CVS 2009 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2009 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2009 includes a full year of net cash provided by operating

activities from the Longs Acquisition compared to 2008. The

increase in net cash provided by operating activities during

2009 was primarily due to increased net income, offset by

an increase in inventory purchases primarily associated with

pharmacy pre-buy opportunities and our increased store

count. 2008 includes a full year of net cash provided by

operating activities from Caremark, compared to 2007, which

includes Caremark from the merger date (March 22, 2007)

forward. 2008 also includes net cash provided by operating

activities from the Longs Acquisition from the acquisition date

(October 20, 2008) forward.

Net cash used in investing activities decreased to approxi-

mately $1.1 billion in 2009. This compares to approximately

$4.6 billion and $3.1 billion in 2008 and 2007, respectively. The

decrease in net cash used in investing activities was primarily

due to a reduction in acquisition activities in 2009 and an increase

in sale-leaseback transactions. The increase in net cash used in

investing activities during 2008 was primarily due to the Longs

Acquisition. The $3.1 billion of net cash used in investing

activities during 2007 was primarily due to the Caremark Merger.

Gross capital expenditures totaled approximately $2.5 billion

during 2009, compared to approximately $2.2 billion in 2008

and $1.8 billion 2007. The increase in gross capital expendi-

tures during 2009 was primarily due to resets related to stores

acquired as part of the Longs Acquisition.

Proceeds from sale-leaseback transactions totaled approxi-

mately $1.6 billion in 2009. This compares to $204 million

in 2008 and $601 million in 2007. Under the sale-leaseback

transactions, the properties are sold at fair value, which

approximates net book value, and the resulting leases qualify

and are accounted for as operating leases. The specific timing

and amount of future sale-leaseback transactions will vary

depending on future market conditions and other factors. The

significant increase in 2009 was primarily due to the deferral of

transactions in 2008 due to market conditions at that time.

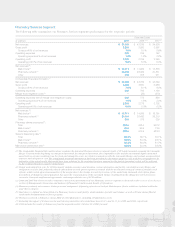

Following is a summary of our store development activity for

the respective years:

2009 2008 2007

Total stores (beginning of year) 6,981 6,301 6,205

New and acquired stores

(1) 175 719 140

Closed stores (82) (39) (44)

Total stores (end of year) 7,074 6,981 6,301

Relocated stores

(2) 110 129 137

(1) 2008 includes 529 Longs Drug Stores that were acquired as part of

the Longs Acquisition.

(2) Relocated stores are not included in new or closed store totals.

Operating expenses, which include store and administrative

payroll, employee benefits, store and administrative occupancy

costs, selling expenses, advertising expenses, administrative

expenses and depreciation and amortization expense increased

slightly to 22.5% of net revenues in 2009, compared to 22.4%

and 22.5% of net revenues in 2008 and 2007, respectively.

As you review our Retail Pharmacy segment’s performance

in this area, we believe you should consider the following

important information:

• Three fewer days in the 2009 fiscal year positively impacted

operating expenses by $92 million, compared to 2008.

• During 2009, operating expenses as a percentage of net

revenues increased as a result of integration costs associated

with the Longs Acquisition.

• Four additional days in the 2008 fiscal year increased

operating expenses by $135 million, compared to 2007.

• During 2008, operating expenses as a percentage of net

revenues continued to be impacted by an increase in

generic drug revenues. Generic drugs typically have a

lower selling price than their brand named equivalents.

Corporate Segment

Operating expenses increased $78 million, or 16.9% and

$50 million, or 12.2% during fiscal 2009 and fiscal 2008,

respectively. Operating expenses within the Corporate segment

include executive management, corporate relations, legal, com-

pliance, human resources, corporate information technology

and finance related costs. Operating expenses increased during

2009 primarily due to higher legal fees associated with increased

litigation activity, depreciation and compensation and benefit

costs. Operating expenses increased during 2008 primarily related

to depreciation and compensation and benefit related costs.

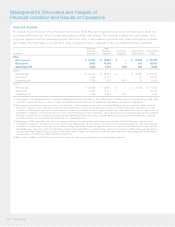

Liquidity and Capital Resources

We maintain a level of liquidity sufficient to allow us to cover

our cash needs in the short-term. Over the long-term, we manage

our cash and capital structure to maximize shareholder return,

strengthen our financial position and maintain flexibility for

future strategic initiatives. We continuously assess our working

capital needs, debt and leverage levels, capital expenditure

requirements, dividend payouts, potential share repurchases

and future investments or acquisitions. We believe our operating

cash flows, commercial paper program, sale-leaseback program,

as well as any potential future borrowings, will be sufficient to

fund these future payments and long-term initiatives.

Net cash provided by operating activities increased to approx-

imately $4.0 billion in 2009. This compares to approximately

$3.9 billion and $3.2 billion in 2008 and 2007, respectively.

2009 Annual Report 33