CVS 2009 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2009 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Impairment of long-lived assets. The Company groups and

evaluates fixed and finite-lived intangible assets, excluding

goodwill, for impairment at the lowest level at which individ-

ual cash flows can be identified. When evaluating assets for

potential impairment, the Company first compares the carrying

amount of the asset group to the individual store’s estimated

future cash flows (undiscounted and without interest charges).

If the estimated future cash flows used in this analysis are less

than the carrying amount of the asset group, an impairment

loss calculation is prepared. The impairment loss calculation

compares the carrying amount of the asset group to the asset

group’s estimated future cash flows (discounted and with

interest charges). If required, an impairment loss is recorded

for the portion of the asset group’s carrying value that exceeds

the asset group’s estimated future cash flows (discounted and

with interest charges).

Redeemable noncontrolling interest. The Company has an

approximately 60% ownership interest in Generation Health,

Inc. (“Generation Health”) and consolidates Generation Health

in its consolidated financial statements. The noncontrolling

shareholders of Generation Health hold put rights for the

remaining interest in Generation Health that if exercised would

require the Company to purchase the remaining interest in

Generation Health in 2015 for a minimum of $27 million and

a maximum of $159 million, depending on certain financial

metrics of Generation Health in 2014. Since the noncontrolling

shareholders of Generation Health have a redemption feature

as a result of the put right, the Company has classified the

redeemable noncontrolling interest in Generation Health in the

mezzanine section of the consolidated balance sheet outside

of shareholders’ equity. The Company initially recorded the

redeemable noncontrolling interest at a fair value of $37 million on

the date of acquisition. At the end of each reporting period, if

the estimated accreted redemption value exceeds the carrying

value of the noncontrolling interest, the difference is recorded

as a reduction of retained earnings. Any such reductions in

retained earnings would also reduce income available to common

shareholders in the Company’s earnings per share calculations.

REVENUE RECOGNITION:

Pharmacy Services Segment. The PSS sells prescription

drugs directly through its mail service pharmacies and

indirectly through its national retail pharmacy network. The

PSS recognizes revenues from prescription drugs sold by its

mail service pharmacies and under national retail pharmacy

network contracts where the PSS is the principal using the

gross method at the contract prices negotiated with its clients.

Net revenue from the PSS includes: (i) the portion of the price

the client pays directly to the PSS, net of any volume-related

The cost method of accounting was used to determine inven-

tory in the Longs Drug Stores as of December 31, 2008. The

Longs Drug Stores began using the retail method of accounting

beginning in the second quarter of 2009.

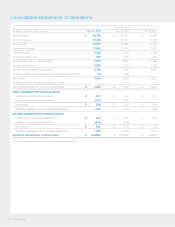

Property and equipment. Property, equipment and improve-

ments to leased premises are depreciated using the straight-line

method over the estimated useful lives of the assets, or when

applicable, the term of the lease, whichever is shorter. Estimated

useful lives generally range from 10 to 40 years for buildings,

building improvements and leasehold improvements and 3 to

10 years for fixtures and equipment. Repair and maintenance

costs are charged directly to expense as incurred. Major renewals

or replacements that substantially extend the useful life of an

asset are capitalized and depreciated.

The following are the components of property and equipment

at December 31:

in millions 2009 2008

Land $ 1,076 $ 1,304

Building and improvements 2,020 1,525

Fixtures and equipment 6,322 6,216

Leasehold improvements 2,673 2,581

Software 853 666

12,944 12,292

Accumulated depreciation

and amortization (5,021) (4,167)

$ 7,923 $ 8,125

The gross amount of property and equipment under capital

leases was $191 million and $182 million as of December 31,

2009 and 2008, respectively.

The Company capitalizes application development stage

costs for significant internally developed software projects.

These costs are amortized over the estimated useful lives

of the software, which generally range from 3 to 5 years.

Goodwill. Goodwill and other indefinite-lived assets are

not amortized, but are subject to impairment reviews annually,

or more frequently if necessary. See Note 3 for additional

information on goodwill.

Intangible assets. Purchased customer contracts and relation-

ships are amortized on a straight-line basis over their estimated

useful lives between 10 and 20 years. Purchased customer

lists are amortized on a straight-line basis over their estimated

useful lives of up to 10 years. Purchased leases are amortized

on a straight-line basis over the remaining life of the lease.

See Note 3 for additional information about intangible assets.

2009 Annual Report 51