CVS 2012 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2012 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CVS CAREMARK 2012 ANNUAL REPORT

64

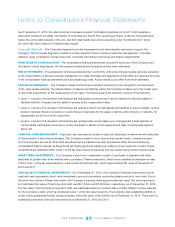

Notes to Consolidated Financial Statements

In September 2011, the FASB issued ASU 2011-08,

Testing Goodwill for Impairment

(“ASU 2011-08”). ASU 2011-08 allows

entities to use a qualitative approach to determine whether it is more likely than not that the fair value of a reporting unit

is less than its carrying value. If after performing the qualitative assessment an entity determines it is not more likely than

not that the fair value of a reporting unit is less than its carrying amount, then performing the two-step goodwill impairment

test is unnecessary. However, if an entity concludes otherwise, then it is required to perform the first step of the two-step

goodwill impairment test. ASU 2011-08 is effective for annual and interim goodwill impairment tests performed for fiscal

years beginning after December 15, 2011. The adoption of ASU 2011-08 did not have a material effect on the Company’s

consolidated financial statements. The Company did not elect to use the qualitative approach in its 2012 annual goodwill

impairment test.

In July 2012, the FASB issued ASU 2012-02,

Testing Indefinite-Lived Intangible Assets for Impairment

(“ASU 2012-02”).

ASU 2012-02 allows entities to use a qualitative approach to determine whether the existence of events and circumstances

indicates that it is more likely than not that the indefinite-lived intangible asset is impaired. If, after assessing the totality of

events and circumstances, an entity concludes that it is not more likely than not that the indefinite-lived intangible asset is

impaired, then the entity is not required to take further action. However, if an entity concludes otherwise, then it is required

to determine the fair value of the indefinite-lived intangible asset and perform the quantitative impairment test by compar-

ing the fair value with the carrying amount and recognize an impairment loss, if any, to the extent the carrying value exceeds

its fair value. ASU 2012-02 is effective for annual and interim impairment tests performed for fiscal years beginning after

September 15, 2012, and early adoption is permitted. The Company did not elect to early adopt ASU 2012-02 and does

not expect the adoption will have a material effect on the Company’s consolidated financial statements.

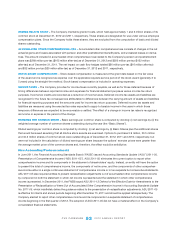

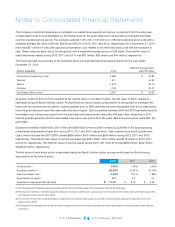

2 Changes in Accounting Principle

Effective January 1, 2012, the Company changed its methods of accounting for prescription drug inventories in the Retail

Pharmacy Segment. Prior to 2012, the Company valued prescription drug inventories at the lower of cost or market on a

first-in, first-out (“FIFO”) basis in retail pharmacies using the retail inventory method and in distribution centers using the

FIFO cost method. Effective January 1, 2012, all prescription drug inventories in the Retail Pharmacy Segment have been

valued at the lower of cost or market using the weighted average cost method. These changes affected approximately

51%ofconsolidatedinventories.

These changes were made primarily to bring all of the pharmacy operations of the Company to a common inventory

valuation methodology and to provide the Company with better information to manage its retail pharmacy operations.

The Company believes the weighted average cost method is preferable to the retail inventory method and the FIFO cost

method because it results in greater precision in the determination of cost of revenues and inventories by specific drug

product and results in a consistent inventory valuation method for all of the Company’s prescription drug inventories as the

Pharmacy Services Segment’s mail service and specialty pharmacies were already on the weighted average cost method.

Most of these mail service and specialty pharmacies in the Pharmacy Services Segment were acquired in the Company’s

2007 acquisition of Caremark Rx, Inc.

The Company recorded the cumulative effect of these changes in accounting principle as of January 1, 2012. The

Company determined that retrospective application for periods prior to 2012 is impracticable, as the period-specific

information necessary to value prescription drug inventories in the Retail Pharmacy Segment under the weighted average

cost method is unavailable. The Company implemented a new pharmacy cost accounting system to value prescription

drug inventory as of January 1, 2012 and calculated the cumulative impact. The effect of these changes in accounting

principle as of January 1, 2012 was a decrease in inventories of $146 million, an increase in current deferred income tax

assets of $57 million and a decrease in retained earnings of $89 million.

2