Capital One 1998 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 1998 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44Capital One Financial Corporation

Notes to Consolidated Financial Statements (continued)

(Currencies in Thousands, Except Per Share Data)

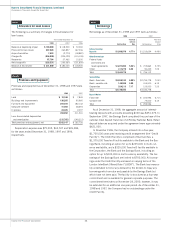

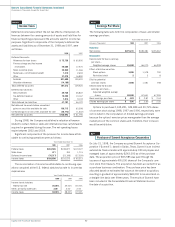

Premises and Equipment

Premises and equipment are stated at cost less accumulated

depreciation and amortization. Depreciation and amortization

expense are computed generally by the straight-line method over

the estimated useful lives of the assets. Useful lives for premises

and equipment are as follows: buildings and improvements

—

5-39

years; furniture and equipment

—

3-10 years; computers and

software

—

3 years.

Marketing

The Company expenses marketing costs as incurred.

Credit Card Fraud Losses

The Company experiences fraud losses from the unauthorized use

of credit cards. Transactions suspected of being fraudulent are

charged to non-interest expense after a sixty-day investigation

period.

Income Taxes

Deferred tax assets and liabilities are determined based on differ-

ences between the financial reporting and tax bases of assets and

liabilities, and are measured using the enacted tax rates and laws

that will be in effect when the differences are expected to reverse.

Comprehensive Income

In June 1997, the FASB issued SFAS No. 130, “Reporting Com-

prehensive Income” (“SFAS 130”). SFAS 130 established new

rules for the reporting and display of comprehensive income and its

components. In 1998, the Company adopted the requirements of

SFAS 130, which require unrealized gains or losses on securities

available for sale and foreign currency translation adjustments to

be included in other comprehensive income. Prior to the adoption

of SFAS 130, such amounts were reported separately in stockhold-

ers’ equity. The adoption of SFAS 130 had no impact on the Com-

pany’s net income or total stockholders’ equity. As of December 31,

1998, 1997 and 1996, cumulative other comprehensive income

net of tax consisted of $63,260, $2,612 and $2,080 in unrealized

gains on securities available for sale and $(2,605), $(73) and

$(132) in foreign currency translation adjustments, respectively.

The provisions of SFAS 130 were applied retroactively.

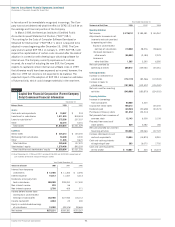

Earnings per Share

Earnings per share are calculated in accordance with SFAS No.

128, “Earnings per Share” (“SFAS 128”). Pursuant to SFAS 128,

basic earnings per share is based only on the weighted average

number of common shares outstanding, excluding any dilutive

effects of options and restricted stock. Diluted earnings per share is

based on the weighted average number of common and common

equivalent shares, dilutive stock options or other dilutive securities

outstanding during the year.

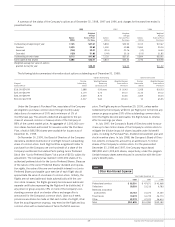

Segments

The Company maintains three distinct business segments: lending,

telecommunications and “other.” The lending segment is com-

prised primarily of credit card lending activities. The telecommuni-

cations segment consists primarily of direct marketing cellular

service.“Other” consists of various, non-lending new business

initiatives.

Management measures the performance of its business seg-

ments on a managed basis and makes resource allocation decisions

based upon several factors, including managed revenue generated

by the segment, net of direct costs before marketing expenses.

Lending is the Company’s only reportable business segment, based

on the definitions provided in SFAS No. 131, “Disclosures about

Segments of an Enterprise and Related Information.” Substantially

all of the Company’s reported assets, revenues and income are

derived from the lending segment in all periods presented.

All lending revenue is generated from external customers and is

predominantly derived in the United States. Lending revenues from

international operations comprised less than 6% of total managed

lending revenues for the year ended December 31, 1998.