CVS 2012 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2012 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CVS CAREMARK 2012 ANNUAL REPORT

65

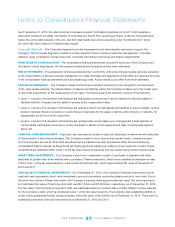

Had the Company not made these changes in accounting principle, for the year ended December 31, 2012, income from

continuing operations and net income attributable to CVS Caremark would have been approximately $19 million lower. For

the year ended December 31, 2012, basic and diluted earnings per common share for income from continuing operations

attributable to CVS Caremark and net income attributable to CVS Caremark would have been reduced by $0.01.

3 Business Combinations

On April 29, 2011, the Company acquired the Medicare prescription drug business of Universal American Corp. (the “UAM

Medicare Part D Business”) for approximately $1.3 billion. The fair value of assets acquired and liabilities assumed were

$2.4 billion and $1.1 billion, respectively, which included identifiable intangible assets of approximately $0.4 billion and

goodwill of approximately $1.0 billion that were recorded in the PSS. The Company’s results of operations and cash flows

include the UAM Medicare Part D Business beginning on April 29, 2011.

In addition to the 2011 acquisition discussed above, there were two immaterial acquisitions during 2012.

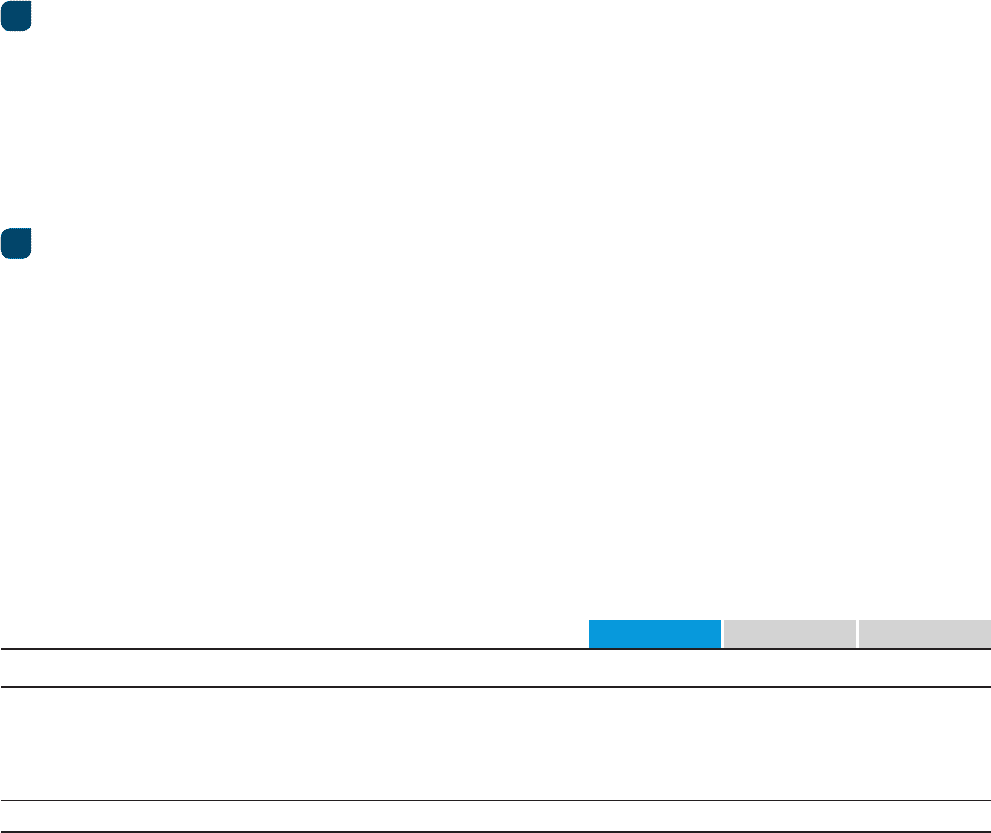

4 Discontinued Operations

On November 1, 2011, the Company sold its TheraCom, L.L.C. (“TheraCom”) subsidiary to AmerisourceBergen Corporation

for $250 million, plus a working capital adjustment of $7 million which the Company received in March 2012. TheraCom is

a provider of commercialization support services to the biotech and pharmaceutical industries. The TheraCom business

had historically been part of the Company’s Pharmacy Services Segment. The results of the TheraCom business are

presented as discontinued operations and have been excluded from both continuing operations and segment results for

all periods presented.

In connection with certain business dispositions completed between 1991 and 1997, the Company retained guarantees on

store lease obligations for a number of former subsidiaries, including Linens ‘n Things which filed for bankruptcy in 2008.

The Company’s income (loss) from discontinued operations includes lease-related costs which the Company believes it will

likely be required to satisfy pursuant to its Linens ‘n Things lease guarantees.

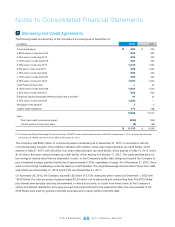

Below is a summary of the results of discontinued operations:

Year Ended December 31,

In millions

2012 2011 2010

Net revenues of TheraCom $ — $ 650 $ 635

Income from operations of TheraCom $ — $ 18 $ 28

Gain on disposal of TheraCom — 53 —

Loss on disposal of Linens ‘n Things (12) (7) (24)

Income tax benefit (provision) 5 (95) (2)

Income (loss) from discontinued operations, net of tax $ (7) $ (31) $ 2

4

3