CVS 2009 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2009 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

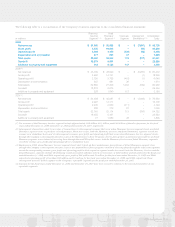

Notes to Consolidated Financial Statements

Note 8 Employee Stock Ownership Plan

The Company sponsored a defined contribution Employee

Stock Ownership Plan (the “ESOP”) that covered full-time

employees with at least one year of service.

In 1989, the ESOP Trust issued and sold $358 million of

20-year, 8.52% notes, which were due and retired on Decem-

ber 31, 2008 (the “ESOP Notes”). The proceeds from the ESOP

Notes were used to purchase 7 million shares of Series One

ESOP Convertible Preference Stock (the “ESOP Preference

Stock”) from the Company. Since the ESOP Notes were

guaranteed by the Company, the outstanding balance was

reflected as long-term debt, and a corresponding guaranteed

ESOP obligation was reflected in shareholders’ equity in the

consolidated balance sheet.

Each share of ESOP Preference Stock had a guaranteed

minimum liquidation value of $53.45, was convertible into

4.628 shares of common stock and was entitled to receive

an annual dividend of $3.90 per share.

The ESOP Trust used the dividends received and contributions

from the Company to repay the ESOP Notes. As the ESOP

Notes were repaid, ESOP Preference Stock was allocated to plan

participants based on (i) the ratio of each year’s debt service

payment to total current and future debt service payments

multiplied by (ii) the number of unallocated shares of ESOP

Preference Stock in the plan.

As of December 31, 2009, no shares of ESOP Preference

Stock were outstanding and allocated to plan participants.

On January 30, 2009, pursuant to the Company’s Amended

and Restated Certificate of Incorporation (the “Charter”), the

Company informed the trustee of the ESOP Trust of its intent

to redeem for cash all of the outstanding shares of ESOP

Preference Stock on February 24, 2009 (the “Redemption

Date”). Under the Charter, at any time prior to the Redemption

Date, the trustee had the right to convert the ESOP Preference

Stock into shares of the Company’s Common Stock. The

conversion rate at the time of the notice was 4.628 shares of

Common Stock for each share of ESOP Preference Stock. The

trustee exercised its right of conversion on February 23, 2009,

and all outstanding shares of ESOP Preference Stock were

converted into Common Stock.

Annual ESOP expense recognized is equal to (i) the interest

incurred on the ESOP Notes plus (ii) the higher of (a) the

principal repayments or (b) the cost of the shares allocated,

less (iii) the dividends paid. Similarly, the guaranteed ESOP

obligation is reduced by the higher of (i) the principal

payments or (ii) the cost of shares allocated.

Note 7 Medicare Part D

The Company offers Medicare Part D benefits through

SilverScript and Accendo, which have contracted with CMS

to be a PDP and, pursuant to the Medicare Prescription Drug,

Improvement and Modernization Act of 2003 (“MMA”), must

be risk-bearing entities regulated under state insurance laws

or similar statutes.

SilverScript and Accendo are licensed domestic insurance

companies under the applicable laws and regulations. Pursuant

to these laws and regulations, SilverScript and Accendo must

file quarterly and annual reports with the National Association

of Insurance Commissioners (“NAIC”) and certain state regula-

tors, must maintain certain minimum amounts of capital and

surplus under a formula established by the NAIC and must,

in certain circumstances, request and receive the approval of

certain state regulators before making dividend payments or

other capital distributions to the Company. The Company does

not believe these limitations on dividends and distributions

materially impact its financial position.

The Company has recorded estimates of various assets and

liabilities arising from its participation in the Medicare Part D

program based on information in its claims management

and enrollment systems. Significant estimates arising from its

participation in this program include: (i) estimates of low-

income cost subsidy and reinsurance amounts ultimately

payable to or receivable from CMS based on a detailed claims

reconciliation that will occur in 2010; (ii) estimates of amounts

payable to or receivable from other PDPs for claims costs

incurred as a result of retroactive enrollment changes, which

were communicated by CMS after such claims had been

incurred; and (iii) an estimate of amounts receivable from or

payable to CMS under a risk-sharing feature of the Medicare

Part D program design, referred to as the risk corridor.

CVS Caremark

60