheet Financial Instruments

The Company has entered into interest rate swaps to effectively

convert certain interest rates on bank notes from variable to fixed.

The pay-fixed, receive-variable swaps, which had a notional amount

totaling $157,000 as of December 31, 1998, will mature from

2001 to 2007 to coincide with maturities of the variable bank

notes to which they are designated. The Company has also entered

into amortizing notional interest rate swaps to effectively convert

certain interest rates on fixed rate consumer loans from fixed to

variable, thereby reducing the interest rate sensitivity of loan secu-

ritizations. These pay-fixed, receive-variable interest rate swaps,

which had an amortizing notional amount totaling $2,877,000 as

of December 31, 1998, will amortize through 2004 and 2005 to

coincide with the estimated attrition of the fixed rate consumer

loans to which they are designated. The Company also had a pay-

fixed, receive-variable interest rate swap with an amortizing

notional amount of C$225,000, which will amortize through 2003

to coincide with the estimated attrition of the fixed rate Canadian

dollar consumer loans to which it is designated.

The Company has also entered into currency swaps that effec-

tively convert fixed rate pound sterling interest receipts to fixed rate

U.S. dollar interest receipts on pound sterling denominated assets.

These currency swaps had notional amounts totaling $260,000 as

of December 31, 1998, and mature from 2001 to 2005, coincid-

ing with the repayment of the assets to which they are designated.

The Company has entered into f/x contracts to reduce the Com-

pany’s sensitivity to foreign currency exchange rate changes on its

foreign currency denominated assets and liabilities. As of Decem-

ber 31, 1998, the Company had f/x contracts with notional

amounts totaling $1,005,000, which mature in 1999 to coincide

with the repayment of the assets to which they are designated.

In 1997, the Company entered into swaps to effectively offset

certain pay-variable, receive-fixed swaps which were designated to

fixed rate bank notes and securitization liabilities. The offsetting

swaps had maturities and terms which paid-fixed and received-

certain liabilities incurred in litigation arising from that business,

which may include liabilities, if any, incurred in the purported class

action case described below.

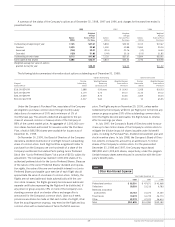

During 1995, the Company and the Bank became involved in a

purported class action suit relating to certain collection practices

engaged in by Signet Bank and, subsequently, by the Bank. The

complaint in this case alleges that Signet Bank and/or the Bank

violated a variety of California state statutes and constitutional and

common law duties by filing collection lawsuits, obtaining judge-

ments and pursuing garnishment proceedings in the Virginia state

courts against defaulted credit card customers who were not resi-

dents of Virginia. This case was filed in the Superior Court of Cali-

fornia in the County of Alameda, Southern Division, on behalf of a

class of California residents. The complaint in this case seeks

unspecified statutory damages, compensatory damages, punitive

damages, restitution, attorneys’ fees and costs, a permanent

injunction and other equitable relief.

In early 1997, the California court entered judgement in favor of

the Bank on all of the plaintiffs’ claims. The plaintiffs appealed the

ruling to the California Court of Appeals First Appellate District

Division 4. In early 1999, the Court of Appeals affirmed the trial

court’s ruling in favor of the Bank on six counts, but reversed the

trial court’s ruling on two counts of the plaintiffs’ complaint. The

Bank intends to petition for further appellate review of the ruling on

the two remaining counts.

Because no specific measure of damages is demanded in the

complaint of the California case and the trial court entered judge-

ment in favor of the Bank before the parties completed any signifi-

cant discovery, an informed assessment of the ultimate outcome of

this case cannot be made at this time. Management believes, how-

ever, that there are meritorious defenses to this lawsuit and intends

to defend it vigorously.

The Company is commonly subject to various other pending and

threatened legal actions arising from the conduct of its normal

business activities. In the opinion of management, the ultimate

aggregate liability, if any, arising out of any pending or threatened

action will not have a material adverse effect on the consolidated

financial condition of the Company. At the present time, however,

management is not in a position to determine whether the resolu-

tion of pending or threatened litigation will have a material effect

on the Company’s results of operations in any future reporting

period.

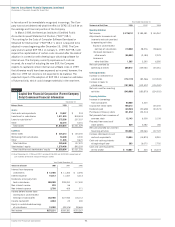

Note M

Related Party Transactions

In the ordinary course of business, executive officers and directors

of the Company may have consumer loans issued by the Company.

Pursuant to the Company’s policy, such loans are issued on the

same terms as those prevailing at the time for comparable loans to

unrelated persons and do not involve more than the normal risk of

collectibility.