CVS 2012 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2012 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CVS CAREMARK 2012 ANNUAL REPORT

73

11 Stock Incentive Plans

Stock-based compensation expense is measured at the grant date based on the fair value of the award and is recognized

as expense over the applicable requisite service period of the stock award (generally three to five years) using the straight-

line method. Stock-based compensation costs are included in selling, general and administrative expenses.

Compensation expense related to stock options, which includes the 2007 Employee Stock Purchase Plan (the “2007

ESPP”) totaled $102 million, $112 million and $127 million for 2012, 2011 and 2010, respectively. The recognized tax

benefit was $33 million, $38 million and $42 million for 2012, 2011 and 2010, respectively. Compensation expense related

to restricted stock awards totaled $30 million, $21 million and $23 million for 2012, 2011 and 2010, respectively.

The 2007 ESPP provides for the purchase of up to 15 million shares of common stock. Under the 2007 ESPP, eligible employ-

eesmaypurchasecommonstockattheendofeachsixmonthofferingperiodatapurchasepriceequalto85%ofthelower

of the fair market value on the first day or the last day of the offering period. During 2012, approximately 2 million shares of

common stock were purchased under the provisions of the 2007 ESPP at an average price of $33.70 per share. As of

December 31, 2012, approximately 3 million shares of common stock were available for issuance under the 2007 ESPP.

The fair value of stock-based compensation associated with the 2007 ESPP is estimated on the date of grant (i.e., the

beginning of the offering period) using the Black-Scholes Option Pricing Model.

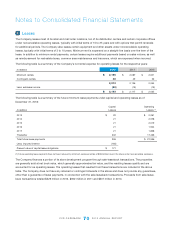

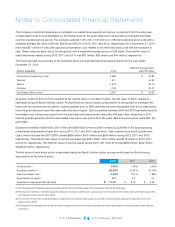

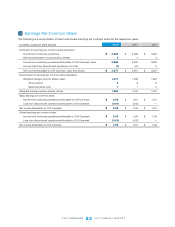

The following table is a summary of the assumptions used to value the ESPP awards for each of the respective periods:

2012 2011 2010

Dividend yield (1) 0.73 % 0.69% 0.57%

Expected volatility (2) 22.88 % 20.42% 32.58%

Risk-free interest rate (3) 0.10 % 0.15% 0.21%

Expected life

(in years)

(4) 0.5 0.5 0.5

Weighted-average grant date fair value $ 9.22 $ 7.21 $ 7.31

(1) The dividend yield is calculated based on semi-annual dividends paid and the fair market value of the Company’s stock at the grant date.

(2) The expected volatility is based on the historical volatility of the Company’s daily stock market prices over the previous six month period.

(3) The risk-free interest rate is based on the Treasury constant maturity interest rate whose term is consistent with the expected term of ESPP options

(i.e., 6 months).

(4) The expected life is based on the semi-annual purchase period.

In May 2010, the Company’s Board of Directors adopted and the shareholders approved the 2010 Incentive Compensation

Plan (the “2010 ICP”), which superseded the 1997 Incentive Compensation Plan (the “1997 ICP”). The terms of the 2010

ICP provide for grants of annual incentive and long-term performance awards to executive officers and other officers and

employees of the Company or any subsidiary of the Company. Payment of such annual incentive and long-term perfor-

mance awards will be in cash, stock, other awards or other property, at the discretion of the Management Planning and

Development Committee of the Company’s Board of Directors. The 2010 ICP allows for a maximum of 74 million shares to

be reserved and available for grants, plus the number of shares subject to awards under the Company’s 1997 ICP which

become available due to cancellation or forfeiture. Following approval and adoption of the 2010 ICP, no new grants can be

made under the 1997 ICP. The 2010 ICP is the only compensation plan under which the Company grants stock options,

restricted stock and other stock-based awards to its employees, with the exception of the Company’s 2007 ESPP. In

November 2012, the Company’s Board of Director’s approved an amendment to the 2010 ICP to eliminate the share

recycling provision of the 2010 ICP. As of December 31, 2012, there were approximately 48 million shares available for

future grants under the 2010 ICP.

11