CVS 2009 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2009 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis of

Financial Condition and Results of Operations

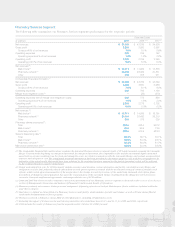

Net revenues increased $11.3 billion and $11.1 billion during

2009 and 2008, respectively. As you review our performance

in this area, we believe you should consider the following

important information:

• During 2009, the Longs Acquisition increased net revenues

by $6.6 billion, compared to 2008.

• Three fewer days in the 2009 fiscal year negatively impacted

net revenues by $671 million, compared to 2008.

• During 2008, the Longs Acquisition increased net revenues

by $1.1 billion, compared to 2007. 2008 includes net revenues

from the Longs Drug Stores and RxAmerica from the acquisi-

tion date (October 20, 2008) forward.

• Four additional days in the 2008 fiscal year increased net

revenues by $1.1 billion, compared to 2007.

• During 2008, the Caremark Merger increased net revenues

by $6.9 billion (net of intersegment eliminations of

$1.0 billion), compared to 2007. 2008 includes a full year

of net revenues from Caremark, compared to 2007, which

includes net revenues from Caremark from the merger date

(March 22, 2007) forward.

Please see the Segment Analysis later in this document for

additional information about our net revenues.

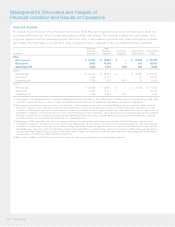

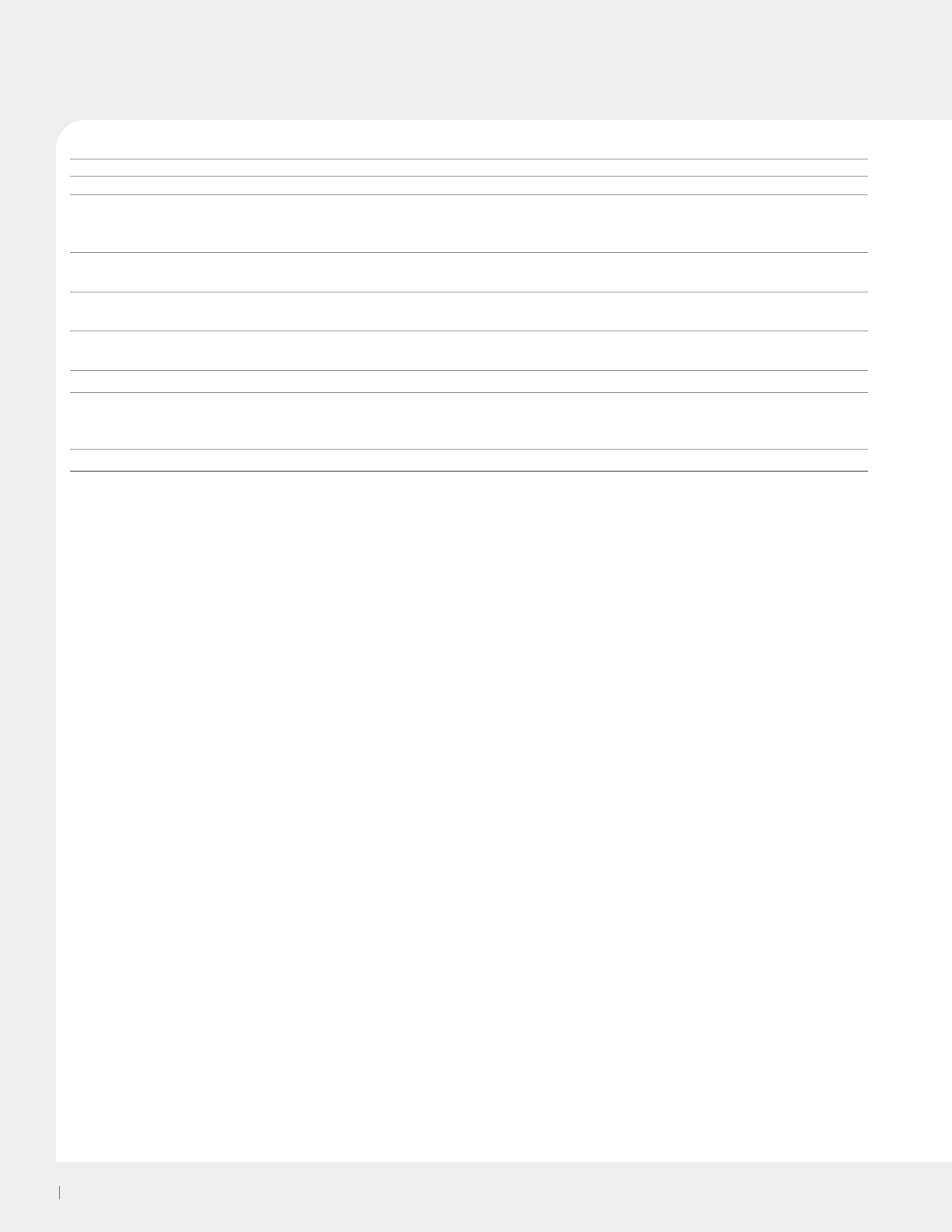

Summary of our Consolidated Financial Results

Fiscal Year

in millions, except per common share amounts 2009 2008 2007

Net revenues $ 98,729 $ 87,472 $ 76,330

Gross profit 20,380 18,290 16,108

Operating expenses 13,942 12,244 11,314

Operating profit 6,438 6,046 4,794

Interest expense, net 525 509 435

Income before income tax provision 5,913 5,537 4,359

Income tax provision 2,205 2,193 1,722

Income from continuing operations 3,708 3,344 2,637

Loss from discontinued operations, net of income tax benefit (12) (132) –

Net income $ 3,696 $ 3,212 $ 2,637

Diluted earnings per common share:

Income from continuing operations $ 2.56 $ 2.27 $ 1.92

Loss from discontinued operations (0.01) (0.09) –

Net income $ 2.55 $ 2.18 $ 1.92

Gross profit increased $2.1 billion and $2.2 billion during 2009

and 2008, respectively. As you review our performance in this

area, we believe you should consider the following important

information:

• During 2009, the Longs Acquisition increased gross profit

dollars by $1.1 billion, but negatively impacted our gross

profit rate compared to 2008.

• Three fewer days in the 2009 fiscal year, negatively impacted

gross profit by $146 million, compared to 2008.

• During 2008, the Caremark Merger increased gross profit

by approximately $553 million, compared to 2007. 2008

includes a full year of gross profit from Caremark, compared

to 2007, which includes gross profit from Caremark from the

merger date (March 22, 2007) forward.

• During 2008, the Longs Acquisition increased gross profit by

$314 million, compared to 2007. 2008 includes gross profit

from the Longs Drug Stores and RxAmerica from the

acquisition date (October 20, 2008) forward.

• Four additional days in the 2008 fiscal year increased gross

profit by $238 million, compared to 2007.

• During 2008 and 2007, our gross profit benefited from

significant purchasing synergies from the Caremark Merger.

• In addition, our gross profit continued to benefit from the

increased utilization of generic drugs (which normally yield

a higher gross profit rate than equivalent brand name drugs)

in both the Pharmacy Services and Retail Pharmacy segments.

Please see the Segment Analysis later in this document for

additional information about our gross profit.

CVS Caremark

24