CVS 2012 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2012 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CVS CAREMARK 2012 ANNUAL REPORT

66

Notes to Consolidated Financial Statements

5 Goodwill and Other Intangibles

Goodwill and other indefinitely-lived assets are not amortized, but are subject to annual impairment reviews, or more

frequent reviews if events or circumstances indicate impairment may exist.

When evaluating goodwill for potential impairment, the Company first compares the fair value of its two reporting units,

the PSS and RPS, to their respective carrying amounts. The Company estimates the fair value of its reporting units using

a combination of a future discounted cash flow valuation model and a comparable market transaction model. If the estimated

fair value of the reporting unit is less than its carrying amount, an impairment loss calculation is prepared. The impairment

loss calculation compares the implied fair value of a reporting unit’s goodwill with the carrying amount of its goodwill. If the

carrying amount of the goodwill exceeds the implied fair value, an impairment loss is recognized in an amount equal to

the excess. During the third quarter of 2012, the Company performed its required annual goodwill impairment tests. The

Company concluded there were no goodwill impairments as of the testing date. The carrying amount of goodwill was

$26.4 billion and $26.5 billion as of December 31, 2012 and 2011, respectively (see Note 14 for a breakdown of Goodwill

by segment). The $63 million decrease in goodwill in 2012 was due to the finalization of the assessment of the fair value

of assets acquired and liabilities assumed in the 2011 acquisition of the UAM Medicare Part D Business which decreased

goodwill by $44 million, the realization of tax benefits associated with replacement stock options issued in a 2007 acquisi-

tion which decreased goodwill by $11 million, certain balance sheet adjustments to land and close store reserves related to

acquisitions in previous years which decreased goodwill by $52 million, partially offset by a $44 million increase in goodwill

associated with two immaterial acquisitions in 2012. These changes to goodwill affected both the PSS and RPS.

Indefinitely-lived intangible assets are tested for impairment by comparing the estimated fair value of the asset to its

carrying value. The Company estimates the fair value of its indefinitely-lived trademark using the relief from royalty method

under the income approach. If the carrying value of the asset exceeds its estimated fair value, an impairment loss is

recognized and the asset is written down to its estimated fair value. During the third quarter of 2012, the Company per-

formed its annual impairment test of the indefinitely-lived trademark and concluded there was no impairment as of the

testing date. The carrying amount of its indefinitely-lived trademark was $6.4 billion as of December 31, 2012 and 2011.

The Company amortizes intangible assets with finite lives over the estimated useful lives of the respective assets, which

have a weighted average useful life of 13.4 years. The weighted average useful lives of the Company’s customer contracts

and relationships and covenants not to compete are 12.9 years. The weighted average lives of the Company’s favorable

leases and other intangible assets are 17.3 years. Amortization expense for intangible assets totaled $486 million, $452

million and $427 million in 2012, 2011 and 2010, respectively. The anticipated annual amortization expense for these

intangible assets for the next five years is $454 million in 2013, $420 million in 2014, $392 million in 2015, $364 million

in 2016 and $341 million in 2017.

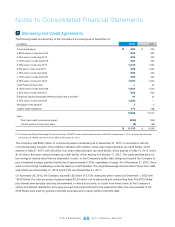

The following table is a summary of the Company’s intangible assets as of December 31:

2012 2011

Gross Net Gross Net

Carrying Accumulated Carrying Carrying Accumulated Carrying

in millions Amount Amortization Amount Amount Amortization Amount

Trademark (indefinitely-lived) $ 6,398 $ — $ 6,398 $ 6,398 $ — $ 6,398

Customer contracts and relationships and

covenants not to compete 5,745 (2,812) 2,933 5,427 (2,386) 3,041

Favorable leases and other 802 (380) 422 769 (339) 430

$ 12,945 $ (3,192) $ 9,753 $ 12,594 $ (2,725) $ 9,869

5