CVS 2009 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2009 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

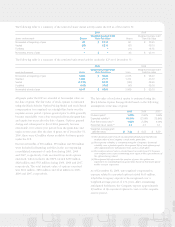

Note 2 Business Combinations

Effective March 22, 2007, pursuant to the Agreement and

Plan of Merger dated as of November 1, 2006, as amended

(the “Merger Agreement”), Caremark Rx, Inc. was merged with

a newly formed subsidiary of CVS Corporation, with Caremark

Rx, Inc., L.L.C. (“Caremark”) continuing as the surviving entity

(the “Caremark Merger”). Following the merger, the Company

changed its name to CVS Caremark Corporation.

Under the terms of the Merger Agreement, Caremark share-

holders received 1.67 shares of common stock, par value

$0.01 per share, of the Company for each share of common

stock of Caremark, par value $0.001 per share, issued and

outstanding immediately prior to the effective time of the

merger. In addition, Caremark shareholders of record as of

the close of business on the day immediately preceding the

closing date of the merger received a special cash dividend

of $7.50 per share.

CVS Corporation was considered the acquirer of Caremark

for accounting purposes and the total purchase price was

allocated to the assets acquired and liabilities assumed from

Caremark based on their fair values as of March 22, 2007.

The total consideration was approximately $26.9 billion

and includes amounts related to Caremark common stock

($23.3 billion), Caremark stock options ($600 million) and

special cash dividend ($3.2 billion), less shares held in trust

($300 million). The results of the operations of Caremark

have been included in the consolidated statements of opera-

tions since March 22, 2007.

Effective October 20, 2008, the Company acquired Longs

Drug Stores Corporation for approximately $2.6 billion (the

“Longs Acquisition”). The fair value of the assets acquired

and liabilities assumed were $4.4 billion and $1.8 billion,

respectively. The Longs Acquisition included 529 retail drug

stores, RxAmerica, LLC, which provides pharmacy benefit

management services and Medicare Part D benefits and other

related assets. The Company’s results of operations and cash

flows include the Longs Acquisition beginning October 20, 2008.

Effective December 30, 2009, the Company acquired an

approximately 60% interest in Generation Health, a genetic

benefit management company for approximately $34 million

in cash and issued certain put rights to the remaining noncon-

trolling shareholders. The put rights allow the noncontrolling

shareholders to require the Company to buy their shares for

cash in the future, depending on certain financial metrics of

Generation Health. The fair value of the redeemable noncon-

trolling interest including put rights on the date of acquisition

was approximately $37 million which was determined using

inputs classified as Level 3 in the fair value hierarchy.

Company to be separately disclosed in the consolidated

statement of operations. Noncontrolling interests in consoli-

dated subsidiaries are generally required to be reported as a

separate component of equity in the consolidated balance

sheet, apart from the equity of the parent company. However,

a redeemable noncontrolling interest subject to a put option,

which may require the purchase of an interest in a consolidated

subsidiary from a noncontrolling interest holder, is required

to be classified outside of shareholders’ equity.

During the first quarter of 2008, the Company adopted addi-

tional guidance within ASC 715-60 Defined Benefit Plans-Other

Postretirement (formerly Emerging Issues Task Force (“EITF”)

No. 06-4, “Accounting for Deferred Compensation and

Postretirement Benefit Aspects of Endorsement Split-Dollar Life

Insurance Arrangements” and EITF No. 06-10, “Accounting for

Collateral Assignment Split-Dollar Life Insurance Agreements”).

The application of this guidance requires a company to

recognize a liability for the discounted value of the future

premium benefits that a company will incur through the death

of the underlying insured and provides guidance for determin-

ing a liability for the postretirement benefit obligation as well

as recognition and measurement of the associated asset on

the basis of the terms of the collateral assignment agreement.

The adoption of the content within ASC 715-60 did not have

a material impact on the Company’s consolidated results of

operations, financial position or cash flows.

RECENT ACCOUNTING PRONOUNCEMENT NOT

YET EFFECTIVE

In June 2009, the FASB issued SFAS No. 167 (not yet codified

in ASC), “Amendments to FASB Interpretation No. 46(R),”

(“SFAS 167”). The standard amends the content within ASC

810 Consolidations (formerly FASB Interpretations (“FIN”)

No. 46 (R)) to require a company to analyze whether its

interest in a variable interest entity (“VIE”) gives it a controlling

financial interest. The determination of whether a company is

required to consolidate another entity is based on, among other

things, the other entity’s purpose and design and a company’s

ability to direct the activities of the other entity that most

significantly impact the other entity’s economic performance.

Additional disclosures are required to identify a company’s

involvement with the VIE and any significant changes in risk

exposure due to such involvement. SFAS 167 is effective for all

new and existing VIEs as of the beginning of the first fiscal year

that begins after November 15, 2009. The Company does not

believe the adoption of SFAS 167 will have a material impact

on the Company’s consolidated results of operations, financial

position or cash flows.

CVS Caremark

56