CVS 2012 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2012 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CVS CAREMARK 2012 ANNUAL REPORT

67

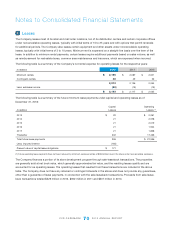

6 Share Repurchase Programs

On September 19, 2012, the Company’s Board of Directors authorized a new share repurchase program for up to

$6.0 billion of outstanding common stock (the “2012 Repurchase Program”). The share repurchase authorization, which

was effective immediately, permits the Company to effect repurchases from time to time through a combination of open

market repurchases, privately negotiated transactions, accelerated share repurchase transactions, and/or other derivative

transactions. The 2012 Repurchase Program may be modified or terminated by the Board of Directors at any time.

On August 23, 2011, the Company’s Board of Directors authorized a share repurchase program for up to $4.0 billion of

outstanding common stock (the “2011 Repurchase Program”). The share repurchase authorization, which was effective

immediately, permitted the Company to effect repurchases from time to time through a combination of open market repur-

chases, privately negotiated transactions, accelerated share repurchase transactions, and/or other derivative transactions.

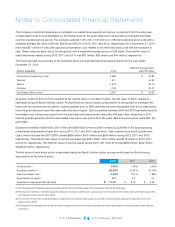

Pursuant to the authorizations under the 2011 and 2012 Repurchase Programs, on September 19, 2012, the Company

entered into a $1.2 billion fixed dollar accelerated share repurchase (“ASR”) agreement with Barclays Bank PLC

(“Barclays”). Upon payment of the $1.2 billion purchase price on September 20, 2012, the Company received a number

ofsharesofitscommonstockequalto50%ofthe$1.2billionnotionalamountoftheASRagreementorapproximately

12.6 million shares at a price of $47.71 per share. The Company received approximately 13.0 million shares of common

stockonNovember16,2012atanaveragepriceof$46.96pershare,representingtheremaining50%ofthe$1.2billion

notional amount of the ASR agreement and thereby concluding the agreement. The total of 25.6 million shares of common

stock delivered to the Company by Barclays over the term of the ASR agreement were placed into treasury stock.

Pursuant to the authorization under the 2011 Repurchase Program, on August 24, 2011, the Company entered into a

$1.0 billion fixed dollar ASR agreement with Barclays. The ASR agreement contained provisions that establish the minimum

and maximum number of shares to be repurchased during its term. Pursuant to the ASR agreement, on August 25, 2011,

the Company paid $1.0 billion to Barclays in exchange for Barclays delivering 20.3 million shares of common stock to the

Company. On September 16, 2011, upon establishment of the minimum number of shares to be repurchased, Barclays

delivered an additional 5.4 million shares of common stock to the Company. At the conclusion of the transaction on

December 28, 2011, Barclays delivered a final installment of 1.6 million shares of common stock on December 29, 2011.

The aggregate 27.3 million shares of common stock delivered to the Company by Barclays, were placed into treasury

stock. This represented all the repurchases that occurred during the year ended December 31, 2011 under the 2011

Repurchase Program.

During the year ended December 31, 2012, the Company repurchased an aggregate of 95.0 million shares of common

stock for approximately $4.3 billion under the 2012 and 2011 Repurchase Programs, which includes shares received from

the ASR described previously. As of December 31, 2012, the 2011 Repurchase Program was complete and there remained

approximately $4.7 billion available for future repurchases under the 2012 Repurchase Program.

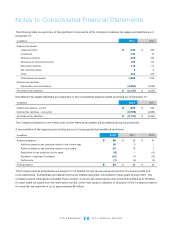

On June 14, 2010, our Board of Directors authorized a share repurchase program for up to $2.0 billion of our outstanding

common stock (the “2010 Repurchase Program”). During the year ended December 31, 2011, the Company repurchased

an aggregate of 56.4 million shares of common stock for approximately $2.0 billion, completing the 2010 Repurchase

Program, which included shares received from the ASR described above.

On November 4, 2009, our Board of Directors authorized a share repurchase program for up to $2.0 billion of our outstand-

ing common stock (the “2009 Repurchase Program”). During 2010, the Company repurchased 42.4 million shares of

common stock for approximately $1.5 billion, completing the 2009 Repurchase Program.

6