CVS 2012 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2012 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Management’s Discussion and Analysis of

Financial Condition and Results of Operations

CVS CAREMARK 2012 ANNUAL REPORT

46

actuarial assumptions. On a quarterly basis, we review our self-insurance liability to determine if it is adequate as it relates

to our general liability, workers’ compensation and auto liability. Similar reviews are conducted semi-annually to determine

if our self-insurance liability is adequate for our health and medical liability.

Our total self-insurance liability covered by this critical accounting policy was $590 million as of December 31, 2012. Although

we believe we have sufficient current and historical information available to us to record reasonable estimates for our

self-insurance liability, it is possible that actual results could differ. In order to help you assess the risk, if any, associated

withtheuncertaintiesdiscussedpreviously,atenpercent(10%)pre-taxchangeinourestimateforourself-insurance

liability, which we believe is a reasonably likely change, would increase or decrease our self-insurance liability by about

$59 million as of December 31, 2012.

We have not made any material changes in the accounting methodology used to establish our self-insurance liability during

the past three years.

New Accounting Pronouncements

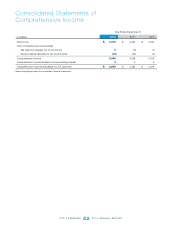

In June 2011, the FASB issued ASU 2011-05,

Presentation of Comprehensive Income

(“ASU 2011-05”). ASU 2011-05

eliminates the current option to report other comprehensive income and its components in the statement of shareholders’

equity. Instead, an entity will have the option to present the total of comprehensive income, the components of net income,

and the components of other comprehensive income either in a single continuous statement of comprehensive income or

in two separate but consecutive statements. ASU 2011-05 also required entities to present reclassification adjustments out

of accumulated other comprehensive income by component in both the statement in which net income is presented and

the statement in which other comprehensive income is presented. In December 2011, the FASB issued ASU 2011-12

Deferral of the Effective Date for Amendments to the Presentation of Reclassification of Items Out of Accumulated Other

Comprehensive Income in Accounting Standards Update No. 2011-05

, which indefinitely defers the guidance related to

the presentation of reclassification adjustments. ASU 2011-05 is effective for interim and annual periods beginning after

December 15, 2011 and should be applied retrospectively. The Company elected to report other comprehensive income

and its components in a separate statement of comprehensive income beginning in the first quarter of 2012. The adoption

of ASU 2011-05 did not have a material effect on the Company’s consolidated financial statements.

In September 2011, the FASB issued ASU 2011-08,

Testing Goodwill for Impairment

(“ASU 2011-08”). ASU 2011-08 allows

entities to use a qualitative approach to determine whether it is more likely than not that the fair value of a reporting unit

is less than its carrying value. If after performing the qualitative assessment an entity determines it is not more likely than

not that the fair value of a reporting unit is less than its carrying amount, then performing the two-step goodwill impairment

test is unnecessary. However, if an entity concludes otherwise, then it is required to perform the first step of the two-step

goodwill impairment test. ASU 2011-08 is effective for annual and interim goodwill impairment tests performed for fiscal

years beginning after December 15, 2011. The adoption of ASU 2011-08 did not have a material effect on the Company’s

consolidated financial statements. The Company did not elect to use the qualitative approach in its 2012 annual goodwill

impairment test.

In July 2012, the FASB issued ASU 2012-02,

Testing Indefinite-Lived Intangible Assets for Impairment

(“ASU 2012-02”).

ASU 2012-02 allows entities to use a qualitative approach to determine whether the existence of events and circumstances

indicates that it is more likely than not that the indefinite-lived intangible asset is impaired. If, after assessing the totality

of events and circumstances, an entity concludes that it is not more likely than not that the indefinite-lived intangible

asset is impaired, then the entity is not required to take further action. However, if an entity concludes otherwise, then it is

required to determine the fair value of the indefinite-lived intangible asset and perform the quantitative impairment test by

comparing the fair value with the carrying amount and recognize an impairment loss, if any, to the extent the carrying value

exceeds its fair value. ASU 2012-02 is effective for annual and interim impairment tests performed for fiscal years begin-

ning after September 15, 2012, and early adoption is permitted. The Company did not elect to early adopt ASU 2012-02

and does not expect the adoption will have a material effect on the Company’s consolidated financial statements.