Capital One 1998 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 1998 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

26Capital One Financial Corporation

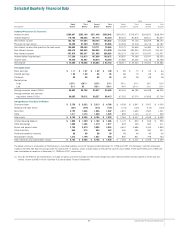

Management’s Discussion and Analysis of Financial Condition and Results of Operations (continued)

The 30-plus day delinquency rate for the reported consumer

loan portfolio decreased to 4.70% as of December 31, 1998, from

5.51% as of December 31, 1997. The 30-plus day delinquency

rate for the managed consumer loan portfolio was 4.70% as of

December 31, 1998, down from 6.20% as of December 31, 1997,

while the dollar amount of delinquent managed consumer loans

decreased approximately $64.2 million. Both the managed and

reported consumer loan portfolio’s delinquency rate decreases

as of December 31, 1998, principally reflected improvements in

consumer credit performance and less seasoned accounts.

Net Charge-Offs

Net charge-offs include the principal amount of losses (excluding

accrued and unpaid finance charges, fees and fraud losses) less

current period recoveries. In 1997, the Company modified its

methodology for charging off credit card loans (net of any collat-

eral) to 180 days past-due from the prior practice of charging

off loans during the next billing cycle after becoming 180 days

past-due.

For the year ended December 31, 1998, the managed net

charge-off rate decreased 126 basis points to 5.33%. For the year

ended December 31, 1998, the reported net charge-off rate

decreased 59 basis points to 4.24%. The decreases in managed

and reported net charge-off rates were the result of improved

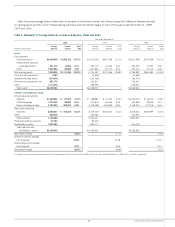

Delinquencies

Table 6 shows the Company’s consumer loan delinquency trends for

the years presented on a reported and managed basis. The entire

balance of an account is contractually delinquent if the minimum

payment is not received by the payment due date. Delinquencies

not only have the potential to impact earnings if the account

charges off, they also are costly in terms of the personnel and other

resources dedicated to resolving the delinquencies.

Table 6: Delinquencies

December 31

1998 1997 1996 1995 1994

% of % of % of % of % of

Total Total Total Total Total

(Dollars in Thousands) Loans Loans Loans Loans Loans Loans Loans Loans Loans Loans

Reported:

Loans outstanding $ 6,157,111 100.00% $ 4,861,687 100.00% $ 4,343,902 100.00% $ 2,921,679 100.00% $2,228,455 100.00%

Loans delinquent:

30-59 days 123,162 2.00 104,216 2.14 96,819 2.23 65,711 2.25 29,032 1.30

60-89 days 67,504 1.10 64,217 1.32 55,679 1.28 38,311 1.31 14,741 .66

90 or more days 98,798 1.60 99,667 2.05 111,791 2.57 79,694 2.73 24,445 1.10

Total $ 289,464 4.70% $ 268,100 5.51% $ 264,289 6.08% $ 183,716 6.29% $ 68,218 3.06%

Managed:

Loans outstanding $17,395,126 100.00% $14,231,015 100.00% $12,803,969 100.00% $10,445,480 100.00% $7,378,455 100.00%

Loans delinquent:

30-59 days 329,239 1.89 327,407 2.30 279,787 2.19 165,306 1.58 90,733 1.23

60-89 days 182,982 1.05 213,726 1.50 162,668 1.27 92,665 .89 45,277 .61

90 or more days 305,589 1.76 340,887 2.40 356,700 2.78 181,243 1.73 81,720 1.11

Total $ 817,810 4.70% $ 882,020 6.20% $ 799,155 6.24% $ 439,214 4.20% $ 217,730 2.95%

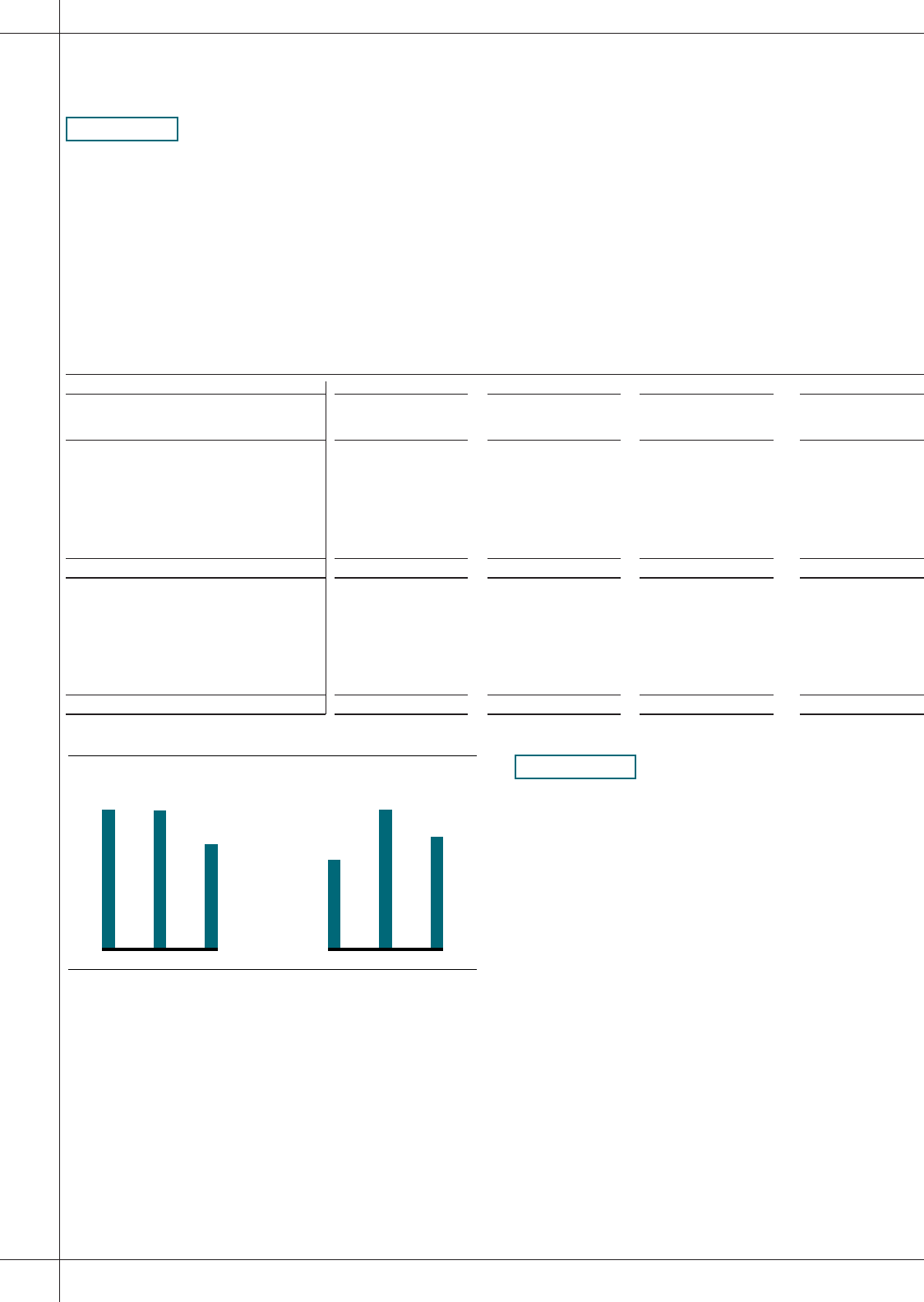

4.70%

6.20%

6.24%

Managed 30+ Day

Delinquency Rate

96 97 98

5.33%

6.59%

4.24%

Managed Net

Charge-Off Rate

96 97 98