Capital One 1998 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 1998 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

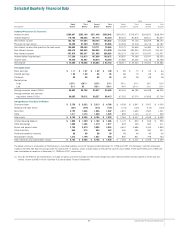

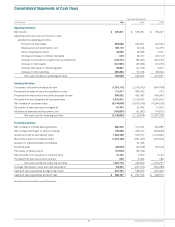

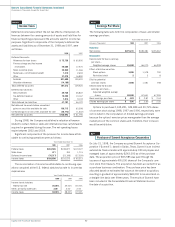

Year Ended December 31

(In Thousands) 1998 1997 1996

Operating Activities:

Net income $ 275,231 $ 189,381 $ 155,267

Adjustments to reconcile net income to cash

provided by operating activities:

Provision for loan losses 267,028 262,837 167,246

Depreciation and amortization, net 108,173 72,674 61,235

Stock compensation plans 70,056 24,878 7,921

(Increase) decrease in interest receivable (141) 26,707 (23,017)

Increase in accounts receivable from securitizations (133,771) (86,261) (143,141)

Increase in other assets (121,951) (49,964) (31,379)

Increase (decrease) in interest payable 22,667 (11,914) 6,431

Increase in other liabilities 293,266 97,914 89,964

Net cash provided by operating activities 780,558 526,252 290,527

Investing Activities:

Purchases of securities available for sale (1,251,713) (1,275,900) (947,478)

Proceeds from sales of securities available for sale 112,277 483,592 773

Proceeds from maturities of securities available for sale 606,532 450,787 490,040

Proceeds from securitizations of consumer loans 4,616,972 2,114,695 2,695,000

Net increase in consumer loans (6,144,640) (2,875,908) (4,264,026)

Recoveries of loans previously charged off 67,764 27,462 13,300

Additions of premises and equipment, net (153,024) (51,602) (74,871)

Net cash used for investing activities (2,145,832) (1,126,874) (2,087,262)

Financing Activities:

Net increase in interest-bearing deposits 686,325 370,632 246,985

Net increase (decrease) in other borrowings 735,288 265,129 (278,820)

Issuances of senior and deposit notes 1,323,700 529,977 2,105,864

Maturities of senior and deposit notes (1,218,162) (891,436) (603,500)

Issuance of preferred beneficial interests 97,428

Dividends paid (20,533) (20,638) (20,573)

Purchases of treasury stock (91,672) (52,314)

Net proceeds from issuances of common stock 12,143 6,509 3,109

Proceeds from exercise of stock options 629 4,082 186

Net cash provided by financing activities 1,427,718 309,369 1,453,251

Increase (decrease) in cash and cash equivalents 62,444 (291,253) (343,484)

Cash and cash equivalents at beginning of year 237,723 528,976 872,460

Cash and cash equivalents at end of year $ 300,167 $ 237,723 $ 528,976

See Notes to Consolidated Financial Statements.

41 Capital One Financial Corporation

Consolidated Statements of Cash Flows