CVS 2012 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2012 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

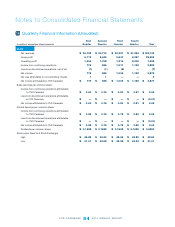

The year-end values of each investment shown in the preceding graph are based on share price appreciation plus dividends,

with the dividends reinvested as of the last business day of the month during which such dividends were ex-dividend. The

calculations exclude trading commissions and taxes. Total stockholder returns from each investment, whether measured in

dollars or percentages, can be calculated from the year-end investment values shown beneath the graph.

CVS CAREMARK 2012 ANNUAL REPORT

88

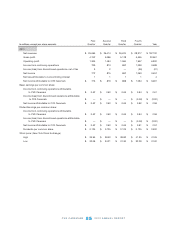

Stock Performance Graph

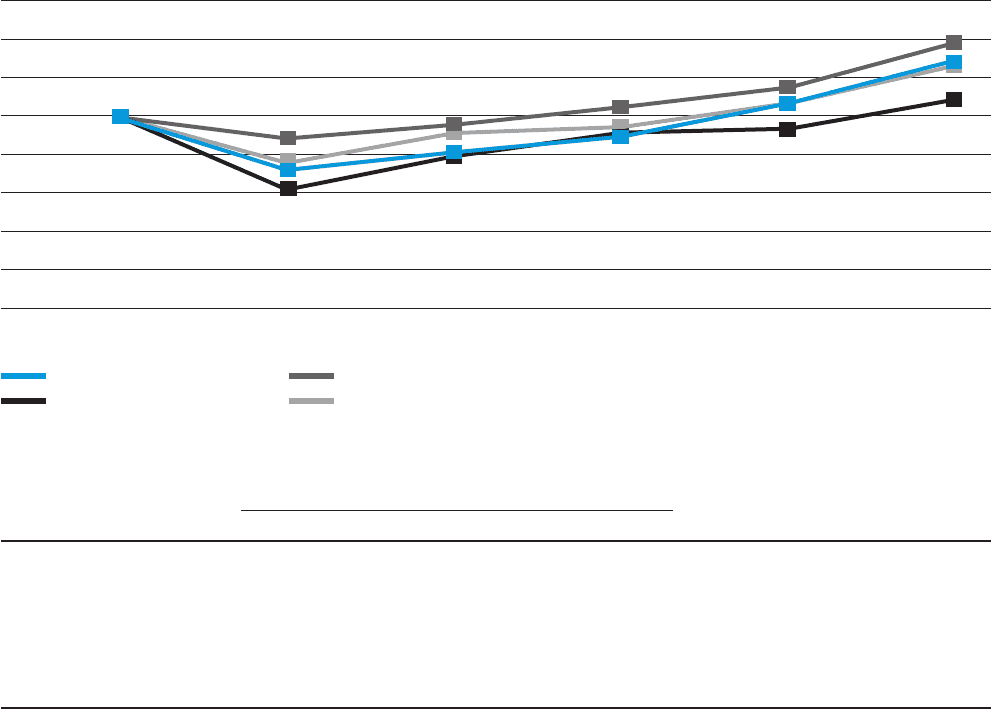

The following graph shows changes over the past five-year period in the value of $100 invested in: (1) our common stock;

(2) S&P 500 Index; (3) S&P 500 Food and Staples Retail Group Index, which currently includes eight retail companies;

(4) S&P 500 Healthcare Group Index, which currently includes 53 health care companies.

RELATIVE TOTAL RETURNS SINCE 2007 – ANNUAL

December 31, 2007 to December 31, 2012

Compound Compound

Annual Annual Annual

Year End Return Rate Return Rate Return Rate

2007 2008 2009 2010 2011 2012 (1 Year) (3 Year) (5 Year)

CVSCaremarkCorporation $100 $ 73 $ 82 $ 90 $107 $129 20.3% 16.0% 5.2%

S&P 500 (1) $100 $ 63 $ 80 $ 92 $ 94 $109 16.0% 10.9% 1.7%

S&P 500 Food & Staples

Retail Group Index (2) $100 $ 89 $ 96 $105 $115 $138 19.6% 12.8% 6.6%

S&P 500 Healthcare

Group Index (3) $100 $ 77 $ 92 $ 95 $107 $126 17.9% 11.0% 4.8%

Note: Analysis assumes reinvestment of dividends.

(1) Includes CVS Caremark.

(2) Includes eight companies: (COST, CVS, KR, SWY, SYY, WAG, WFM, WMT).

(3) Includes 53 companies.

$160

$80

$100

$120

$140

$60

$40

$20

$0

2007 2008 2009 2010 2011 2012

CVS Caremark Corporation

S&P 500

S&P 500 Food & Staples Retail Group Index

S&P 500 Healthcare Group Index