CVS 2009 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2009 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We recently sat down with CVS Caremark executives Per Lofberg and

Larry Merlo to ask them some of the questions that have been on the minds

of investors. Below are excerpts where they discuss the state of the

PBM business, prospects for continued retail growth, and our integrated

approach to pharmacy care.

Q&A with Per Lofberg and Larry Merlo

QUESTION: Per, you joined CVS Caremark in January 2010.

What prompted your decision to make the move?

PER LOFBERG: Truth be told, it wasn’t a hard decision

to make. Caremark has been one of the leaders in the

PBM space for a long time now, and today CVS Caremark

has the most innovative offering. I think the integrated

PBM/retail approach will prove to be the winning model,

and I couldn’t resist the opportunity to help shape the

future of pharmacy care.

QUESTION: What have you been focusing on in these first

few months?

PER LOFBERG: The majority of my efforts have been

centered on achieving a successful 2011 selling season

and on future innovation. Fortunately, I inherited a PBM

business that was executing well when I got here. Our

isolated service issues were already resolved. Caremark

hadn’t won as much business for 2010 as hoped for,

but that was primarily a messaging issue. We’ve got

great technology, an executive team with an impressive

depth of experience, and a long-standing reputation for

outstanding customer service.

QUESTION: What are your key messages for prospective

clients?

PER LOFBERG: We’ve been emphasizing our industry-

leading strengths as a PBM, our ability to offer lower

prices through scale and efficiency, and our superior

core clinical capabilities. Obviously, our integrated

retail offerings can help lower costs further and improve

the plan member experience, so that is also part of

the discussion.

QUESTION: You’re talking about services such as

Maintenance Choice?

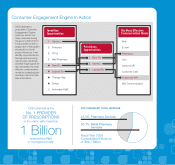

PER LOFBERG: That’s certainly one offering that we think

is pretty compelling. Clients can reap substantial savings

by driving additional utilization of 90-day prescriptions,

and they can still achieve the same or better generic

dispensing rates and levels of adherence. Their plan

members also like the option of picking up their 90-day

prescriptions at one of our stores. For some people it’s

just more convenient, and they also appreciate face-to-

face interaction with a pharmacist. It’s more than just

Maintenance Choice, though. It’s our ability to provide

specialty drugs at retail or to incorporate MinuteClinic

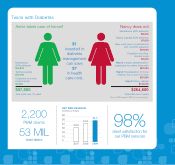

into our disease management offerings. For example,

in certain locations a diabetic can now walk into

MinuteClinic for his or her A1c test. That level of access

will have a positive impact on patient outcomes.

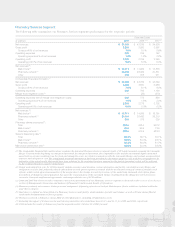

QUESTION: Let’s talk about retail. Larry, your side of the

business posted great numbers again in 2009, with same-

store sales gains that led all pharmacy retailers. How can

you maintain this level of growth?

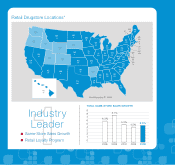

LARRY MERLO: There are so many aspects of the retail

business working well, but I’ll mention just a few. We’ve

invested in technology that will drive greater efficiencies

in the pharmacy; we’re leveraging the ExtraCare card to

target customers more effectively; we’re taking share from

competitors; and we’re very aggressive in executing our

private-label strategy. In California and Hawaii, we’ve only

just begun to reap the rewards of the Longs acquisition.

Through the introduction of our best practices, we’re

going to make those stores much more profitable.

CVS Caremark

18