Capital One 1998 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 1998 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

19 Capital One Financial Corporation

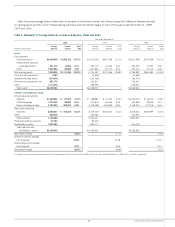

Table 1: Managed Consumer Loan Portfolio

Year Ended December 31

(In Thousands) 1998 1997 1996 1995 1994

Year-End Balances:

Reported consumer loans $ 6,157,111 $ 4,861,687 $ 4,343,902 $ 2,921,679 $2,228,455

Off-balance sheet consumer loans 11,238,015 9,369,328 8,460,067 7,523,801 5,150,000

Total managed consumer loan portfolio $17,395,126 $14,231,015 $12,803,969 $10,445,480 $7,378,455

Average Balances:

Reported consumer loans $ 5,348,559 $ 4,103,036 $ 3,651,908 $ 2,940,208 $2,286,684

Off-balance sheet consumer loans 9,860,978 8,904,146 7,616,553 6,149,070 3,910,739

Total managed consumer loan portfolio $15,209,537 $13,007,182 $11,268,461 $ 9,089,278 $6,197,423

Managed Consumer Loan Portfolio

The Company analyzes its financial performance on a managed

consumer loan portfolio basis. Managed consumer loan data adds

back the effect of off-balance sheet consumer loans. The Company

also evaluates its interest rate exposure on a managed portfolio basis.

The Company’s managed consumer loan portfolio is comprised of

As of December 31, 1998, the managed consumer loan portfo-

lio consisted of 68% fixed and 32% variable interest rate loans.

The Company’s reported consumer loan portfolio as of December

31, 1998, consisted of 62% fixed and 38% variable interest

rate loans.

Since 1990, the Company has actively engaged in consumer

loan securitization transactions. Securitization involves the transfer

by the Company of a pool of loan receivables to an entity created

for securitizations, generally a trust or other special purpose entity

(“the trusts”). The credit quality of the receivables is supported by

credit enhancements, which may be in various forms including a

letter of credit, a cash collateral guaranty or account, or a subordi-

nated interest in the receivables in the pool. Certificates ($11.2 bil-

lion outstanding as of December 31, 1998) representing undivided

ownership interests in the receivables are sold to the public through

an underwritten offering or to private investors in private placement

transactions. The Company receives the proceeds of the sale. The

Company retains an interest in the trusts (“seller’s interest”) equal

to the amount of the receivables transferred to the trust in excess of

the principal balance of the certificates. The Company’s interest in

the trusts varies as the amount of the excess receivables in the

trusts fluctuates as the accountholders make principal payments

and incur new charges on the selected accounts. The securitization

generally results in the removal of the receivables, other than the

seller’s interest, from the Company’s balance sheet for financial

and regulatory accounting purposes.

The Company’s relationship with its customers is not affected by

the securitization. The Company acts as a servicing agent and

receives a fee for doing so.

Collections received from securitized receivables are used to pay

interest to certificateholders, servicing and other fees, and are

available to absorb the investors’ share of credit losses. Amounts

collected in excess of that needed to pay the above amounts are

remitted to the Company, as described in Servicing and Securitiza-

tions Income.

Certificateholders in the Company’s securitization program are

generally entitled to receive principal payments either through

monthly payments during an amortization period or in one lump

sum after an accumulation period. Amortization may begin sooner

in certain circumstances, including if the annualized portfolio yield

reported and off-balance sheet loans. Off-balance sheet loans are

those which have been securitized in accordance with Statement of

Financial Accounting Standards (“SFAS”) No. 125, “Accounting for

Transfers and Servicing of Financial Assets and Extinguishments of

Liabilities” (“SFAS 125”), and are not assets of the Company.

Therefore, those loans are not shown on the balance sheet.

Table 1 summarizes the Company’s managed consumer loan

portfolio.

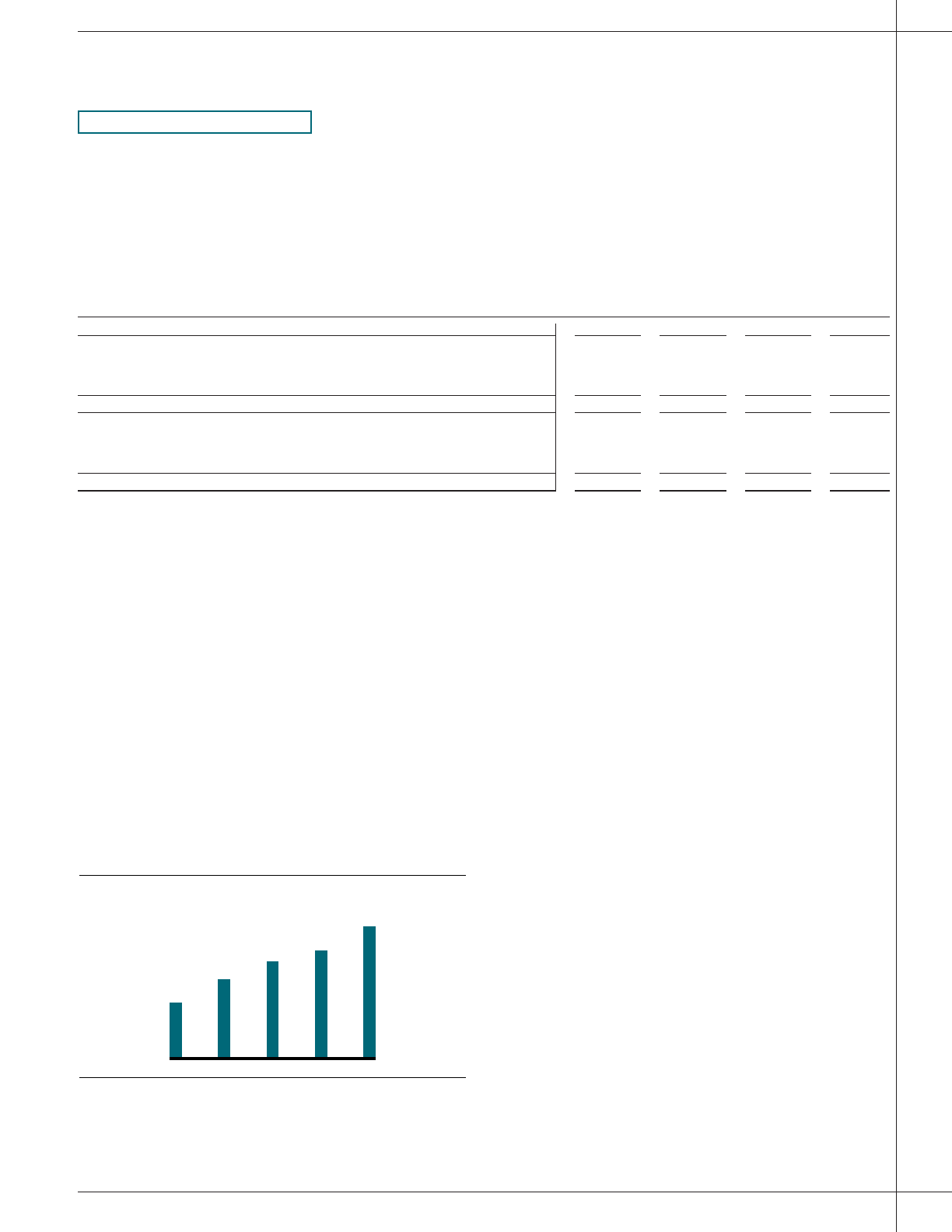

$17.4

$12.8

$14.2

$10.4

$7.4

Managed Loans

(In Billions)

9594 96 97 98