Capital One 1998 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 1998 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

28Capital One Financial Corporation

Management’s Discussion and Analysis of Financial Condition and Results of Operations (continued)

Internationally, the Company has funding programs designed for

foreign investors or to raise funds in foreign currencies. The Com-

pany has accessed the international securitization market for a

number of years with both US$ and foreign denominated transac-

tions. Both of the Company’s committed revolving credit facilities

offer foreign currency funding options. The Bank has established a

$1.0 billion Euro Debt Issuance program that is targeted to non-

U.S. investors. The Company funds its foreign assets by directly or

synthetically borrowing or securitizing in the local currency to miti-

gate the financial statement effect of currency translation.

The Company has significantly expanded its retail deposit gath-

ering efforts through both direct and broker marketing channels.

The Company uses its IBS capabilities to test and market a variety

of retail deposit origination strategies, as well as to develop cus-

tomized account management programs. As of December 31,

1998, the Company had $2.0 billion in interest-bearing deposits,

with original maturities up to five years.

12% from December 31, 1996, and the continued growth of other

customized card products. In consideration of these factors, the

Company increased the allowance for loan losses by $64.5 million

during 1997.

Funding

The Company has established access to a wide range of domestic

funding alternatives, in addition to securitization of its consumer

loans. The Company primarily issues senior unsecured debt of the

Bank through its $8.0 billion bank note program, of which $3.4 bil-

lion was outstanding as of December 31, 1998, with original terms

of one to ten years. During 1998, the Bank continued to expand its

fixed income investor base by launching $300 million five-year and

$200 million ten-year benchmark underwritten senior note transac-

tions, followed by additional issuances in response to investor inter-

est. The Corporation also continued to access the capital markets

with a $200 million ten-year senior note.

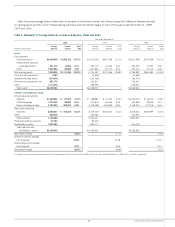

Table 9 reflects the costs of other borrowings of the Company as of and for each of the years ended December 31, 1998, 1997 and 1996.

Table 9: Other Borrowings

Maximum

Outstanding as of Outstanding Average Average Year-End

(Dollars in Thousands) any Month-End as of Year-End Outstanding Interest Rate Interest Rate

1998

Federal funds purchased and resale agreements $1,451,029 $1,227,000 $1,169,952 6.09% 5.53%

Other 417,279 417,279 206,204 8.44 6.58

Total $1,644,279 $1,376,156 6.44% 5.80%

1997

Federal funds purchased and resale agreements $ 999,200 $ 705,863 $ 503,843 5.54% 5.75%

Other 160,144 90,249 128,033 8.71 7.09

Total $ 796,112 $ 631,876 6.18% 5.90%

1996

Federal funds purchased and resale agreements $ 617,303 $ 445,600 $ 342,354 5.63% 6.26%

Other 207,689 85,383 112,545 8.20 6.43

Total $ 530,983 $ 454,899 6.27% 6.29%

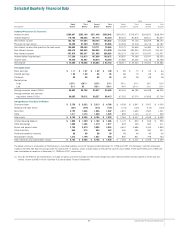

$98

$2,658

$796

$1,313

$975

$98

$2,478

$1,644

$2,000

$1,261

Funding

(In Billions)

●● Interest-bearing Deposits

●● Other Borrowings

●● Senior and Deposit Notes < 3 years

●● Senior and Deposit Notes > 3 years

●● Preferred Beneficial Interests

$7,481

December 31, 1998

$5,480

December 31, 1997