CVS 2012 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2012 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CVS CAREMARK 2012 ANNUAL REPORT

59

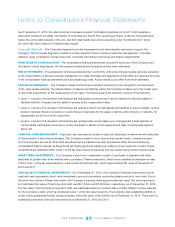

The gross amount of property and equipment under capital leases was $219 million and $211 million as of December 31,

2012 and 2011, respectively. Amortization of property and equipment under capital lease is included within depreciation

expense. Depreciation expense totaled $1.3 billion, $1.1 billion and $1.0 billion in 2012, 2011 and 2010, respectively.

GOODWILL AND OTHER INDEFINITELY-LIVED ASSETS –

Goodwill and other indefinitely-lived assets are not amortized,

but are subject to impairment reviews annually, or more frequently if necessary. See Note 5 for additional information on

goodwill and other indefinitely-lived assets.

INTANGIBLE ASSETS – Purchased customer contracts and relationships are amortized on a straight-line basis over their

estimated useful lives between 10 and 20 years. Purchased customer lists are amortized on a straight-line basis over their

estimated useful lives of up to 10 years. Purchased leases are amortized on a straight-line basis over the remaining life of

the lease. See Note 5 for additional information about intangible assets.

IMPAIRMENT OF LONG-LIVED ASSETS – The Company groups and evaluates fixed and finite-lived intangible assets for

impairment at the lowest level at which individual cash flows can be identified, whenever events or changes in circum-

stances indicate that the carrying value of an asset may not be recoverable. If indicators of impairment are present, the

Company first compares the carrying amount of the asset group to the estimated future cash flows associated with the

asset group (undiscounted and without interest charges). If the estimated future cash flows used in this analysis are less

than the carrying amount of the asset group, an impairment loss calculation is prepared. The impairment loss calculation

compares the carrying amount of the asset group to the asset group’s estimated future cash flows (discounted and with

interest charges). If required, an impairment loss is recorded for the portion of the asset group’s carrying value that exceeds

the asset group’s estimated future cash flows (discounted and with interest charges).

REDEEMABLE NONCONTROLLING INTEREST – ThroughJune29,2012,theCompanyhadanapproximately60%

ownership interest in Generation Health, Inc. (“Generation Health”) and consolidated Generation Health in its consolidated

financial statements. The nonemployee noncontrolling shareholders of Generation Health held put rights for the remaining

interest in Generation Health that if exercised would require the Company to purchase the remaining interest in Generation

Health in 2015 for a minimum of $26 million and a maximum of $159 million, depending on certain financial metrics of

Generation Health in 2014. Since the noncontrolling shareholders of Generation Health had a redemption feature as a result

of the put rights, the Company had classified the redeemable noncontrolling interest in Generation Health in the mezzanine

section of the consolidated balance sheet outside of shareholders’ equity. On June 29, 2012, the Company acquired the

remaining40%interestinGenerationHealthfromminorityshareholdersandemployeeoptionholdersfor$26millionand

$5 million, respectively, for a total of $31 million.

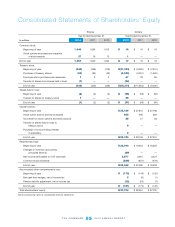

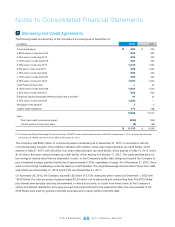

The following is a reconciliation of the changes in the redeemable noncontrolling interest:

In millions 2012 2011 2010

Beginning balance $ 30 $ 34 $ 37

Net loss attributable to noncontrolling interest (2) (4) (3)

Purchase of noncontrolling interest (26) — —

Reclassification to capital surplus in connection with purchase

of noncontrolling interest (2) — —

Ending balance $ — $ 30 $ 34