CVS 2012 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2012 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis of

Financial Condition and Results of Operations

CVS CAREMARK 2012 ANNUAL REPORT

24

Overview of Our Corporate Segment

The Corporate Segment provides management and administrative services to support the Company. The Corporate

Segment consists of certain aspects of our executive management, corporate relations, legal, compliance, human

resources, corporate information technology and finance departments.

Results of Operations

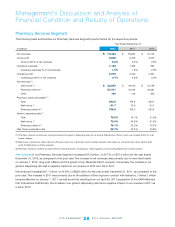

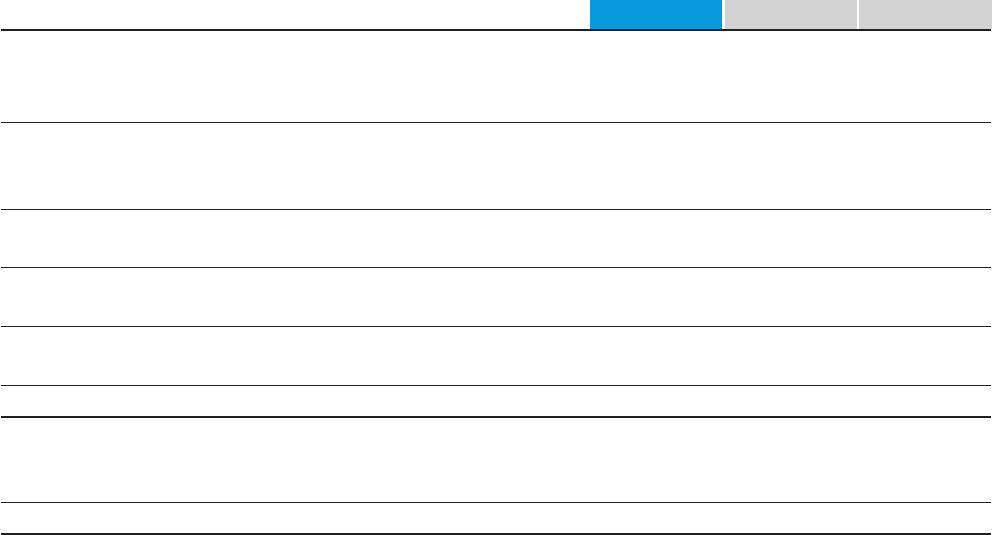

SUMMARY OF OUR CONSOLIDATED FINANCIAL RESULTS

Year Ended December 31,

In millions, except per common share amounts 2012 2011 2010

Net revenues $ 123,133 $ 107,100 $ 95,778

Gross profit 22,506 20,561 20,219

Operating expenses 15,278 14,231 14,082

Operating profit 7,228 6,330 6,137

Interest expense, net 557 584 536

Loss on early extinguishment of debt 348 — —

Income before income tax provision 6,323 5,746 5,601

Income tax provision 2,441 2,258 2,179

Income from continuing operations 3,882 3,488 3,422

Income (loss) from discontinued operations, net of tax (7) (31) 2

Net income 3,875 3,457 3,424

Net loss attributable to noncontrolling interest 2 4 3

Net income attributable to CVS Caremark $ 3,877 $ 3,461 $ 3,427

Diluted earnings per common share:

Income from continuing operations attributable to CVS Caremark $ 3.03 $ 2.59 $ 2.49

Loss from discontinued operations attributable to CVS Caremark (0.01) (0.02) —

Net income attributable to CVS Caremark $ 3.03 $ 2.57 $ 2.49

Net revenues

increased $16.0 billion in 2012 compared to 2011, and increased $11.3 billion in 2011 compared to 2010.

As you review our performance in this area, we believe you should consider the following important information:

• During2012,netrevenuesinourPharmacyServicesSegmentincreased24.7%andnetrevenuesinourRetailPharmacy

Segmentincreased6.8%comparedtotheprioryear.

• During2011,netrevenuesinourPharmacyServicesSegmentincreasedby24.9%andnetrevenuesinourRetail

PharmacySegmentincreased3.9%comparedtotheprioryear.

• Theincreaseinourgenericdispensingratesinbothofouroperatingsegmentscontinuedtohaveanadverseeffecton

net revenue in 2012 as compared to 2011, as well as in 2011 as compared to 2010.

Please see the Segment Analysis later in this document for additional information about our net revenues.

Gross profit

increased$1.9billion,or9.5%in2012,to$22.5billion,or18.3%ofnetrevenues,ascomparedto$20.6billion,

or19.2%ofnetrevenuesin2011.Grossprotincreased$342million,or1.7%in2011,to$20.6billion,or19.2%ofnet

revenues,ascomparedto$20.2billion,or21.1%ofnetrevenuesin2010.