Capital One 1998 Annual Report Download

Download and view the complete annual report

Please find the complete 1998 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The

Innovation

Imperative

Capital One Financial Corporation

1998 Annual Report

Table of contents

-

Page 1

Capital One Financial Corporation 1998 Annual Report The Innovation Imperative -

Page 2

...in Falls Church, Richmond and Fredericksburg, Virginia; Tampa, Florida; Dallas/Fort Worth, Texas; Federal Way, Washington; Boston, Massachusetts; and London and Nottingham, England. The common stock of Capital One Financial Corporation, part of the Standard & Poor's 500 Index, trades on the New York... -

Page 3

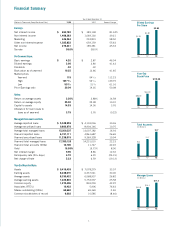

... Consumer Loan Data: Average reported loans Average securitized loans Average total managed loans Year-end reported loans Year-end securitized loans Year-end total managed loans Year-end total accounts (000s) Yield Net interest margin Delinquency rate (30+ days) Net charge-off rate $ 5,348,559... -

Page 4

Richard D. Fairbank Chairman and Chief Executive Ofï¬cer Nigel W. Morris President and Chief Operating Ofï¬cer -

Page 5

...earnings growth. This investment, which funds current marketing efforts and the vast testing we do to ï¬nd and pursue new opportunities, generates a steady stream of innovation and growth for Capital One. Total revenue (managed net interest income plus noninterest income) also reached record levels... -

Page 6

... cards, we are successfully applying our strategy to other geographies and businesses. In the United Kingdom and Canada, our credit cards are winning market share through customization and lower prices. With America One, we are reinventing the marketing of wireless phone service by selling directly... -

Page 7

... for technology-based marketing. â- Globalization, which gives rise to marketing opportunities all over the world. â- Excellent product growth trends. The credit card is steadily replacing cash and checks as the preferred medium of exchange. Wireless phones are becoming a mass consumer product as... -

Page 8

... job skills to high school and community college students. And we started a scholarship program that rewards improvement in math and science grades. As we begin 1999, Capital One is stronger than ever. We're building on four years of record earnings, record marketing investments and record levels... -

Page 9

... strategy and into every associate, every department, every piece of technology, every process and every test of new ideas. Our goal: be ï¬rst to market, roll out at full speed, then move on. Rather than wait for the competition to obsolete our products, we do it ourselves. Capital One's strategy... -

Page 10

... Strategy with one of the world's largest data warehouses, we're using mass customization to market to people's passions. Some of our competitors offer afï¬nity cards by forming alliances with clubs and other groups to create cards for their members. We leapfrog the groups and go direct, with cards... -

Page 11

... to new levels in this market, superprime loans have grown to 30% of our portfolio in only two years. In the process, we have given Capital One a gateway to America's premier consumer market. Through further innovation and segmentation, we expect continued growth with superprime customers. 9 -

Page 12

Our Information-Based Strategy travels well. In the United Kingdom and Canada, we're winning customers with innovative products that are slashing the price of credit cards-a major consumer beneï¬t in markets long dominated by banks charging 20% or more. Through scientiï¬c testing and mass ... -

Page 13

... superprime customers. The college market gives us an opportunity to begin relationships we hope will last a lifetime. We want the ï¬rst credit card in a student's wallet to be one of ours. Our credit cards are designed to help students stretch their dollars. We offer low prices, airline discounts... -

Page 14

... wireless phone service with the same successful strategy we use for credit cards. In the card business, we buy funds wholesale and lend them retail, and we market directly rather than through retail middlemen. In America One, our wireless business, we buy air time wholesale from phone companies and... -

Page 15

... still largely reliant on traditional marketing and lending practices. We are beginning by integrating our technologies and scientiï¬cally testing new marketing ideas. Summit's management has built a solid company with a successful track record and is well suited to partner with Capital One. 13 -

Page 16

With the Internet, we're wired to the world. Cyberspace is the marketplace of our dreams and the ultimate channel for our Information-Based Strategy. Interactions with Internet customers are data-rich and high-speed, allowing us to test and mass customize in real time. We expect to be able to ... -

Page 17

...ï¬t center as we market carefully selected, high quality branded products. For example, through Capital One's relationship with a leading insurance company, we can offer our customers the opportunity to save an average of $200 a year on auto insurance. More than half the customers we added in 1998... -

Page 18

1998 Financial Presentation Page 17 Selected Financial and Operating Data Page 18 Management's Discussion and Analysis of Financial Condition and Results of Operations Page 35 Selected Quarterly Financial Data Page 36 Management's Report on Consolidated Financial Statements and Internal Controls ... -

Page 19

...,980 452,201 2,062,688 474,557 Average reported loans Average off-balance sheet loans Average total managed loans Interest income Year-end total managed loans Year-end total accounts (000's) Yield Net interest margin Delinquency rate Net charge-off rate Operating Ratios: $ 5,348,559 9,860,978 15... -

Page 20

..., or 65%, reï¬,ect the increase in marketing investment in existing and new product opportunities and the cost of operations to manage the growth in the Company's accounts and products offered. Average managed consumer loans grew 17% for the year ended December 31, 1998, to $15.2 billion from $13... -

Page 21

...its customers is not affected by the securitization. The Company acts as a servicing agent and receives a fee for doing so. Collections received from securitized receivables are used to pay interest to certiï¬cateholders, servicing and other fees, and are available to absorb the investors' share of... -

Page 22

...interest margin, but also the fee income associated with these products. By deducting net charge-offs, consideration is given to the risk inherent in these differing products. The Company markets its card products to speciï¬c consumer segments. The terms of each card product are actively managed in... -

Page 23

... immediate impact on managed loan balances of the balance transfer products but typically consist of lower credit limit accounts and balances that build over time. The terms of these customized card products tend to include annual membership fees and higher annual ï¬nance charge rates. The proï¬le... -

Page 24

... fees and growth in higher yielding loans. The average rate paid on borrowed funds increased slightly to 6.04% for the year ended December 31, 1998, from 5.95% in 1997, reï¬,ecting the Company's shift to more ï¬xed rate funding to match the increase in ï¬xed rate consumer loan products. Reported... -

Page 25

... 31 1998 (Dollars in Thousands) 1997 1996 Yield/ Rate Average Balance Income/ Expense Yield/ Rate Average Balance Income / Expense Yield / Rate Average Balance Income/ Expense Assets: Earning assets Consumer loans (1) Federal funds sold and resale agreements Other Total earning assets Cash... -

Page 26

... 31, 1997. These increases were due to a 39% increase in the average number of accounts for the year ended December 31, 1998, from 1997, an increase in charge volume, a shift to more fee-intensive products and changes in the terms of overlimit fees charged. Capital One Financial Corporation 24 -

Page 27

...average age of the Company's accounts increases. Changes in the rates of delinquency and credit losses can also result from a shift in the product mix. As discussed in "Risk Adjusted Revenue and Margin," certain other customized card products have, in some cases, higher delinquency and higher charge... -

Page 28

... for charging off credit card loans (net of any collateral) to 180 days past-due from the prior practice of charging off loans during the next billing cycle after becoming 180 days past-due. For the year ended December 31, 1998, the managed net charge-off rate decreased 126 basis points to... -

Page 29

... the Company's credit quality standards and to manage the risk of loss on existing accounts. See "Risk Adjusted Revenue and Margin" for further discussion. Table 7: Net Charge-Offs Year Ended December 31 (Dollars in Thousands) 1998 1997 1996 1995 1994 Reported: Average loans outstanding... -

Page 30

... to access the capital markets with a $200 million ten-year senior note. Internationally, the Company has funding programs designed for foreign investors or to raise funds in foreign currencies. The Company has accessed the international securitization market for a number of years with both US... -

Page 31

... by the Company's ability to obtain borrowed funds in the ï¬nancial markets in adequate amounts and at favorable rates. As of December 31, 1998, the Company, the Bank and the Savings Bank collectively had over $1.9 billion in unused commitments, under its credit facilities, available for liquidity... -

Page 32

... such repricing by giving timely written notice to the Company and thereby relinquishing charging privileges. However, the repricing of credit card loans may be limited by competitive factors as well as certain legal constraints. Interest rate sensitivity at a point in time can also be analyzed... -

Page 33

... payment patterns, credit quality of its earning assets (which affects fees and charge-offs), marketing expenses and operating expenses. Product and Market Opportunities The Company's strategy for future growth has been, and is expected to continue to be, to apply its proprietary IBS to its lending... -

Page 34

... a new operations center in Nottingham, England. The Company will continue to apply its IBS in an effort to balance the mix of credit card products with other ï¬nancial and nonï¬nancial products and services to optimize proï¬tability within the context of acceptable risk. The Company's growth... -

Page 35

... provide cash management, trustee, paying agent, stock transfer agent or other services. These vendors also include third parties that the Company uses to outsource certain operations for America One, the United Kingdom and Summit. In assessing overall compliance, the Company requests information... -

Page 36

... personnel to assist in the management and operations of new products and services; the ability of the Company and its suppliers to successfully address year 2000 compliance issues; and other factors listed from time to time in the Company's SEC reports, including, but not limited to, the Annual... -

Page 37

... results for the years ended December 31, 1998 and 1997. The Company's common shares are traded on the New York Stock Exchange under the symbol COF. In addition, shares may be traded in the over-the-counter stock market. There were 9,692 and 10,585 common stockholders of record as of December... -

Page 38

...1998, in all material respects, the Company maintained effective internal controls over ï¬nancial reporting. Richard D. Fairbank Chairman and Chief Executive Ofï¬cer Nigel W. Morris President and Chief Operating Ofï¬cer David M. Willey Senior Vice President, Finance and Accounting Capital One... -

Page 39

... We have audited the accompanying consolidated balance sheets of Capital One Financial Corporation as of December 31, 1998 and 1997, and the related consolidated statements of income, changes in stockholders' equity, and cash ï¬,ows for each of the three years in the period ended December 31... -

Page 40

Consolidated Balance Sheets December 31 (Dollars in Thousands, Except Per Share Data) 1998 1997 Assets: Cash and due from banks Federal funds sold and resale agreements Interest-bearing deposits at other banks Cash and cash equivalents Securities available for sale Consumer loans Less: Allowance ... -

Page 41

... and securitizations Service charges and other fees Interchange Total non-interest income 789,844 611,958 86,481 1,488,283 682,345 337,755 49,030 1,069,130 459,833 252,192 51,399 763,424 Non-Interest Expense: Salaries and associate beneï¬ts Marketing Communications and data processing Supplies and... -

Page 42

... income Cash dividends-$.32 per share Purchases of treasury stock Issuances of common stock Exercise of stock options 1,500 Common stock issuable under incentive plan Other items, net (1,938) Balance, December 31, 1998 66,556,792 See Notes to Consolidated Financial Statements. Capital One Financial... -

Page 43

... of senior and deposit notes Issuance of preferred beneï¬cial interests Dividends paid Purchases of treasury stock Net proceeds from issuances of common stock Proceeds from exercise of stock options Net cash provided by ï¬nancing activities Increase (decrease) in cash and cash equivalents Cash and... -

Page 44

... a variety of products and services to consumers. The principal subsidiaries are Capital One Bank (the "Bank"), which offers credit card products, and Capital One, F.S.B. (the "Savings Bank"), which offers consumer lending products (including credit cards) and deposit products. The Corporation and... -

Page 45

... servicing fee income was recorded over the life of each sale transaction. Off-Balance Sheet Financial Instruments The nature and composition of the Company's assets and liabilities and off-balance sheet items expose the Company to interest rate risk. The Company's foreign currency denominated... -

Page 46

... earnings per share is based on the weighted average number of common and common equivalent shares, dilutive stock options or other dilutive securities outstanding during the year. Segments The Company expenses marketing costs as incurred. Credit Card Fraud Losses The Company experiences fraud... -

Page 47

... Available for Sale Securities available for sale as of December 31, 1998, 1997 and 1996 were as follows: Maturity Schedule 1 Year or Less 1-5 Years 5-10 Years Over 10 Years Market Value Totals Amortized Cost Totals December 31, 1998 Commercial paper U.S. Treasury and other U.S. government agency... -

Page 48

... an option for up to $100,000 in multi-currency availability. The borrowings of the Savings Bank are limited to $750,000. All borrowings under the Credit Facility are based on varying terms of the London InterBank Offered Rate ("LIBOR"). The Bank has irrevocably undertaken to honor any demand by the... -

Page 49

...ii) preferred stock, which may be issued in the form of depository shares evidenced by depository receipts and (iii) common stock. The amount of securities registered is limited to a $625,000 aggregate public offering price or its equivalent (based on the applicable exchange rate at the time of sale... -

Page 50

...500 and 417,500 shares were available for grant under this plan, respectively. The options vest after one year and their maximum term is ten years. The exercise price of each option equals the market price of the Company's stock on the date of grant. As of December 31, 1998, there was no outstanding... -

Page 51

...Plan, associates of the Company are eligible to purchase common stock through monthly salary deductions of a maximum of 15% and a minimum of 1% of monthly base pay. The amounts deducted are applied to the purchase of unissued common or treasury stock of the Company at 85% of the current market price... -

Page 52

...' exercise prices were greater than the average market price of the common shares and, therefore, their inclusion would be antidilutive. Note J Purchase of Summit Acceptance Corporation On July 31, 1998, the Company acquired Summit Acceptance Corporation ("Summit"), based in Dallas, Texas. Summit... -

Page 53

... not anticipate, that all of its customers will exercise their entire available line at any given point in time. The Company generally has the right to increase, reduce, cancel, alter or amend the terms of these available lines of credit at any time. Certain premises and equipment are leased under... -

Page 54

... is demanded in the complaint of the California case and the trial court entered judgement in favor of the Bank before the parties completed any signiï¬cant discovery, an informed assessment of the ultimate outcome of this case cannot be made at this time. Management believes, however, that there... -

Page 55

... carrying amounts of cash and due from banks, federal funds sold and resale agreements and interest-bearing deposits at other banks approximated fair value. Securities Available for Sale The fair value of securities available for sale was determined using current market prices. See Note B. Consumer... -

Page 56

... of senior notes Dividends paid Purchases of treasury stock Net proceeds from issuances of common stock Proceeds from exercise of stock options Net cash provided by (used for) ï¬nancing activities Increase (decrease) in cash and cash equivalents Cash and cash equivalents at beginning of year Cash... -

Page 57

...and Chief Executive Ofï¬cer Nigel W. Morris Nigel W. Morris President and Chief Operating Ofï¬cer Capital One Financial Corporation President and Chief Operating Ofï¬cer Marjorie M. Connelly Sr. Vice President, Credit Card Operations W. Ronald Dietz* Managing Partner Customer Contact Solutions... -

Page 58

..., VA 22042 Principal Financial Contact Paul Paquin Vice President, Investor Relations Capital One Financial Corporation 2980 Fairview Park Drive, Suite 1300 Falls Church, VA 22042-4525 (703) 205-1039 Copies of Form 10-K ï¬led with the Securities and Exchange Commission are available without charge... -

Page 59

-

Page 60

® 2980 Fairview Park Drive Suite 1300 Falls Church, VA 22042-4525 (703) 205-1000 www.capitalone.com