CVS 2012 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2012 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CVS CAREMARK 2012 ANNUAL REPORT

68

Notes to Consolidated Financial Statements

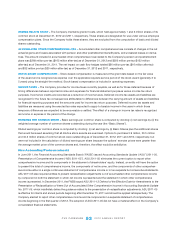

7 Borrowing and Credit Agreements

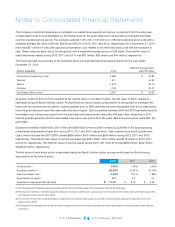

The following table is a summary of the Company’s borrowings as of December 31:

In millions 2012 2011

Commercial paper $ 690 $ 750

4.875%seniornotesdue2014 550 550

3.25%seniornotesdue2015 550 550

6.125%seniornotesdue2016 421 700

5.75%seniornotesdue2017 1,310 1,750

6.6%seniornotesdue2019 394 1,000

4.75%seniornotesdue2020 450 450

4.125%seniornotesdue2021 550 550

6.25%seniornotesdue2027 1,000 1,000

Trust Preferred Securities — 50

6.125%seniornotesdue2039 1,500 1,500

5.75%seniornotesdue2041 950 950

Enhanced Capital Advantage Preferred Securities due 2062 (1)

41 42

2.75%seniornotesdue2022 1,250 —

Mortgage notes payable 1 4

Capital lease obligations 171 168

9,828 10,014

Less:

Short-term debt (commercial paper) (690) (750)

Current portion of long-term debt (5) (56)

$ 9,133 $ 9,208

(1)TheEnhancedCapitalAdvantagePreferredSecurities(“ECAPS”)hadastatedrateofinterestof6.302%throughJune1,2012,atwhichtimetherate

convertedtoavariableratewhichwas2.59%atDecember31,2012.

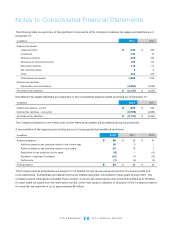

The Company had $690 million of commercial paper outstanding as of December 31, 2012. In connection with its

commercial paper program, the Company maintains a $1.0 billion, three-year unsecured back-up credit facility, which

expires on May 27, 2013, a $1.25 billion, four-year unsecured back-up credit facility, which expires on May 12, 2015, and a

$1.25 billion, five-year unsecured back-up credit facility, which expires on February 17, 2017. The credit facilities allow for

borrowings at various rates that are dependent, in part, on the Company’s public debt ratings and require the Company to

payaweightedaveragequarterlyfacilityfeeofapproximately0.05%,regardlessofusage.AsofDecember31,2012,there

were no borrowings outstanding under the back-up credit facilities. The weighted average interest rate for short-term debt

was0.35%asofDecember31,2012and0.37%asofDecember31,2011.

OnNovember26,2012,theCompanyissued$1.25billionof2.75%unsecuredseniornotesdueDecember1,2022(the

“2012 Notes”) for total proceeds of approximately $1.24 billion, net of discounts and underwriting fees. The 2012 Notes

pay interest semi-annually and may be redeemed, in whole at any time, or in part from time to time, at the Company’s

option at a defined redemption price plus accrued and unpaid interest to the redemption date. The net proceeds of the

2012 Notes were used for general corporate purposes and to repay certain corporate debt.

7