Capital One 1998 Annual Report Download - page 27

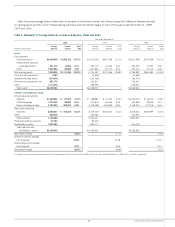

Download and view the complete annual report

Please find page 27 of the 1998 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

25 Capital One Financial Corporation

Non-interest expense for the year ended December 31, 1997

increased $170.8 million, or 24%, to $884.0 million from

$713.2 million for the year ended December 31, 1996. Contrib-

uting to the increase in non-interest expense was salaries and asso-

ciate benefits expense, which increased $74.1 million, or 34%, to

$289.3 million in 1997 compared to $215.2 million in 1996. This

increase reflected additional staff associated with the cost of opera-

tions to manage the growth in accounts and $17.0 million in addi-

tional expense associated with the Company’s associate stock

plans. Also contributing to the increase in non-interest expense was

marketing expenses which increased $18.2 million, or 9%, to

$224.8 million in 1997, from $206.6 million in 1996. All other

non-interest expenses increased $78.4 million, or 27%, to $369.8

million in 1997 compared to $291.4 million in 1996. The increase

in other non-interest expenses was primarily the result of a 33%

increase in the average number of accounts for the year ended

December 31, 1997.

Income Taxes

The Company’s income tax rate was 38% for the years ended

December 31, 1998 and 1997, and 37.5% for the year ended

December 31, 1996. The effective rate includes both state and

federal income tax components.

Asset Quality

The asset quality of a portfolio is generally a function of the initial

underwriting criteria used, seasoning of the accounts, levels of

competition, account management activities and demographic con-

centration, as well as general economic conditions. Accounts tend

to exhibit a rising trend of delinquency and credit losses as they

season. As of December 31, 1998 and 1997, 59% and 53% of

managed accounts, representing 51% and 43% of the total man-

aged loan balance, respectively, were less than eighteen months

old. Accordingly, it is likely that the Company’s managed loan port-

folio could experience increased levels of delinquency and credit

losses as the average age of the Company’s accounts increases.

Changes in the rates of delinquency and credit losses can also

result from a shift in the product mix. As discussed in “Risk

Adjusted Revenue and Margin,” certain other customized card

products have, in some cases, higher delinquency and higher

charge-off rates. In the case of secured card loans, collateral, in the

form of cash deposits, reduces any ultimate charge-offs. The costs

associated with higher delinquency and charge-off rates are consid-

ered in the pricing of individual products.

During 1998, general economic conditions for consumer credit

stabilized and improved as industry levels of charge-offs (including

bankruptcies) and delinquencies both decreased. These trends

have positively impacted the Company’s 1998 results.

Interchange income decreased $2.4 million, or 5%, to $49.0 mil-

lion for the year ended December 31, 1997, from $51.4 million in

1996 as a result of the securitization of a higher percentage of more

fee-intensive other credit card products in 1997 compared to 1996.

Service charges and other fees increased to $337.8 million, or 34%,

for the year ended December 31, 1997 compared to $252.2 million

for the year ended December 31, 1996. This increase was due to a

33% increase in the average number of accounts for the year ended

December 31, 1997, from 1996, a shift to more fee-intensive prod-

ucts and changes in the terms of overlimit fees charged.

Non-Interest Expense

Non-interest expense for the year ended December 31, 1998,

increased $588.1 million, or 67%, to $1.5 billion from $884.0

million for the year ended December 31, 1997. Contributing to the

increase in non-interest expense were marketing expenses which

increased $221.4 million, or 98%, to $446.3 million in 1998,

from $224.8 million in 1997. The increase in marketing expenses

during 1998 reflects the Company’s continued identification of and

investments in opportunities for growth. Salaries and associate

benefits increased $187.1 million, or 65%, to $476.4 million in

1998, from $289.3 million in 1997, as the Company added 4,526

associates to manage the growth in the Company’s accounts. This

increase also reflects an additional $45.3 million in compensation

expense associated with the Company’s associate stock plans com-

pared to the prior year. All other non-interest expenses increased

$179.6 million, or 49%, to $549.5 million for the year ended

December 31, 1998, from $369.8 million in 1997. The increase

in other non-interest expense, as well as the increase in salaries

and associate benefits not attributable to the Company’s associate

stock plans, was primarily a result of a 39% increase in the average

number of accounts for the year ended December 31, 1998, which

resulted in an increase in staff and other operational costs associ-

ated with the Company’s growth pattern.

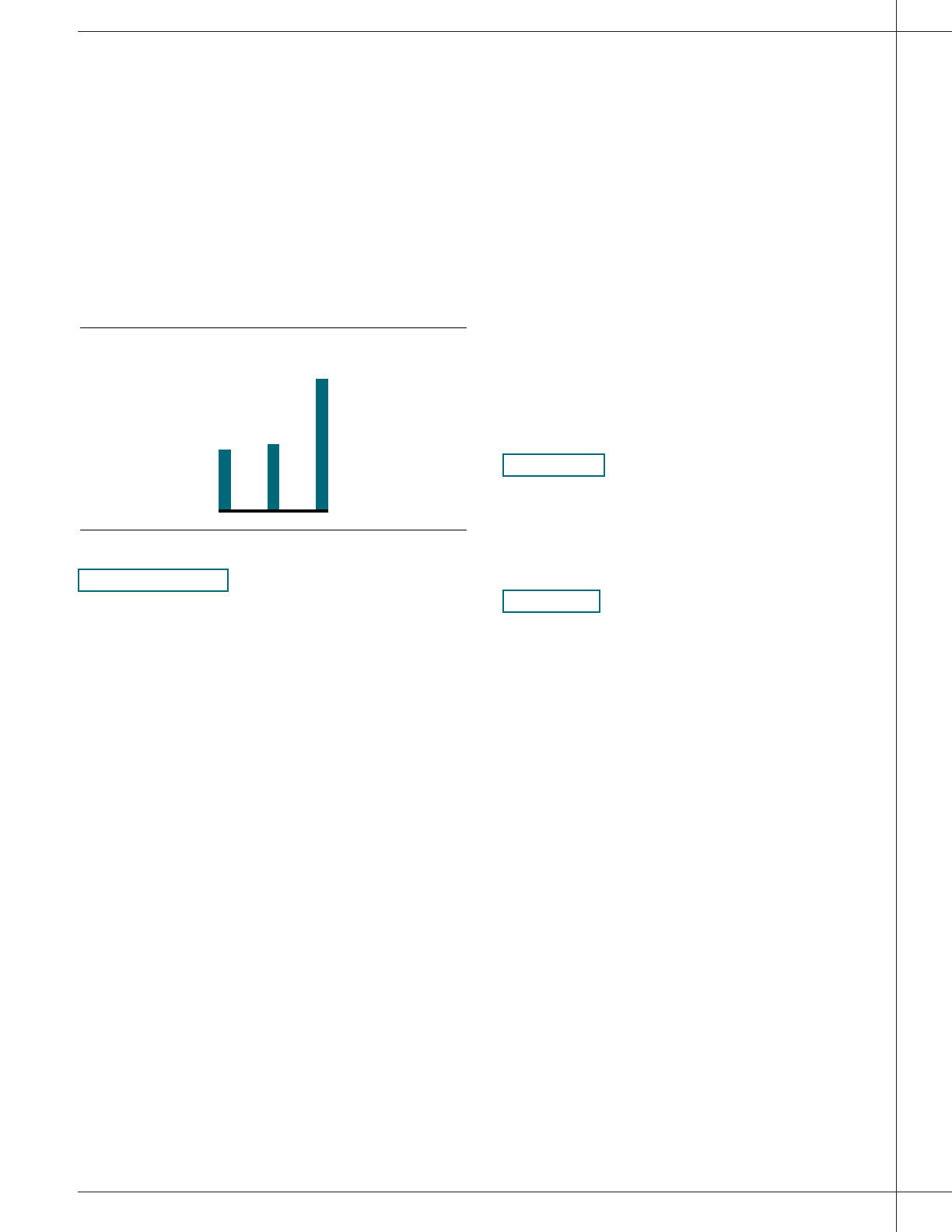

$446

$225

$207

Marketing Investment

(In Millions)

96 97 98