CVS 2012 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2012 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CVS CAREMARK 2012 ANNUAL REPORT

25

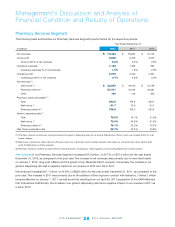

• During2012,grossprotinourPharmacyServicesSegmentandRetailPharmacySegmentincreasedby16.1%and

9.4%,respectively,comparedtotheprioryear.FortheyearendedDecember31,2012,grossprotasapercentofnet

revenuesinourPharmacyServicesSegmentandRetailPharmacySegmentwas5.2%and30.0%,respectively.

• During2011,grossprotinourRetailPharmacySegmentincreasedby2.5%whichwaspartiallyoffsetbydeclinesin

ourPharmacyServicesSegmentof1.1%,comparedtotheprioryear.FortheyearendedDecember31,2011,gross

protasapercentofnetrevenuesinourPharmacyServicesSegmentandRetailPharmacySegmentwas5.6%and

29.3%,respectively.

• TheincreasedweightingtowardthePharmacyServicesSegment,whichhasalowergrossmarginthantheRetailPharmacy

Segment, is resulting in a continued decline in consolidated gross profit as a percent of net revenues. In addition, gross

profit has been negatively impacted by the efforts of managed care organizations, pharmacy benefit managers and

governmental and other third-party payors to reduce their prescription drug costs.

• Inaddition,forthethreeyears2010through2012,ourgrossprotcontinuedtobenetfromtheincreasedutilizationof

generic drugs (which normally yield a higher gross profit rate than equivalent brand name drugs) in both the Pharmacy

Services and Retail Pharmacy Segments.

Please see the Segment Analysis later in this document for additional information about our gross profit.

Operating expenses

increased$1.0billion,or7.4%intheyearendedDecember31,2012,ascomparedtotheprior

year.Operatingexpensesasapercentofnetrevenuesimprovedapproximately90basispointsto12.4%intheyear

ended December 31, 2012. The increase in operating expenses in the year ended December 31, 2012 was primarily due

to incremental store operating costs associated with a higher store count as compared to the prior year period, as well as

the expansion of our Medicare Part D business. The improvement in operating expenses as a percent of net revenues is

primarily due to expense leverage from net revenue growth and expense control initiatives.

Operating expenses increased $149 million in the year ended December 31, 2011 as compared to the prior year.

Operatingexpensesasapercentofnetrevenuesincreasedapproximately140basispointsto13.3%intheyearended

December 31, 2011. The increase in operating expenses in the year ended December 31, 2011 was primarily due to

incremental store operating costs associated with a higher store count as compared to the prior year period, as well as

costs associated with changes designed to streamline our Pharmacy Services Segment and expenses associated with

the acquisition and integration of the Medicare prescription drug business of Universal Medicare Corp. (the “UAM

Medicare Part D Business”).

Please see the Segment Analysis later in this document for additional information about operating expenses.

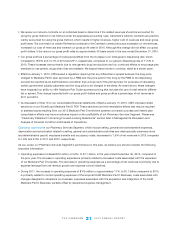

Interest expense, net

consisted of the following:

In millions 2012 2011 2010

Interest expense $ 561 $ 588 $ 539

Interest income (4) (4) (3)

Interest expense, net $ 557 $ 584 $ 536

Net interest expense decreased $27 million during the year ended December 31, 2012, which resulted from a reduction in

our average outstanding short-term and long-term debt. During 2011, net interest expense increased by $48 million, to

$584 million compared to 2010, due to a higher average interest rate during the period as we shifted from short-term debt

to long-term debt.