CVS 2009 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2009 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Part D Prescription Drug Plan (a “PDP”). We are also a

national provider of drug benefits to eligible beneficiaries

under the Medicare Part D program through our subsidiaries,

SilverScript and Accendo (which have been approved by

CMS as PDPs), and in 2008 and 2007, through a joint venture

with Universal American Corp. (“UAC”), which sponsored a

CMS approved PDP. The Company and UAC dissolved this

joint venture at the end of 2008 and divided the responsibility

for providing Medicare Part D services to the affected plan

members beginning with the 2009 plan year. In addition,

we assist employer, union and other health plan clients that

qualify for the retiree drug subsidy under Medicare Part D

by collecting eligibility data from and submitting drug cost

data to CMS in order for them to obtain the subsidy.

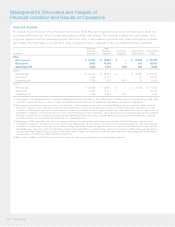

Gross profit includes net revenues less cost of revenues. Cost

of revenues includes (i) the cost of pharmaceuticals dispensed,

either directly through our mail service and specialty retail

pharmacies or indirectly through our national retail pharmacy

network, (ii) shipping and handling costs and (iii) the operating

costs of our mail service pharmacies, customer service opera-

tions and related information technology support. Gross profit

as a percentage of revenues was 7.5%, 8.1% and 8.6% in 2009,

2008 and 2007, respectively.

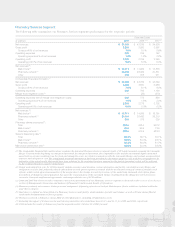

As you review our Pharmacy Services segment’s performance

in this area, we believe you should consider the following

important information:

• Three fewer days in the 2009 fiscal year negatively impacted

gross profit by $23 million, compared to 2008.

• Four additional days in the 2008 fiscal year increased gross

profit by $49 million, compared to 2007.

• Our gross profit dollars and gross profit rates continued

to be impacted by our efforts to (i) retain existing clients,

(ii) obtain new business and (iii) maintain or improve

the purchase discounts we received from manufacturers,

wholesalers and retail pharmacies. In particular, competitive

pressures in the PBM industry have caused us and other

PBM’s to share a larger portion of rebates and/or discounts

received from pharmaceutical manufacturers. During the

2008 selling season, the Company renewed a number of

existing clients and obtained new clients at lower rates,

which resulted in gross profit compression during 2009.

• As discussed previously in this document, we review

our national retail network contracts on an individual basis

to determine if the related revenues should be accounted

for using the gross method or net method under the

The increase in 2008 was primarily due to the addition of

approximately 13.5 million RxAmerica claims (beginning

October 20, 2008), growth in our existing business (including

our Medicare Part D business), the four additional days in

the 2008 reporting period compared to the 2007 reporting

period and new clients.

• During 2009, our average revenue per pharmacy network

claim processed increased by 15.4%, compared to 2008. Our

average revenue per pharmacy network claim processed

is affected by (i) the inclusion of RxAmerica results, whose

retail pharmacy network contracts were accounted for using

the net revenue recognition method prior to April 1, 2009,

as discussed above; (ii) higher drug costs, which normally

result in higher claim revenues, (iii) client pricing, (iv)

changes in the percentage of generic drugs dispensed and

(v) claims mix.

• During 2008, our comparable average revenue per pharmacy

network claim processed increased by 1.2%, compared to

2007. This increase was primarily due to the change in the

revenue recognition method from net to gross for certain

PharmaCare contracts (as discussed previously) and higher

drug costs. These factors increased our average revenue per

retail network claim by approximately 6.6%. These increases

were offset, in part by (i) the inclusion of RxAmerica’s

results (beginning October 20, 2008), which decreased our

average revenue per retail network claim by 2.1%, (ii) client

pricing, (iii) claims mix and (iv) an increase in the percentage

of generic drugs dispensed.

• During 2009 and 2008, our pharmacy network generic

dispensing rate increased to 69.3% and 66.2%, respectively,

compared to our comparable pharmacy network dispensing

rate of 61.7% in 2007. These increases were primarily due to

the impact of new generic drug introductions, our continued

efforts to encourage plan members to use generic drugs

when they are available and the impact of RxAmerica claims.

RxAmerica pharmacy network claims increased our generic

dispensing rate by approximately 120 basis points in 2009

compared to 20 basis points in 2008. We believe our generic

dispensing rates will continue to increase in future periods.

This increase will be affected by, among other things, the

number of new generic drug introductions and our success

at encouraging plan members to utilize generic drugs when

they are available.

• During 2009 and 2008, our net revenues benefited from our

participation in the administration of the Medicare Part D

drug benefit by providing PBM services to our health plan

clients and other clients that have qualified as a Medicare

2009 Annual Report 29