Capital One 1998 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 1998 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

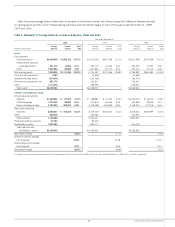

Table 5: Interest Variance Analysis

Year Ended December 31

1998 vs. 1997 1997 VS. 1996

Increase Change Due to(1) Increase Change Due to(1)

(In Thousands) (Decrease) Volume Yield/Rate (Decrease) Volume Yield/Rate

Interest Income:

Consumer loans $383,337 $213,453 $169,884 $(27,697 $ 69,924 $(42,227)

Federal funds sold and resale agreements (3,859) (3,371) (488) (4,870) (5,676) 806

Other 14,073 16,856 (2,783) 34,675 36,545 (1,870)

Total interest income 393,551 206,040 187,511 57,502 123,085 (65,583)

Interest Expense:

Deposits 25,547 22,007 3,540 (14,340) (4,422) (9,918)

Other borrowings 49,534 47,854 1,680 10,557 10,947 (390)

Senior and deposit notes 6,826 4,713 2,113 43,631 37,446 6,185

Total interest expense 81,907 81,157 750 39,848 40,394 (546)

Net interest income(1) $311,644 $113,910 $197,734 $(17,654 $ 67,129 $(49,475)

(1) The change in interest due to both volume and yield/rates has been allocated in proportion to the relationship of the absolute dollar amounts of the change in each. The changes in income and

expense are calculated independently for each line in the table. The totals for the volume and yield/rate columns are not the sum of the individual lines.

24Capital One Financial Corporation

Management’s Discussion and Analysis of Financial Condition and Results of Operations (continued)

The increase in servicing and securitizations income of $222.5

million, or 48%, to $682.3 million for the year ended December

31, 1997, from $459.8 million for 1996 was due to a number of

factors, including the incremental effect of the implementation of

SFAS 125 and a 17% increase in average off-balance sheet loans.

The incremental effect of adopting the requirements of SFAS 125

was to increase servicing and securitizations income in 1997 by

$32.0 million ($19.8 million net of tax). Prior to 1997, no gains

were recorded due to the relatively short average life of the con-

sumer loans securitized. Excess servicing fee income was recorded

over the life of each sale transaction.

Certain estimates inherent in the determination of the fair value

of the I/O strip are influenced by factors outside the Company’s

control, and as a result, such estimates could materially change in

the near term. Any future gains that will be recognized in accor-

dance with SFAS 125 will be dependent on the timing and amount

of future securitizations. The Company will continuously assess the

performance of new and existing securitization transactions as esti-

mates of future cash flows change.

Other Non-Interest Income

Interchange income increased $37.5 million, or 76%, to $86.5

million for the year ended December 31, 1998, from $49.0 million

in 1997. Service charges and other fees increased to $612.0 mil-

lion, or 81%, for the year ended December 31, 1998 compared to

$337.8 million for the year ended December 31, 1997. These

increases were due to a 39% increase in the average number of

accounts for the year ended December 31, 1998, from 1997, an

increase in charge volume, a shift to more fee-intensive products

and changes in the terms of overlimit fees charged.

Servicing and Securitizations Income

In accordance with SFAS 125, the Company records gains or losses

on the securitizations of consumer loan receivables on the date of

sale based on the estimated fair value of assets sold and retained

and liabilities incurred in the sale. Gains represent the present

value of estimated excess cash flows the Company has retained

over the estimated outstanding period of the receivables and are

included in servicing and securitizations income. This excess cash

flow essentially represents an “interest only” (“I/O”) strip, consist-

ing of the excess of finance charges and past-due fees over the sum

of the return paid to certificateholders, estimated contractual ser-

vicing fees and credit losses. However, exposure to credit losses on

the securitized loans is contractually limited to these cash flows.

Servicing and securitizations income increased $107.5 million,

or 16%, to $789.8 million for the year ended December 31, 1998,

from $682.3 million in 1997. This increase was primarily due to

an increase of 11% in average off-balance sheet loans. Also con-

tributing to this increase were decreased charge-offs on such loans

as a result of improving consumer credit.

affected by changes in the volume of earning assets and interest-

bearing liabilities. Table 5 sets forth the dollar amount of the

increases (decreases) in interest income and interest expense

resulting from changes in the volume of earning assets and inter-

est-bearing liabilities and from changes in yields and rates.

Interest Variance Analysis

Net interest income is affected by changes in the average interest

rate earned on earning assets and the average interest rate paid on

interest-bearing liabilities. In addition, net interest income is