Capital One 1998 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 1998 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46Capital One Financial Corporation

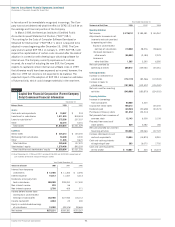

Notes to Consolidated Financial Statements (continued)

(Currencies in Thousands, Except Per Share Data)

Note E

Borrowings

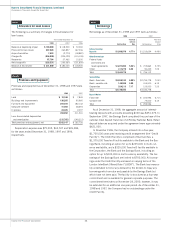

Borrowings as of December 31, 1998 and 1997 were as follows:

1998 1997

Year-End Year-End

Interest Interest

Outstanding Rate Outstanding Rate

Interest-bearing

Deposits $1,999,979 4.77% $1,313,654 4.49%

Other Borrowings

Federal funds

purchased and

resale agreements $1,227,000 5.53% $ 705,863 5.75%

Other 417,279 6.58 90,249 7.09

Total $1,644,279 $ 796,112

Senior Notes

Bank – fixed rate $3,268,182 6.29% $2,793,778 7.03%

Bank – variable rate 146,998 5.89 414,000 6.19

Corporation 324,213 7.17 125,000 7.25

Total $3,739,393 $3,332,778

Deposit Notes

Fixed rate $ 224,996 6.71%

Variable rate 75,000 6.15

Total $ 299,996

As of December 31, 1998, the aggregate amount of interest-

bearing deposits with accounts exceeding $100 was $451,076. In

September 1997, the Savings Bank completed the purchase of the

national retail deposit franchise of JCPenney National Bank. Retail

deposit balances acquired under the agreement were approximately

$421,000.

In November 1996, the Company entered into a four-year,

$1,700,000 unsecured revolving credit arrangement (the “Credit

Facility”). The Credit Facility is comprised of two tranches: a

$1,375,000 Tranche A facility available to the Bank and the Sav-

ings Bank, including an option for up to $225,000 in multi-cur-

rency availability, and a $325,000 Tranche B facility available to

the Corporation, the Bank and the Savings Bank, including an

option for up to $100,000 in multi-currency availability. The bor-

rowings of the Savings Bank are limited to $750,000. All borrow-

ings under the Credit Facility are based on varying terms of the

London InterBank Offered Rate (“LIBOR”). The Bank has irrevoca-

bly undertaken to honor any demand by the lenders to repay any

borrowings which are due and payable by the Savings Bank but

which have not been paid. The facility is structured as a four-year

commitment and is available for general corporate purposes. The

commitment terminates on November 24, 2000; however, it may

be extended for an additional one-year period. As of December 31,

1998 and 1997, the Company had no outstandings under the

Credit Facility.

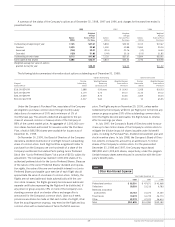

Note C

Allowance for Loan Losses

The following is a summary of changes in the allowance for

loan losses:

Year Ended December 31

1998 1997 1996

Balance at beginning of year $ 183,000 $ 118,500 $ 72,000

Provision for loan losses 267,028 262,837 167,246

Acquisitions/other 7,503 (2,770) (18,887)

Charge-offs (294,295) (223,029) (115,159)

Recoveries 67,764 27,462 13,300

Net charge-offs (226,531) (195,567) (101,859)

Balance at end of year $ 231,000 $ 183,000 $ 118,500

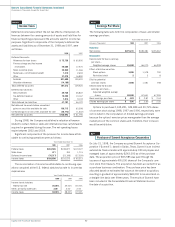

Note D

Premises and Equipment

Premises and equipment as of December 31, 1998 and 1997 were

as follows:

1998 1997

Land $ 10,168 $ 7,849

Buildings and improvements 126,205 90,960

Furniture and equipment 254,070 182,142

Computer software 41,084 28,693

In process 23,325 2,297

454,852 311,941

Less: Accumulated depreciation

and amortization (212,705) (149,215)

Total premises and equipment, net $ 242,147 $ 162,726

Depreciation expense was $75,005, $63,537 and $39,284,

for the years ended December 31, 1998, 1997 and 1996,

respectively.