CVS 2009 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2009 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

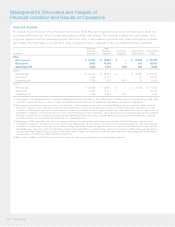

Management’s Discussion and Analysis of

Financial Condition and Results of Operations

• During 2008, the inclusion of Caremark’s results increased

net revenues by $7.9 billion, compared to 2007. 2008

includes a full year of net revenues from Caremark, com-

pared to 2007, which includes net revenues from Caremark

from the merger date (March 22, 2007) forward.

• Three fewer days in the 2009 fiscal year negatively impacted

net revenues by $268 million, compared to 2008.

• Four additional days in the 2008 fiscal year increased our net

revenue by $495 million, compared to 2007.

• During 2009, our comparable mail choice claims processed

increased 8.3% to 66.0 million claims. This increase was

primarily due to favorable net new business and significant

adoption of mail choice plan design. During 2008, our

comparable mail choice claims processed decreased 17.6%

to 60.9 million claims, compared to 73.9 million claims in

2007. This decrease was primarily due to the termination

of the Federal Employees Health Benefit Plan (“FEP”) mail

contract on December 31, 2007.

• During 2009 and 2008, our average revenue per mail choice

claim increased by 3.5% and 7.8%, compared to 2008 and

2007, respectively. Specialty mail choice claims, which have

significantly higher average net revenues per claim, were the

primary driver of the increase. Average revenue per specialty

mail choice claim increased primarily due to drug cost inflation

and claims mix. These increases were offset, in part, by an

increase in the percentage of generic drugs dispensed and

changes in client pricing.

• During 2009 and 2008, our mail choice generic dispensing

rate increased to 56.5% and 54.4%, respectively, compared

to our comparable mail choice generic dispensing rate

of 48.1% in 2007. These increases were primarily due to

new generic drug introductions and our continued efforts

to encourage plan members to use generic drugs when

they are available. In addition, the termination of the FEP

mail contract caused our comparable mail choice generic

dispensing rate to increase by approximately 120 basis

points during 2008, compared to 2007.

• During 2009 and 2008, our pharmacy network claims

processed increased to 592.5 million and 572.5 million,

respectively, compared to our comparable pharmacy

network claims of 533.3 million in 2007. The increase

in 2009, was primarily due to an increase of 61.0 million

RxAmerica claims compared with 2008. This was offset by

the reduction in claims due to the termination of two large

health plan clients effective January 1, 2009 and having three

fewer days in the 2009 reporting period compared to 2008.

During 2009, the Pharmacy Services segment’s results of

operations include a full year of RxAmerica results compared

to 2008, which includes RxAmerica results from the acquisition

date (October 20, 2008) forward.

During 2008 and 2007, the Pharmacy Services segment’s results

of operations were significantly affected by the Caremark

Merger. As such, the primary focus of our Pharmacy Services

segment discussion is based on the comparable financial

information presented previously in this document.

We define mail choice as claims filled at a Pharmacy Services’

mail facility, which includes specialty mail claims, as well as

90-day claims filled at retail pharmacies under the Maintenance

Choice program.

Mail choice penetration rate is calculated based on mail

choice and specialty claims divided by total pharmacy

claims processed.

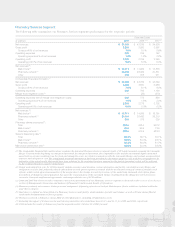

Net revenues. As you review our Pharmacy Services segment’s

revenue performance, we believe you should consider the

following important information:

• The Pharmacy Services segment recognizes revenues for

its national retail pharmacy network transactions based on

individual contract terms. Caremark’s contracts are predomi-

nantly accounted for using the gross method. Prior to

April 1, 2009, RxAmerica’s contracts were accounted for

using the net method. Effective April 1, 2009, we converted

a number of RxAmerica’s retail pharmacy network contracts

to the Caremark contract structure, which resulted in those

contracts being accounted for using the gross method. As

a result, net revenues increased by $2.5 billion during 2009

compared to 2008.

In addition, prior to September 2007, PharmaCare’s contracts

were accounted for using the net method. Effective Septem-

ber 1, 2007, we converted a number PharmaCare’s retail

pharmacy network contracts to the Caremark contract structure,

which resulted in those contracts being accounted for using

the gross method. As a result, net revenues increased by

approximately $1.8 billion during 2008 compared to 2007.

Please see Note 1 to the consolidated financial statements

for additional information about the Pharmacy Services

segment’s revenue recognition policies.

• During 2009, the inclusion of RxAmerica’s results increased

net revenues by approximately $3.2 billion compared to

2008. These increases include the conversion of RxAmerica’s

retail pharmacy network contracts to the Caremark contract

structure discussed above.

CVS Caremark

28