CVS 2009 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2009 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

most recently served as president and CEO of our strategic

partner, Generation Health, Inc. Per is widely respected

in the industry, and his expertise, along with his demon-

strated ability to execute growth strategies, makes him

the perfect person to guide our PBM in this evolving

health care environment.

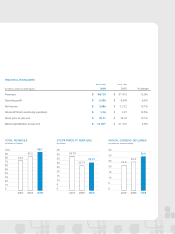

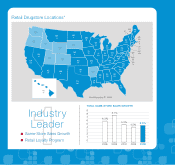

OUR SAME-STORE SALES GROWTH LEADS ALL

PHARMACY RETAILERS

Despite the recession, our retail stores put up outstanding

numbers. Same-store sales rose 5.0 percent, while pharmacy

same-store sales increased 6.9 percent. These results led

our industry throughout 2009, and we gained significant

market share. Organic growth continued apace as we

opened 287 new or relocated stores. Factoring in closings,

net unit growth was 102 stores. Today, approximately

75 percent of the U.S. population lives within three miles

of a CVS store. Our stores fill nearly one in five prescrip-

tions nationwide, and we have the #1 or #2 market share

in 14 of the top 15 U.S. drugstore markets.

Our industry-leading customer service and the use of

advanced technology, combined with the increasing

adoption of Maintenance Choice by PBM clients, all

contributed to our pharmacy growth.

In the front of the store, we gained share in 82 percent

of our core categories. Moreover, sales of private-label and

CVS-exclusive brands rose faster than they have historically

to account for nearly 17 percent of our front-end total.

These lower-cost products offer excellent value, which

clearly appealed to cost-conscious consumers in the midst

of a recession. We, in turn, benefited from the higher

margins these products provide compared with national

brands. Our private-label program is ambitious, and

we added more than 900 offerings to our shelves

during the year.

The Longs Drugs® stores we acquired in October 2008

were integrated on schedule and are on track to be

accretive to earnings in 2010. Profitability is already

on the rise as we’ve begun to leverage our systems,

our focus on private label, our category mix, and the

ExtraCare® card. We have a solid track record at making

the most of our acquisitions, roughly doubling the profit-

ability of the drugstores we acquired from JCPenney in

2004 and from Albertsons in 2006.

EXTRACARE AND OTHER LONG-TERM INVESTMENTS

HAVE HELPED DRIVE PROFITABILITY

We can trace our industry-leading performance in no

small part to the many investments we have made over

the past decade in technology, in enhancing the layout

and “shopability” of our stores, and in driving customer

loyalty. The ExtraCare loyalty program, which we rolled

out in 2001, is today the most popular among all retailers.

More than 64 million active cardholders take advantage

of sales in the store and at CVS.com, and they received

$1.9 billion in ExtraCare savings and Extra Bucks rewards

throughout 2009. ExtraCare represents a significant com-

petitive advantage for us, and CVS Caremark has a huge

head start over any drug retailer contemplating its own

loyalty program.

More recent investments position CVS Caremark for

greater profitability in the coming years. For example,

our proprietary RxConnect™ computer system, whose

rollout will be completed during 2010, should improve

both efficiency and customer service in our pharmacies.

We’ve also opened call centers that allow us to redirect

much of the telephone call volume from our busiest stores.

That frees up retail pharmacists to spend more time

counseling patients face-to-face.

WE’VE EXPANDED MINUTECLINIC’S OFFERINGS AND

FORGED NEW ALLIANCES

At MinuteClinic, our retail-based health clinics, we expanded

the services offered, further integrated MinuteClinic into our

PBM offerings, and forged a number of strategic alliances

with highly regarded health care providers such as Humana,

Inc., and the Cleveland Clinic. Today we have approxi-

mately 570 clinics in 56 markets across the country.

We generated approximately $3 billion in free cash flow, deploying

part of it to complete a $2 billion share repurchase program.

“”

CVS Caremark

4