Capital One 1998 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 1998 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

9

Everybody in our industry wants blue-

chip customers. We’ve got them. And

they’re the fastest-growing segment of

our business. Most card issuers treat

all affluent customers with good credit

histories alike. We know this market is

not a monolith. It’s a mosaic of many, many micro-

segments. We’re rapidly growing our business with these

“superprime” customers by using scientific testing and

mass customization to create distinctive products serving

a multiplicity of needs. The 9.9% fixed rate card we

introduced for the superprime market is widely

recognized as a best buy. Our Miles One frequent flyer

program comes without blackout periods or seat

restrictions and is redeemable on any airline. Because of

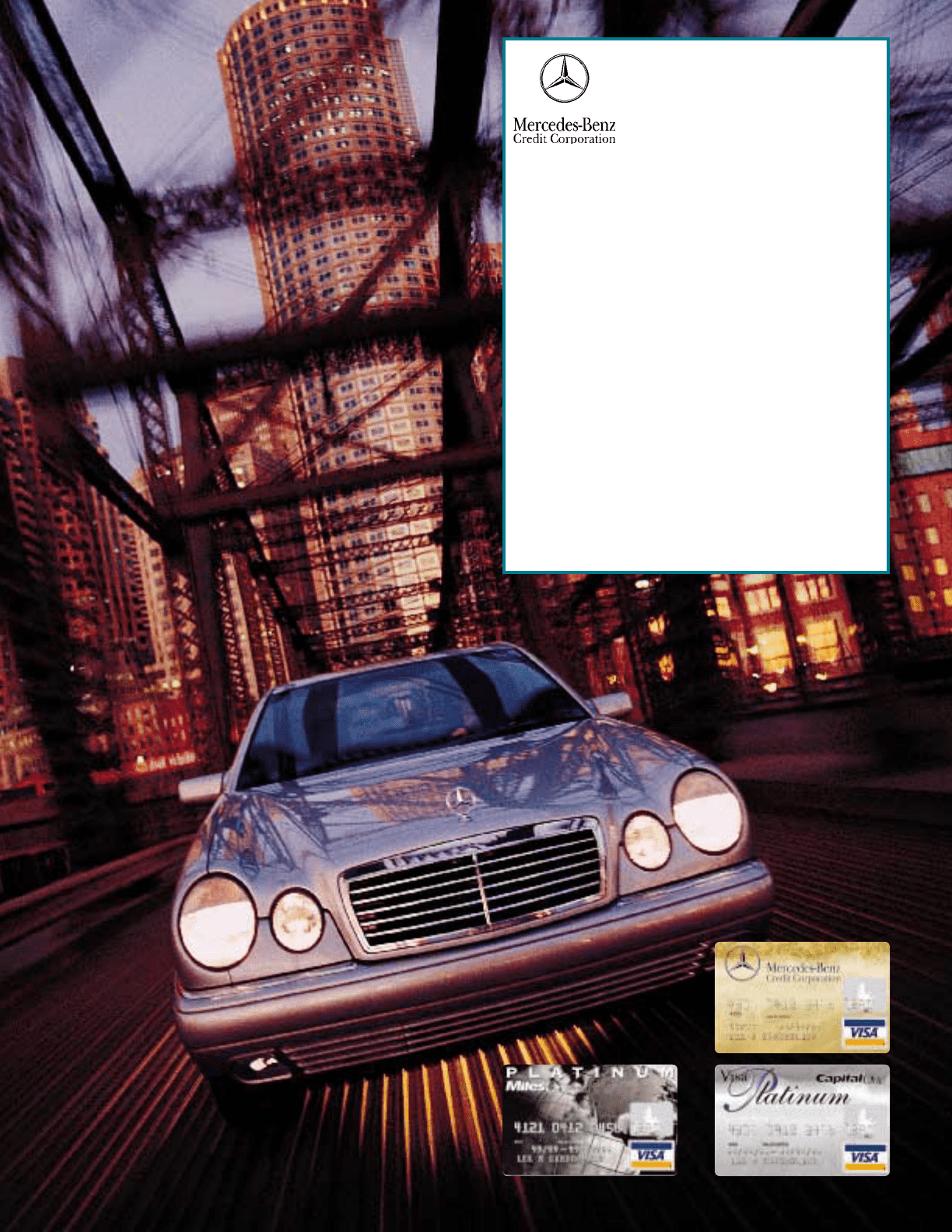

our commitment to looking after customers, Mercedes-

Benz invited us to create a card offering Mercedes

drivers the high prestige and quality of its own brand.

The card has been a big success. As we have pushed

innovation and microsegmentation to new levels in this

market, superprime loans have grown to 30% of our

portfolio in only two years. In the process, we have given

Capital One a gateway to America’s premier consumer

market. Through further innovation and segmentation,

we expect continued growth with superprime customers.